Question: Need help calculating E, please show work. Assuming a 30 percent marginal tax rate, compute the after-tax cost of the following business expenses: a. $5,700

Need help calculating E, please show work.

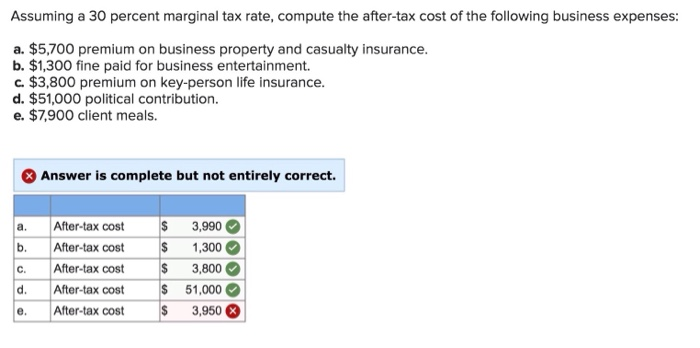

Need help calculating E, please show work. Assuming a 30 percent marginal tax rate, compute the after-tax cost of the following business expenses: a. $5,700 premium on business property and casualty insurance. b. $1,300 fine paid for business entertainment. c. $3,800 premium on key-person life insurance. d. $51,000 political contribution. e. $7,900 client meals. Answer is complete but not entirely correct. a. After-tax cost 3,990 b After-tax cost 1,300 C. Aer-lax cost 3,800 d. After-tax cost 51,000 e. After-tax cost 3,950

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock