Question: NEED HELP ASAP Universal life insurance combines elements from term life insurance and whole life insarance. Term policies provide a death benefit savings component, whole

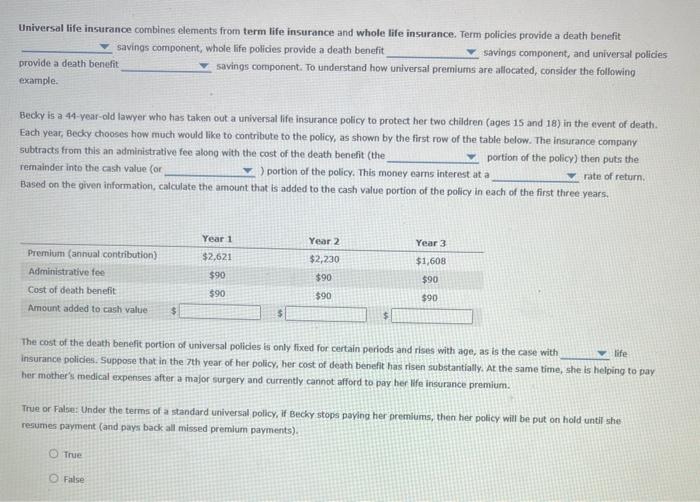

Universal life insurance combines elements from term life insurance and whole life insarance. Term policies provide a death benefit savings component, whole life policies provide a death benefit savings component, and universal policies provide a death benefit savings component: To understand how universal premiums are allocated, consider the following. example. Becky is a 44-year-old lawyer who has taken out a universal life insurance policy to protect her two chidren (ages 15 and 18 ) in the event of death. Each year, Becky chooses how much would like to contribute to the policy, as shown by the first row of the table below. The insurance company isubtracts from this an administrative fee along with the cost of the death benefit (the portion of the policy) then pute the remainder into the cash value for portion of the policy. This money eams interest at a Based on the given information, calculate the amount that is added to the cash value portion of the policy in each of the first three-years. True or False: Under the terms of a standard universal policy, if Becky stops paying her premiums, then her policy will be put on hold until she resumes payment (and pays back all missed premium payments). irue False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts