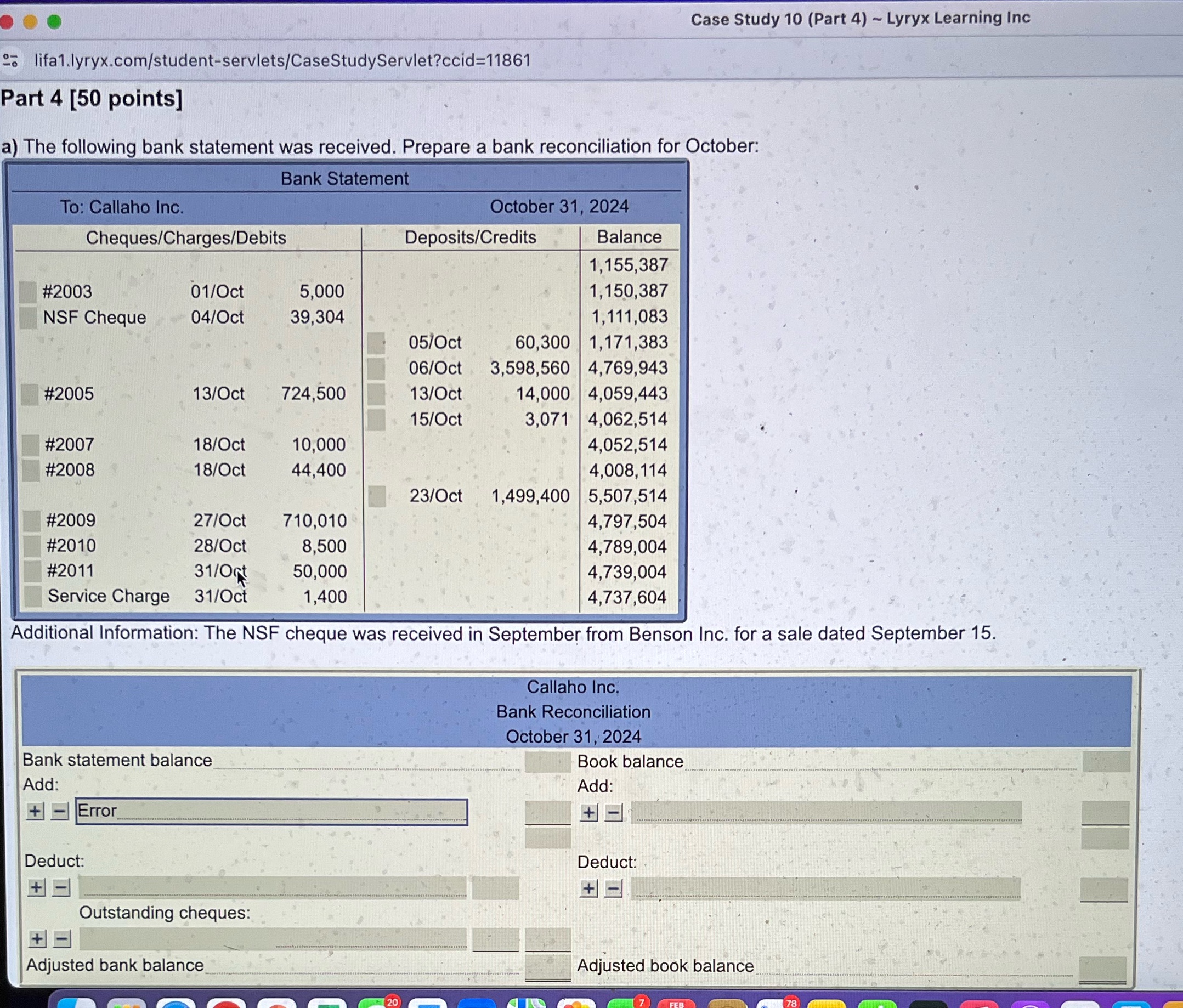

Question: Need help awnsering Case Study 10 (Part 4) ~ Lyryx Learning Inc 2. lifa1.lyryx.com/student-servlets/CaseStudyServlet?ccid=11861 Part 4 [50 points] a) The following bank statement was received.

Need help awnsering

Case Study 10 (Part 4) ~ Lyryx Learning Inc 2. lifa1.lyryx.com/student-servlets/CaseStudyServlet?ccid=11861 Part 4 [50 points] a) The following bank statement was received. Prepare a bank reconciliation for October: Bank Statement To: Callaho Inc. October 31, 2024 Cheques/Charges/Debits Deposits/Credits Balance 1,155,387 #2003 01/Oct 5,000 1,150,387 NSF Cheque 04/Oct 39,304 1, 111,083 05/Oct 60,300 1, 171,383 06/Oct 3,598,560 4,769,943 #2005 13/Oct 724,500 13/Oct 14,000 4,059,443 15/Oct 3,071 4,062,514 #2007 18/Oct 10,000 4,052,514 #2008 18/Oct 44,400 4,008, 114 23/Oct 1,499,400 5,507,514 #2009 27/Oct 710,010 4,797,504 #2010 28/Oct 8,500 4,789,004 #2011 31/Oct 50,000 4,739,004 Service Charge 31/Oct 1,400 4,737,604 Additional Information: The NSF cheque was received in September from Benson Inc. for a sale dated September 15. Callaho Inc. Bank Reconciliation October 31, 2024 Bank statement balance Book balance Add: Add: + Error Deduct: Deduct: + - Outstanding cheques: + 9 Adjusted bank balance Adjusted book balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts