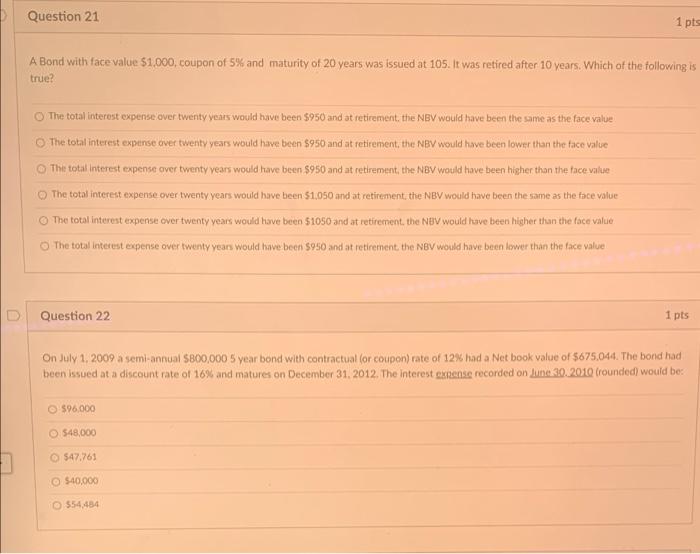

Question: need help asap Question 21 1 pts A Bond with face value $1.000, coupon of 5% and maturity of 20 years was issued at 105.

Question 21 1 pts A Bond with face value $1.000, coupon of 5% and maturity of 20 years was issued at 105. It was retired after 10 years. Which of the following is true? The total interest expense over twenty years would have been $950 and at retirement the NBV would have been the same as the face value The total interest expense over twenty years would have been $950 and at retirement, the NBV would have been lower than the face value The total interest expense over twenty years would have been $950 and at retirement, the NBV would have been higher than the face value The total interest expense over twenty years would have been $1,050 and at retirement, the NBV would have been the same as the face value The total interest expense over twenty years would have been $1050 and at retirement, the Nev would have been higher than the face value The total interest expense over twenty years would have been $950 and at retirement, the NBV would have been lower than the face value Question 22 1 pts On July 1, 2009 a semi-annual $800,000 5 year bond with contractual for coupon) rate of 12% had a Netbook value of $675.044. The bond had been issued at a discount rate of 16% and matures on December 31, 2012. The interest expense recorded on June 30.2010 crounded) would be 596.000 548,000 $47.761 $40,000 554,484

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts