Question: NEED HELP ASAP PLEASEEEEE!!!!!!!! D This question will be sent to your instructor for grading. THE COMPANY's current year income statement, comparative balance sheets, and

NEED HELP ASAP PLEASEEEEE!!!!!!!!

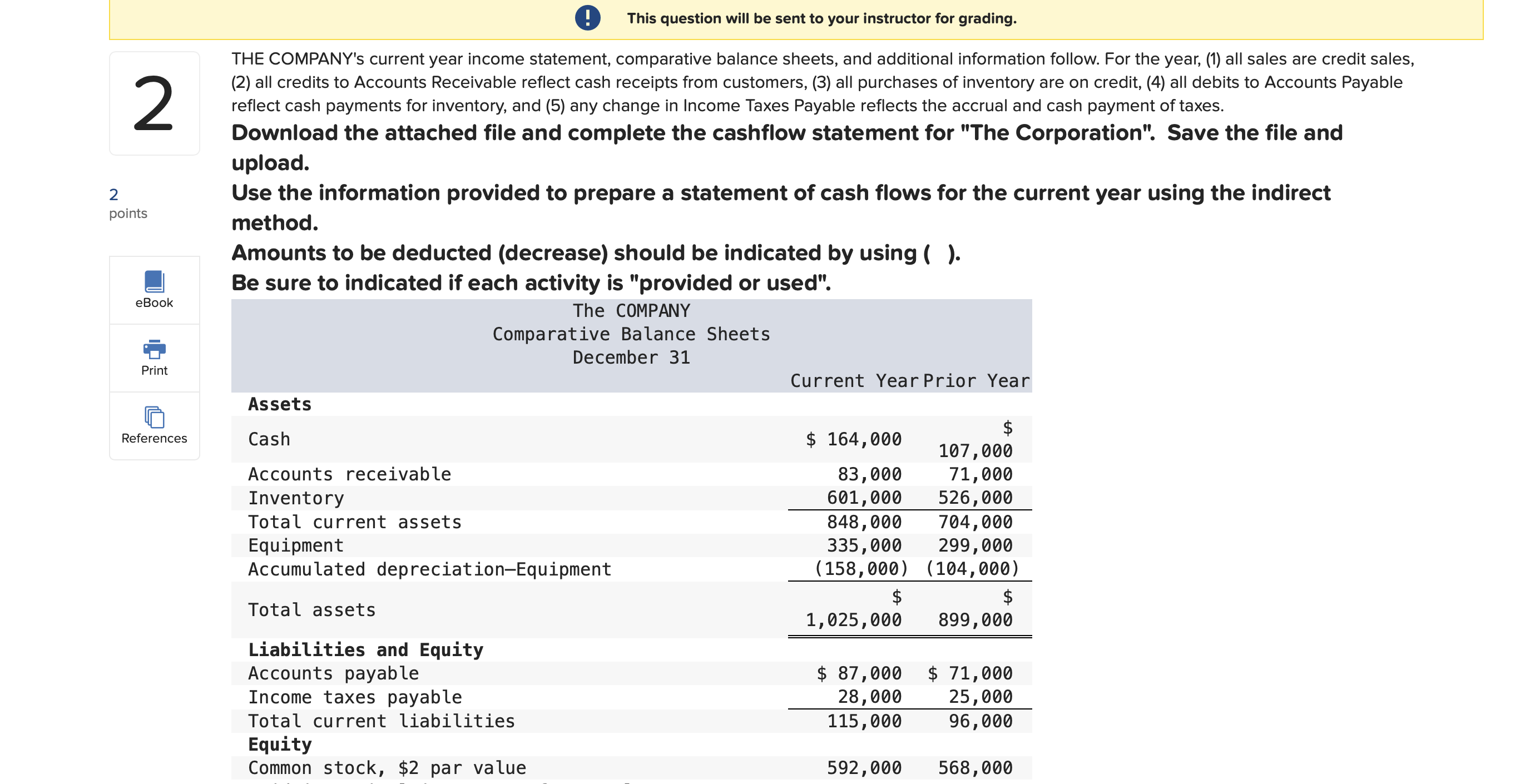

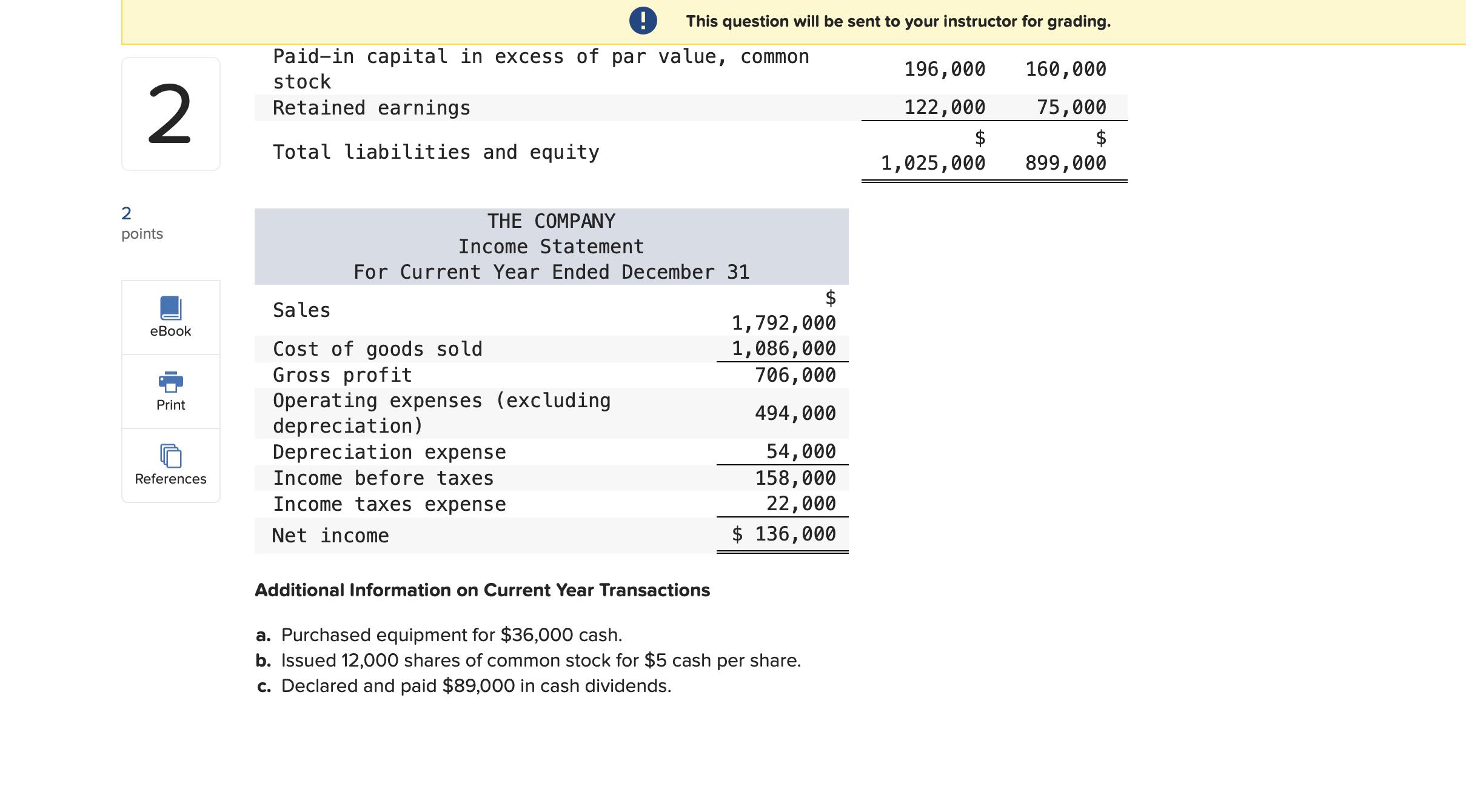

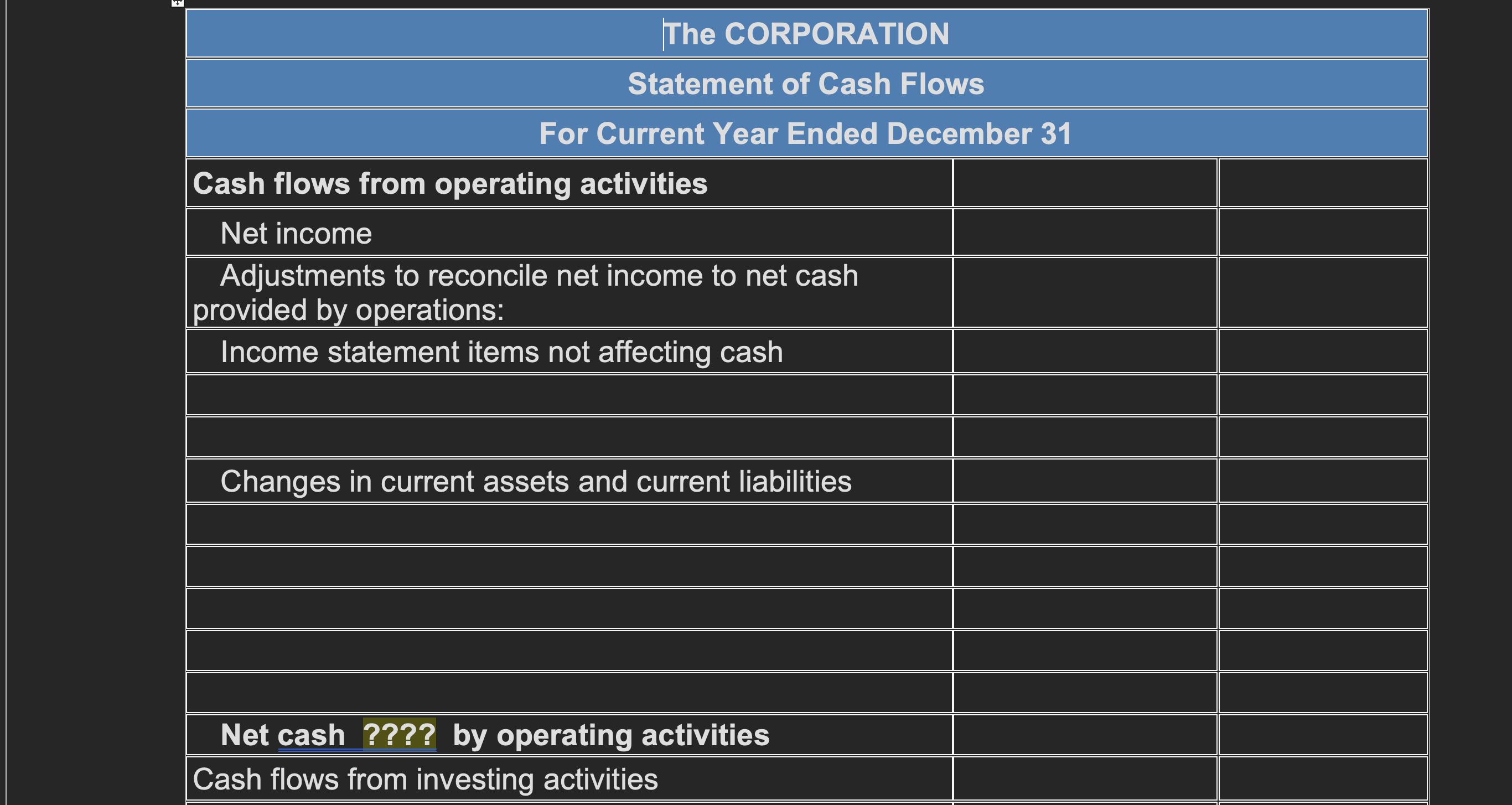

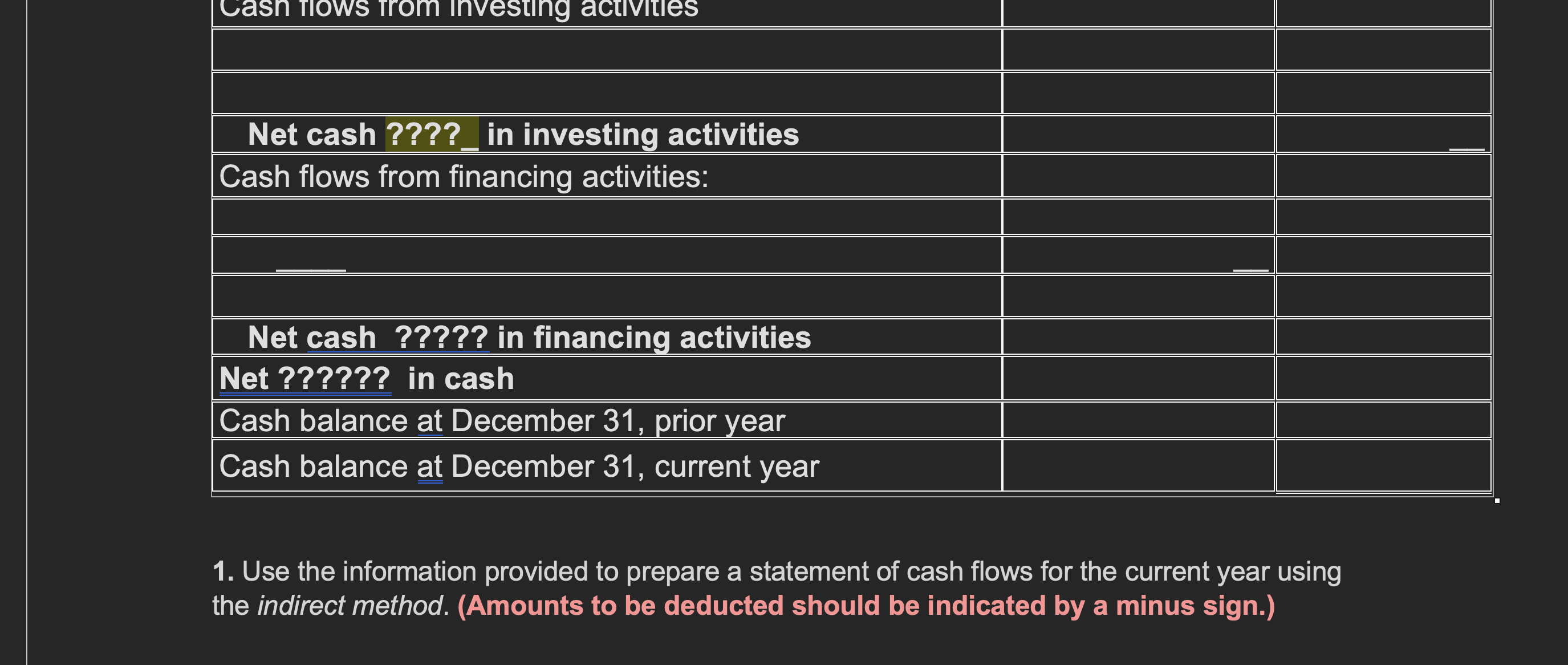

D This question will be sent to your instructor for grading. THE COMPANY's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Download the attached file and complete the cashflow statement for "The Corporation". Save the file and upload. Use the information provided to prepare a statement of cash flows for the current year using the indirect method. Amounts to be deducted (decrease) should be indicated by using ( ). Be sure to indicated if each activitv is "provided or used". ( This question will be sent to your instructor for grading. Additional Information on Current Year Transactions a. Purchased equipment for $36,000 cash. b. Issued 12,000 shares of common stock for $5 cash per share. c. Declared and paid $89,000 in cash dividends. \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ Statement of Cash Flows } \\ \hline \multicolumn{2}{|c|}{ For Current Year Ended December 31 } \\ \hline Cash flows from operating activities & & \\ \hline Net income & & \\ \hline Adjustmentstoreconcilenetincometonetcashprovidedbyoperations: & & \\ \hline Income statement items not affecting cash & & \\ \hline & & \\ \hline & & \\ \hline Changes in current assets and current liabilities & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Net cash ???? by operating activities & & \\ \hline Cash flows from investing activities & & \\ \hline \end{tabular} Net cash ????_in investing activities Cash flows from financing activities: \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline \hline Net cash ???? in financing activities & & \\ \hline Net ????? in cash & & \\ \hline Cash balance at December 31, prior year & & \\ \hline Cash balance at December 31, current year & & \\ \hline \hline \end{tabular} 1. Use the information provided to prepare a statement of cash flows for the current year using the indirect method. (Amounts to be deducted should be indicated by a minus sign.) D This question will be sent to your instructor for grading. THE COMPANY's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Download the attached file and complete the cashflow statement for "The Corporation". Save the file and upload. Use the information provided to prepare a statement of cash flows for the current year using the indirect method. Amounts to be deducted (decrease) should be indicated by using ( ). Be sure to indicated if each activitv is "provided or used". ( This question will be sent to your instructor for grading. Additional Information on Current Year Transactions a. Purchased equipment for $36,000 cash. b. Issued 12,000 shares of common stock for $5 cash per share. c. Declared and paid $89,000 in cash dividends. \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ Statement of Cash Flows } \\ \hline \multicolumn{2}{|c|}{ For Current Year Ended December 31 } \\ \hline Cash flows from operating activities & & \\ \hline Net income & & \\ \hline Adjustmentstoreconcilenetincometonetcashprovidedbyoperations: & & \\ \hline Income statement items not affecting cash & & \\ \hline & & \\ \hline & & \\ \hline Changes in current assets and current liabilities & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Net cash ???? by operating activities & & \\ \hline Cash flows from investing activities & & \\ \hline \end{tabular} Net cash ????_in investing activities Cash flows from financing activities: \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline \hline Net cash ???? in financing activities & & \\ \hline Net ????? in cash & & \\ \hline Cash balance at December 31, prior year & & \\ \hline Cash balance at December 31, current year & & \\ \hline \hline \end{tabular} 1. Use the information provided to prepare a statement of cash flows for the current year using the indirect method. (Amounts to be deducted should be indicated by a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts