Question: Need help ASAP t Tht Cytie Hamework Handout es 134 135 in Fundamental Accounting Principles, 23 ed.) 3-3A (pages 134-135 3-3A (pa germ a school

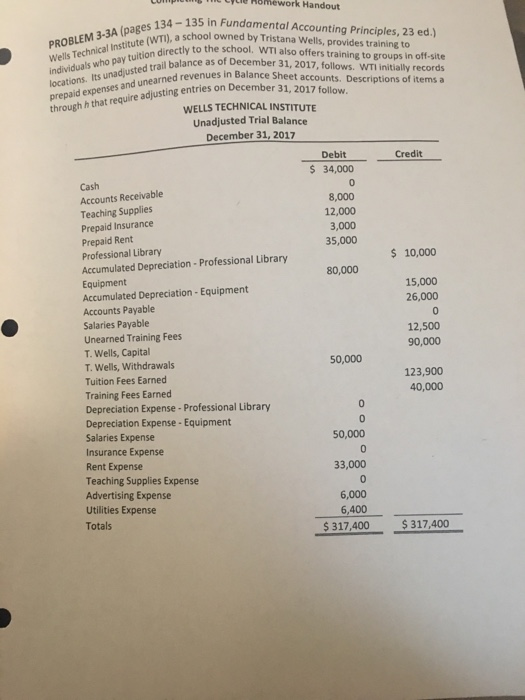

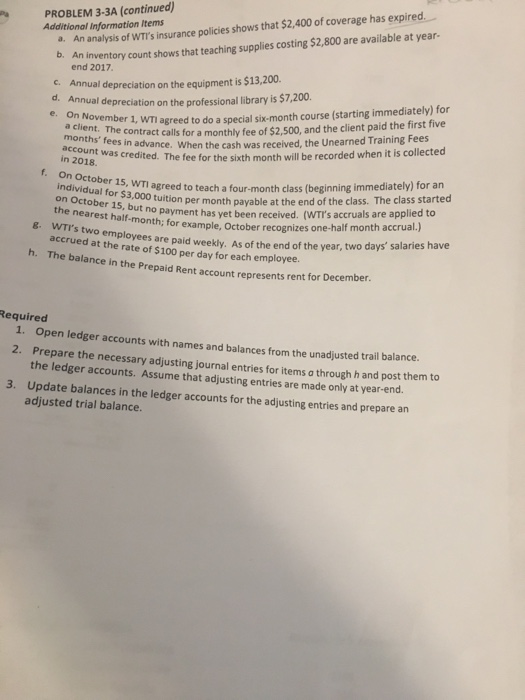

t Tht Cytie Hamework Handout es 134 135 in Fundamental Accounting Principles, 23 ed.) 3-3A (pages 134-135 3-3A (pa germ a school owned by Tristana wells, provides training to PROBLEM ca Insitutey to the school. WTI also offers training to groups in off-site directly to th individuals who pa locations. Its unadjusted trail prepaid through hthatWELLS TECHNICAL INSTITUTE y tuition l balance as of December 31, 2017, follows. WTI initially records nues in Balance Sheet accounts. Descriptions of items a December 31, 2017 follow. through h that require adjusting entries on Unadjusted Trial Balance December 31, 2017 Debit Credit $ 34,000 Cash Accounts Receivable Teaching Supplies Prepaid Insurance Prepaid Rent Professional Library Accumulated Depreciation - Professional Library Equipment Accumulated Depreciation- Equipment Accounts Payable Salaries Payable Unearned Training Fees T. wells, Capital T. Wells, Withdrawals Tuition Fees Earned Training Fees Earned Depreciation Expense - Professional Library Depreciation Expense- Equipment Salaries Expense Insurance Expense Rent Expense Teaching Supplies Expense Advertising Expense Utilities Expense 8,000 12,000 3,000 35,000 10,000 80,000 15,000 26,000 0 12,500 90,000 50,000 123,900 40,000 0 50,000 33,000 6,000 6,400 Totals $317,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts