Question: need help ASAP. please solve 1 &2 with formulas/explanation. will upvote once answered! thank you in advance! 1. Suppose a company wants to sell 1,000

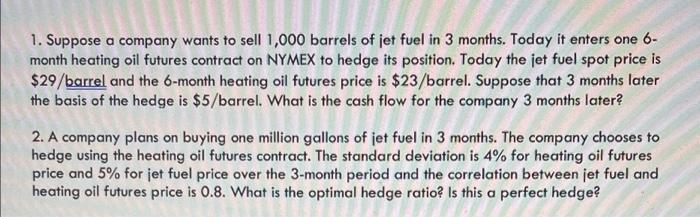

1. Suppose a company wants to sell 1,000 barrels of jet fuel in 3 months. Today it enters one 6month heating oil futures contract on NYMEX to hedge its position. Today the jet fuel spot price is $29/ barrel and the 6-month heating oil futures price is $23/ barrel. Suppose that 3 months later the basis of the hedge is $5 /barrel. What is the cash flow for the company 3 months later? 2. A company plans on buying one million gallons of jet fuel in 3 months. The company chooses to hedge using the heating oil futures contract. The standard deviation is 4% for heating oil futures price and 5% for jet fuel price over the 3-month period and the correlation between jet fuel and heating oil futures price is 0.8. What is the optimal hedge ratio? Is this a perfect hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts