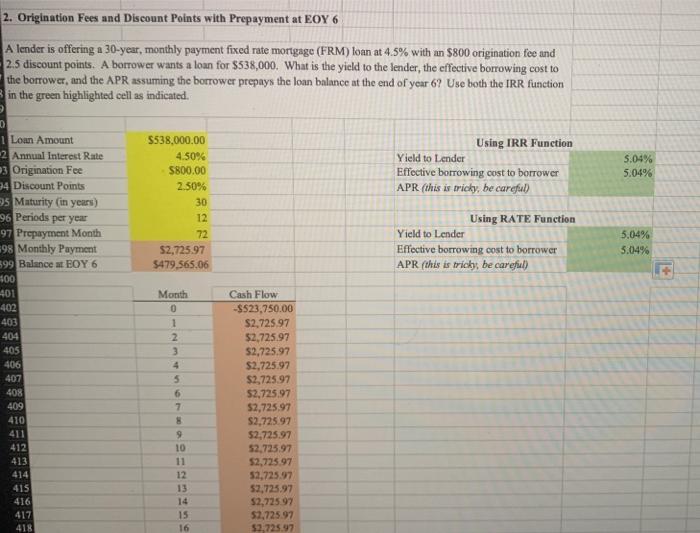

Question: need help calculating APR, with excel functions please 5.04% 5.04% 5.04% 5.04% 2. Origination Fees and Discount Points with Prepayment at EOY 6 A lender

5.04% 5.04% 5.04% 5.04% 2. Origination Fees and Discount Points with Prepayment at EOY 6 A lender is offering a 30-year, monthly payment fixed rate mortgage (FRM) loan at 4.5% with an $800 origination fee and 2.5 discount points. A borrower wants a loan for $538,000. What is the yield to the lender, the effective borrowing cost to the borrower, and the APR assuming the borrower prepays the loan balance at the end of year 6? Use both the IRR function in the green highlighted cell as indicated. 3 0 1 Lonn Amount $538,000.00 Using IRR Function 2 Annual Interest Rate 4.50% Yield to Lender 3 Origination Fee $800.00 Effective borrowing cost to borrower 14 Discount Points 2.50% APR (this is tricky, be careful 35 Maturity (in years) 30 196 Periods per year 12 Using RATE Function 97 Prepayment Month 72 Yield to Lender 98 Monthly Payment $2,725.97 Effective borrowing cost to borrower 599 Balance at BOY 6 5479,565.06 APR (this is trich, be careful 400 401 Month Cash Flow 402 0 -S523,750.00 1 $2,725.97 404 2 $2,725.97 405 3 52,725.97 406 $2,72597 407 $2,725.97 408 52,72597 409 52,725.97 410 $2,725.97 411 9 52,725.97 412 10 52,72597 413 11 52,725.97 414 12 52,725.97 415 13 52,725.97 416 14 52,72597 417 15 52,725.97 418 16 52.725.97 + 403 5 6 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts