Question: Need help asap Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you

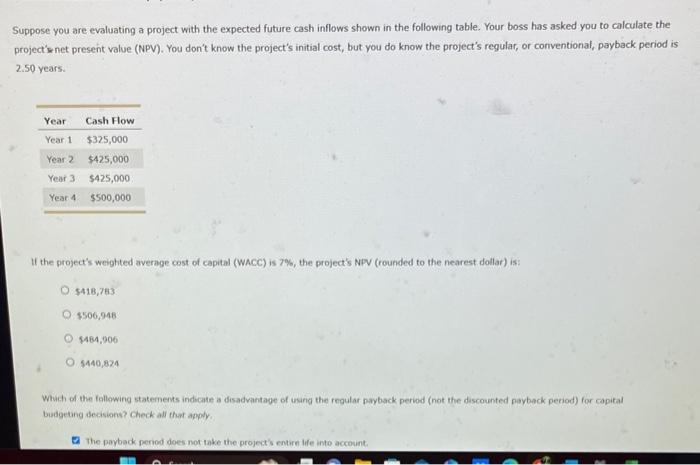

Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the projec's weighted average cost of capital (WACC) is 7\%, the project's NPV (rounded to the nearest dollar) is: $418,783$506,948$464,906$440,824 Which of the following statements indicate a disadvantage of wang the regular payback period (not the discounted payback period) for capital budgetung deasions? Check all that apply. The payback period does not take the project's entirn life inte account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts