Question: Need HELP ASAP, WILL LEAVE THUMBS UP Cathy Company started a business on January 1, 2021. Cathy purchased $1,500 of supplies for use in the

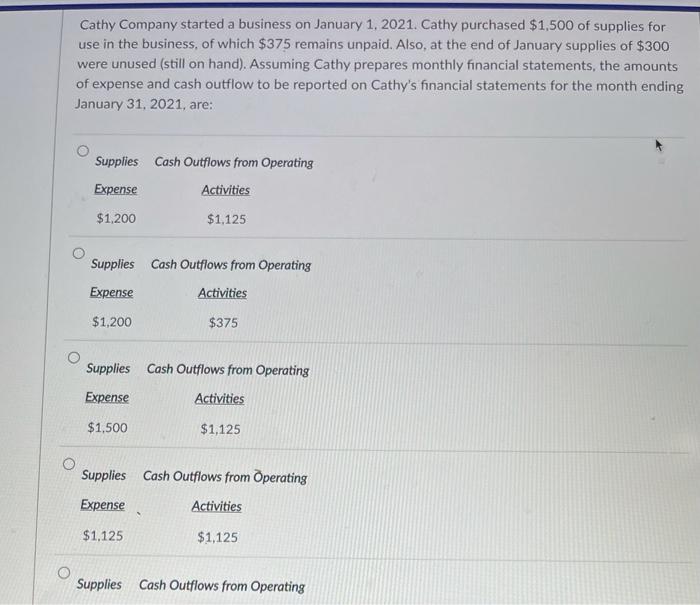

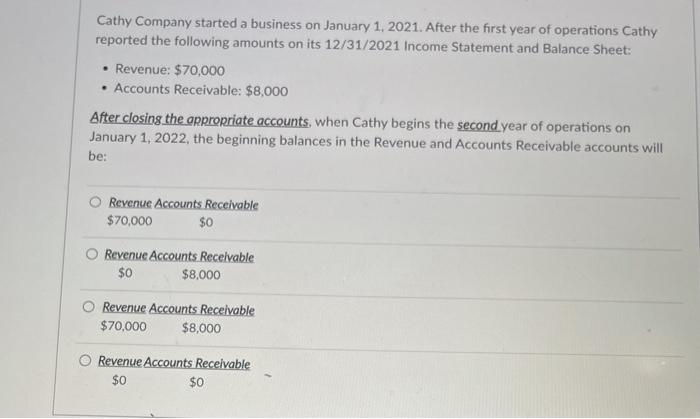

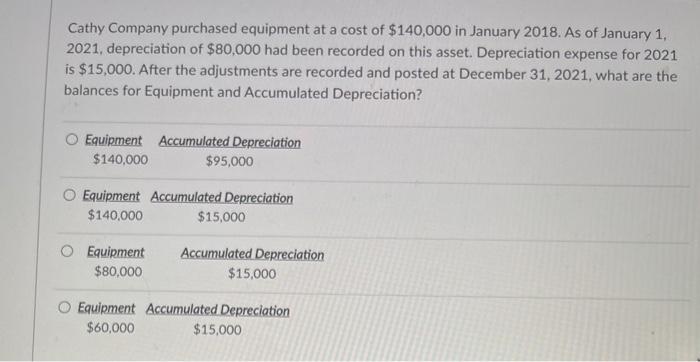

Cathy Company started a business on January 1, 2021. Cathy purchased $1,500 of supplies for use in the business, of which $375 remains unpaid. Also, at the end of January supplies of $300 were unused (still on hand). Assuming Cathy prepares monthly financial statements, the amounts of expense and cash outflow to be reported on Cathy's financial statements for the month ending January 31, 2021, are: Supplies Cash Outflows from Operating Expense Activities $1,200 $1,125 Supplies Cash Outflows from Operating Expense Activities $1,200 $375 Supplies Cash Outflows from Operating Activities Expense $1,500 $1,125 Supplies Cash Outflows from Operating Expense Activities $1,125 $1,125 O Supplies Cash Outflows from Operating Cathy Company started a business on January 1, 2021. After the first year of operations Cathy reported the following amounts on its 12/31/2021 Income Statement and Balance Sheet: Revenue: $70,000 Accounts Receivable: $8,000 After closing the appropriate accounts, when Cathy begins the second year of operations on January 1, 2022, the beginning balances in the Revenue and Accounts Receivable accounts will be: Revenue Accounts Receivable $70,000 $0 Revenue Accounts Receivable $0 $8,000 Revenue Accounts Receivable $70,000 $8,000 Revenue Accounts Receivable $0 $0 Cathy Company purchased equipment at a cost of $140,000 in January 2018. As of January 1, 2021, depreciation of $80,000 had been recorded on this asset. Depreciation expense for 2021 is $15,000. After the adjustments are recorded and posted at December 31, 2021, what are the balances for Equipment and Accumulated Depreciation? Equipment Accumulated Depreciation $140,000 $95,000 Equipment Accumulated Depreciation $140,000 $15,000 O Equipment $80,000 Accumulated Depreciation $15,000 Equipment Accumulated Depreciation $60,000 $15,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts