Question: Need help: Can you please help me solve this question? Company A Company B and Company Chad purchased the same piece of machinery 2 years

Need help: Can you please help me solve this question?

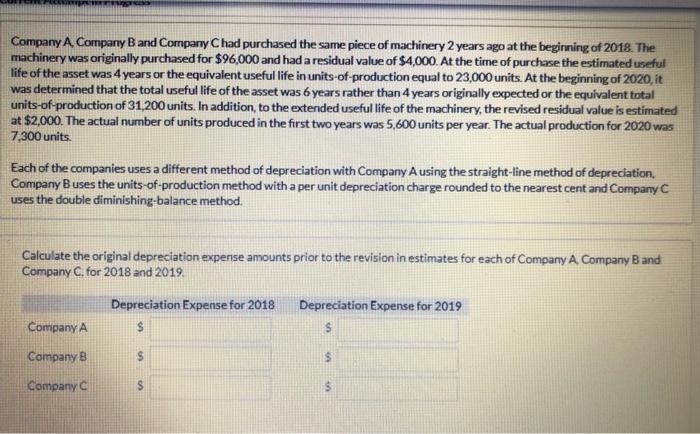

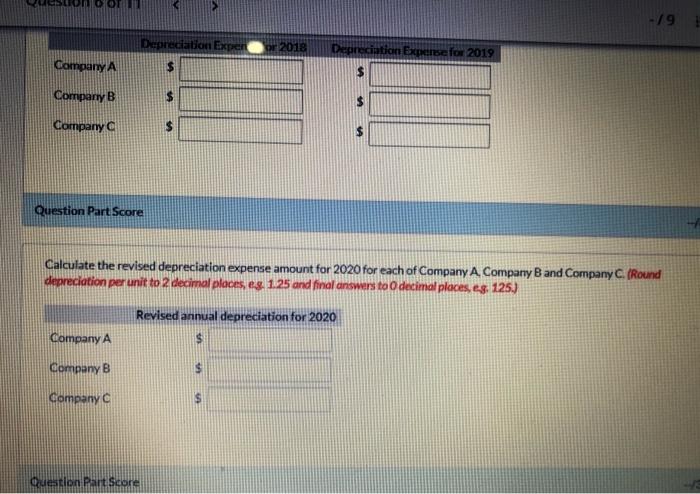

Need help: Can you please help me solve this question? Company A Company B and Company Chad purchased the same piece of machinery 2 years ago at the beginning of 2018. The machinery was originally purchased for $96,000 and had a residual value of $4,000. At the time of purchase the estimated useful life of the asset was 4 years or the equivalent useful life in units-of-production equal to 23,000 units. At the beginning of 2020, it was determined that the total useful life of the asset was 6 years rather than 4 years originally expected or the equivalent total units-of-production of 31,200 units. In addition, to the extended useful life of the machinery, the revised residual value is estimated at $2,000. The actual number of units produced in the first two years was 5,600 units per year. The actual production for 2020 was 7,300 units. Each of the companies uses a different method of depreciation with Company A using the straight-line method of depreciation, Company Buses the units-of-production method with a per unit depreciation charge rounded to the nearest cent and Company C uses the double diminishing-balance method. Calculate the original depreciation expense amounts prior to the revision in estimates for each of Company A Company B and Company C, for 2018 and 2019, Depreciation Expense for 2018 $ Depreciation Expense for 2019 $ Company A Company B UR S Company c $ -19 Depreciation Experor 2018 Depreciation Expense for 2019 Company A Comparty B $ $ $ Company a Question Part Score Calculate the revised depreciation expense amount for 2020 for each of Company A Company B and Company C. (Round depreciation per unit to 2 decimal places, eg. 1.25 and final answers to decimal places, eg. 125.) Revised annual depreciation for 2020 Company A $ Company B $ Company C Question Part Score

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts