Question: Need help ASAP Question 3 An entity licenses customer relationship management software to a customer. In addition, the entity promises to provide consulting services to

Need help ASAP Question 3

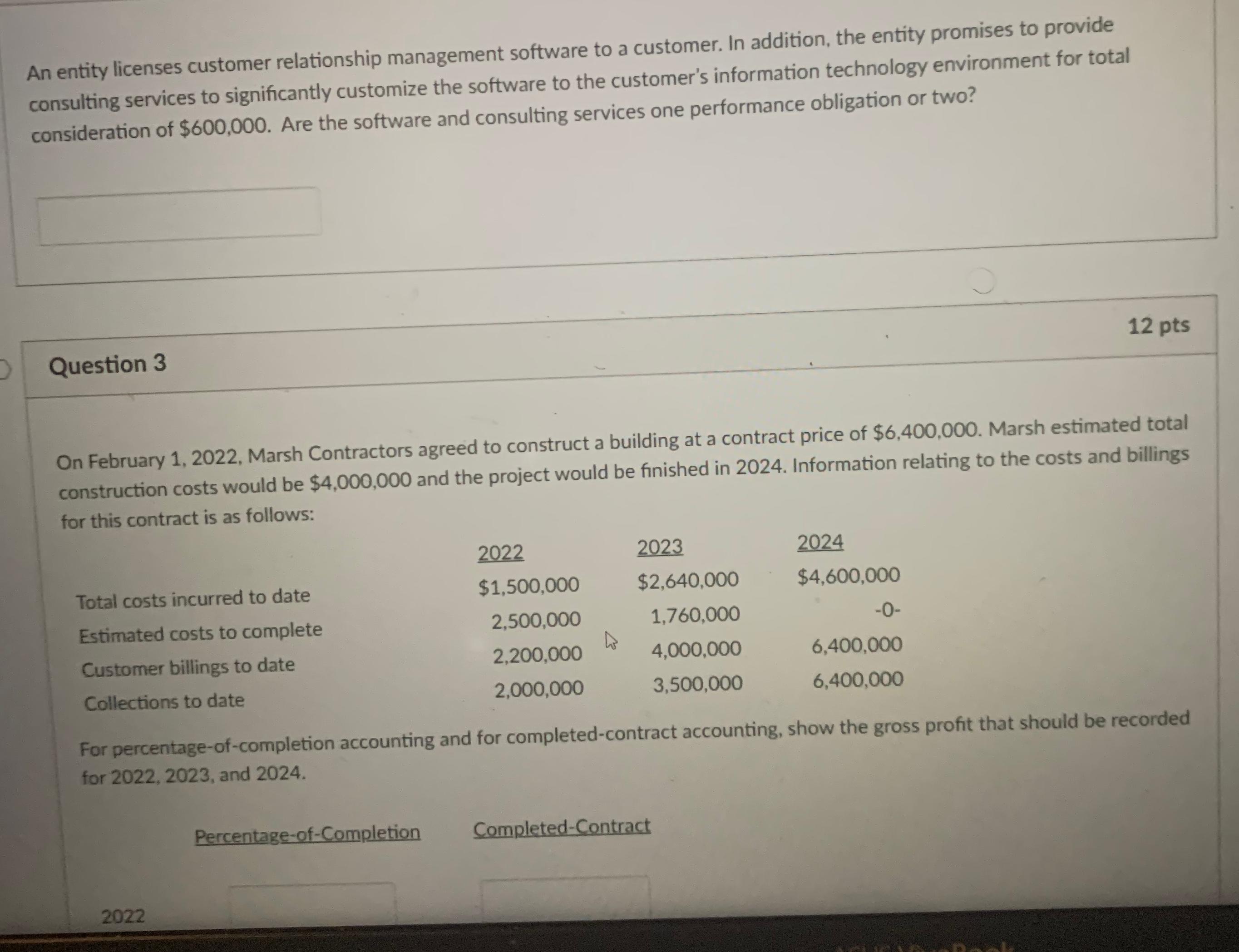

An entity licenses customer relationship management software to a customer. In addition, the entity promises to provide consulting services to significantly customize the software to the customer's information technology environment for total consideration of $600,000. Are the software and consulting services one performance obligation or two? 12 pts Question 3 On February 1, 2022, Marsh Contractors agreed to construct a building at a contract price of $6,400,000. Marsh estimated total construction costs would be $4,000,000 and the project would be finished in 2024. Information relating to the costs and billings for this contract is as follows: 2023 2024 2022 $2,640.000 $4,600,000 Total costs incurred to date -0- $1,500,000 2,500,000 2,200.000 Estimated costs to complete 1,760,000 4,000,000 Customer billings to date 6,400,000 6,400,000 2,000,000 3,500,000 Collections to date For percentage-of-completion accounting and for completed-contract accounting, show the gross profit that should be recorded for 2022, 2023, and 2024. Percentage-of-Completion Completed-Contract 2022 An entity licenses customer relationship management software to a customer. In addition, the entity promises to provide consulting services to significantly customize the software to the customer's information technology environment for total consideration of $600,000. Are the software and consulting services one performance obligation or two? 12 pts Question 3 On February 1, 2022, Marsh Contractors agreed to construct a building at a contract price of $6,400,000. Marsh estimated total construction costs would be $4,000,000 and the project would be finished in 2024. Information relating to the costs and billings for this contract is as follows: 2023 2024 2022 $2,640.000 $4,600,000 Total costs incurred to date -0- $1,500,000 2,500,000 2,200.000 Estimated costs to complete 1,760,000 4,000,000 Customer billings to date 6,400,000 6,400,000 2,000,000 3,500,000 Collections to date For percentage-of-completion accounting and for completed-contract accounting, show the gross profit that should be recorded for 2022, 2023, and 2024. Percentage-of-Completion Completed-Contract 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts