Question: Need Help ASAP QUESTION 8 6 points CHAPTER 13 After-tax salvage value = Sales price - taxes paid from salvage of asset. After-tax salvage value

Need Help ASAP

Need Help ASAP

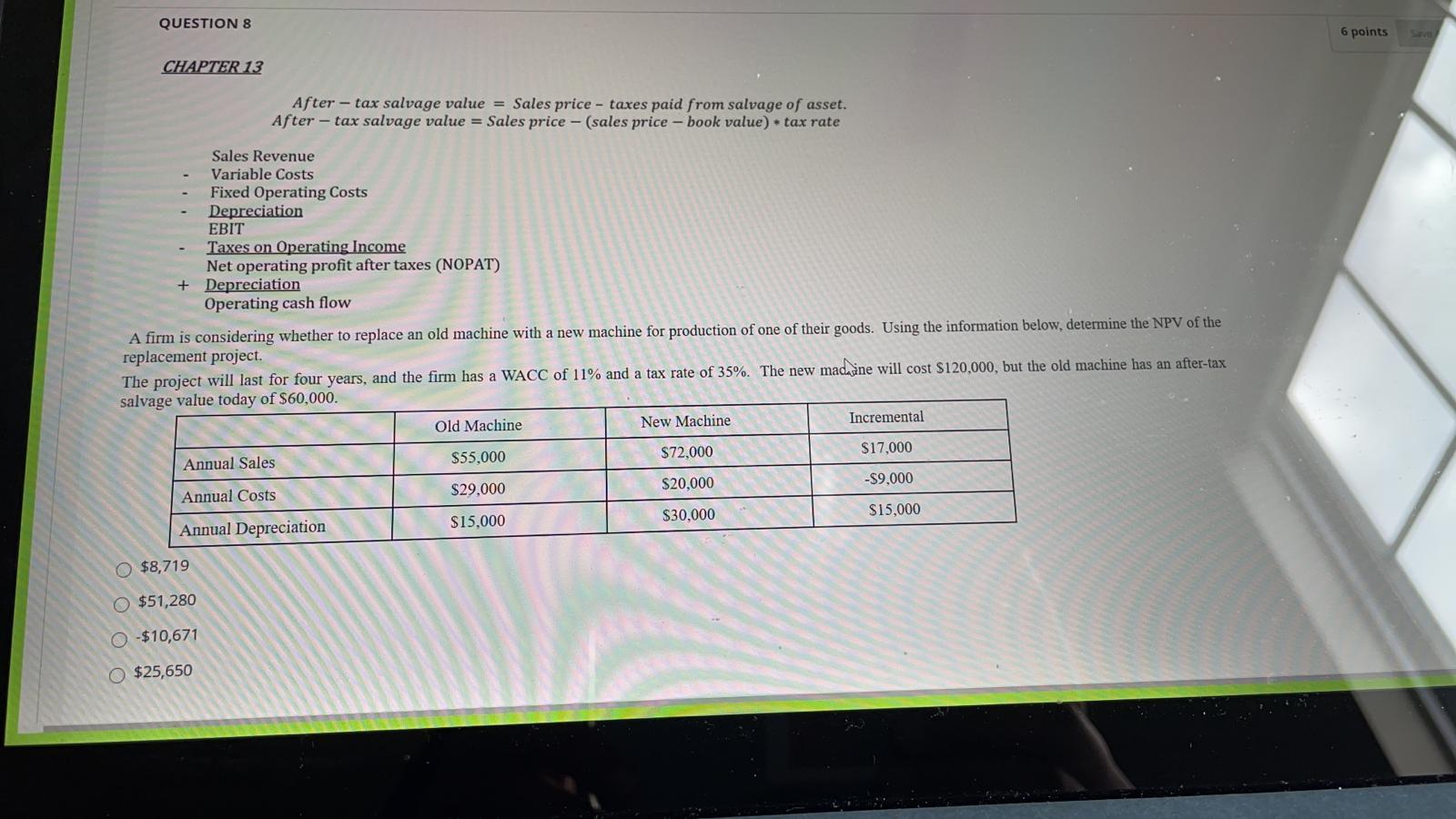

QUESTION 8 6 points CHAPTER 13 After-tax salvage value = Sales price - taxes paid from salvage of asset. After-tax salvage value = Sales price - (sales price - book value) .tax rate Sales Revenue Variable Costs Fixed Operating Costs Depreciation EBIT Taxes on Operating Income Net operating profit after taxes (NOPAT) + Depreciation Operating cash flow A firm is considering whether to replace an old machine with a new machine for production of one of their goods. Using the information below, determine the NPV of the replacement project. The project will last for four years, and the firm has a WACC of 11% and a tax rate of 35%. The new macaane will cost $120,000, but the old machine has an after-tax salvage value today of $60,000. Old Machine New Machine Incremental $72,000 $17,000 $55,000 Annual Sales $20,000 -$9,000 $29,000 Annual Costs $30.000 $15,000 $15,000 Annual Depreciation $8,719 $51,280 0-$10,671 O $25,650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts