Question: need help asap will upvote Average 13 11. Net present value (NPV) Evaluating cash flows with the NPV method The net present value (NPV) rule

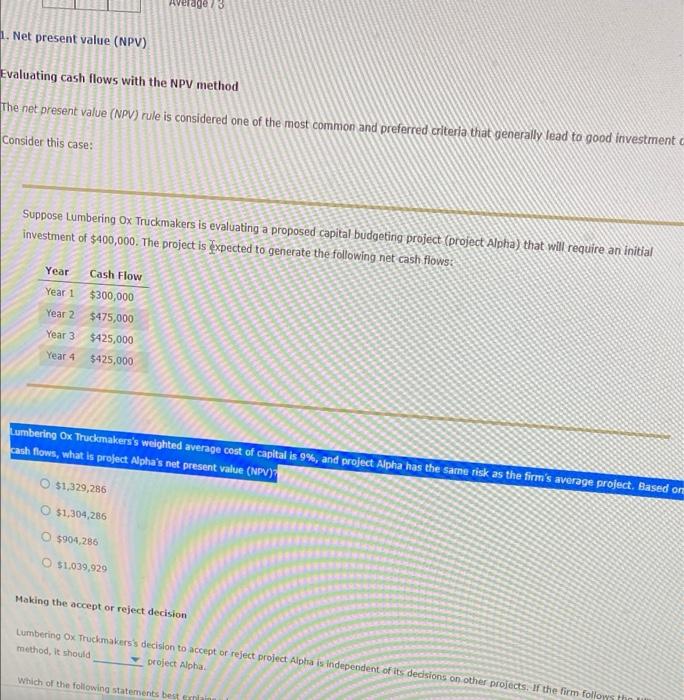

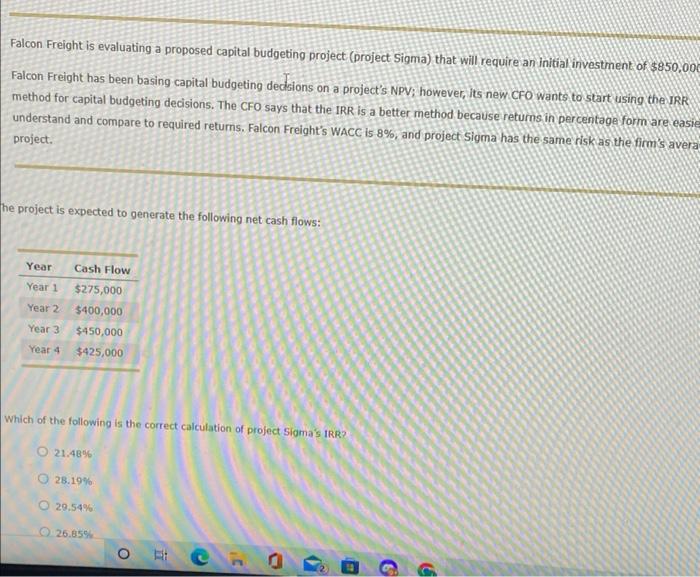

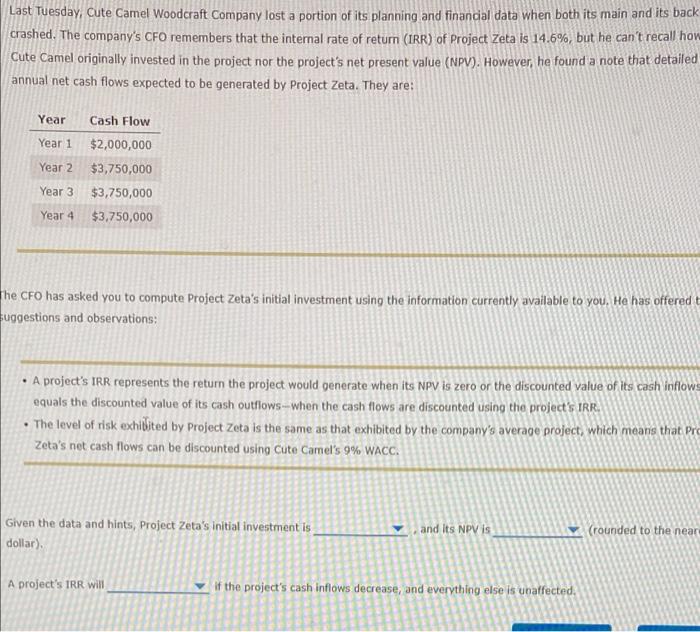

Average 13 11. Net present value (NPV) Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment Consider this case: Suppose Lumbering Ox Truckmakers is evaluating a proposed capital budgeting project (project Alpha) that will require an initial investment of $400,000. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $300,000 Year 2 $475,000 Year 3 $425,000 Year 4 $425,000 Lumbering Ox Truckmakers's weighted average cost of capital is 9%, and project Alpha has the same risk as the firm's average project. Based or cash flows, what is project Alpha's net present value (NPV) O $1,329,286 O $1,304,286 $904,286 O $1.039,929 Making the accept or reject decision Lumbering Ox Truckmakers's decision to accept or reject project Alphia is Independent of its decisions on other projects. If the firm follows the method, it should project Alpha Which of the following statements best Falcon Freight is evaluating a proposed capital budgeting project (project Sigma) that will require an initial investment of $850,000 Falcon Freight has been basing capital budgeting decisions on a project's NPV; however, its new CFO wants to start using the IRR method for capital budgeting decisions. The CFO says that the IRR is a better method because returns in percentage form are easie understand and compare to required returns. Falcon Freight's WACC is 8%, and project Sigma has the same risk as the firm's avera project. the project is expected to generate the following net cash flows: Year Year 1 Year 2 Cash Flow $275,000 $400,000 $450,000 $425,000 Year 3 Year 4 Which of the following is the correct calculation of project Sigma's IRR? 21.48% 28.19% 29.54% 26.859 oc 6 Last Tuesday, Cute Camel Woodcraft Company lost a portion of its planning and financial data when both its main and its back crashed. The company's CFO remembers that the internal rate of return (IRR) of Project Zeta is 14.6%, but he can't recall how Cute Camel originally invested in the project nor the project's net present value (NPV). However, he found a note that detailed annual net cash flows expected to be generated by Project Zeta. They are: Year Year 1 Year 2 Cash Flow $2,000,000 $3,750,000 $3,750,000 $3,750,000 Year 3 Year 4 The CFO has asked you to compute Project Zeta's initial investment using the information currently available to you. He has offered suggestions and observations: A project's IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows --- when the cash flows are discounted using the project's IRR. The level of risk exhibited by Project Zeta is the same as that exhibited by the company's average project, which means that Pro Zeta's net cash flows can be discounted using Cute Camel's 9% WACC. Given the data and hints, Project Zeta's initial investment is dollar) and Its NPV is (rounded to the near A project's IRR will if the project's cash inflows decrease, and everything else is unaffected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts