Question: Need help Calculating this not sure how to do it. 5. The 15-Year Mortgage Repayment: The interest rate for mortgages is ideal to refinance at

Need help Calculating this not sure how to do it.

Need help Calculating this not sure how to do it.

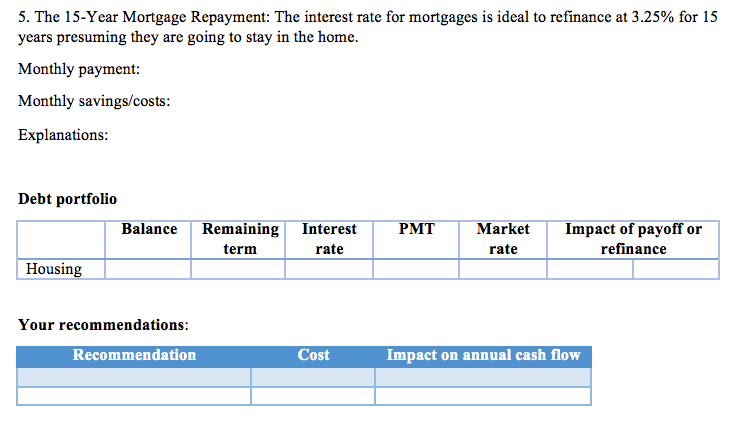

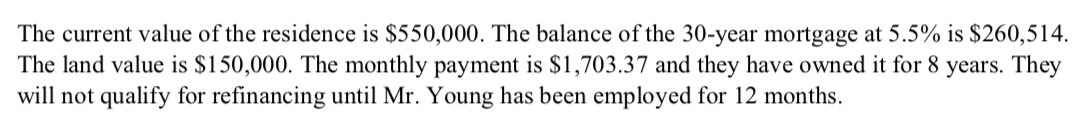

5. The 15-Year Mortgage Repayment: The interest rate for mortgages is ideal to refinance at 3.25% for 15 years presuming they are going to stay in the home. Monthly payment: Monthly savings/costs: Explanations: Debt portfolio Balance Remaining term Housing PMT Interest rate Market rate Impact of payoff or refinance Your recommendations: Recommendation Cost Impact on annual cash flow The current value of the residence is $550,000. The balance of the 30-year mortgage at 5.5% is $260,514. The land value is $150,000. The monthly payment is $1,703.37 and they have owned it for 8 years. They will not qualify for refinancing until Mr. Young has been employed for 12 months. 5. The 15-Year Mortgage Repayment: The interest rate for mortgages is ideal to refinance at 3.25% for 15 years presuming they are going to stay in the home. Monthly payment: Monthly savings/costs: Explanations: Debt portfolio Balance Remaining term Housing PMT Interest rate Market rate Impact of payoff or refinance Your recommendations: Recommendation Cost Impact on annual cash flow The current value of the residence is $550,000. The balance of the 30-year mortgage at 5.5% is $260,514. The land value is $150,000. The monthly payment is $1,703.37 and they have owned it for 8 years. They will not qualify for refinancing until Mr. Young has been employed for 12 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts