Question: Need help choosing the best answer choice Answers Scoring 1. A key source of information for computing employer payroll taxes is the (A) end-of-period balance

Need help choosing the best answer choice

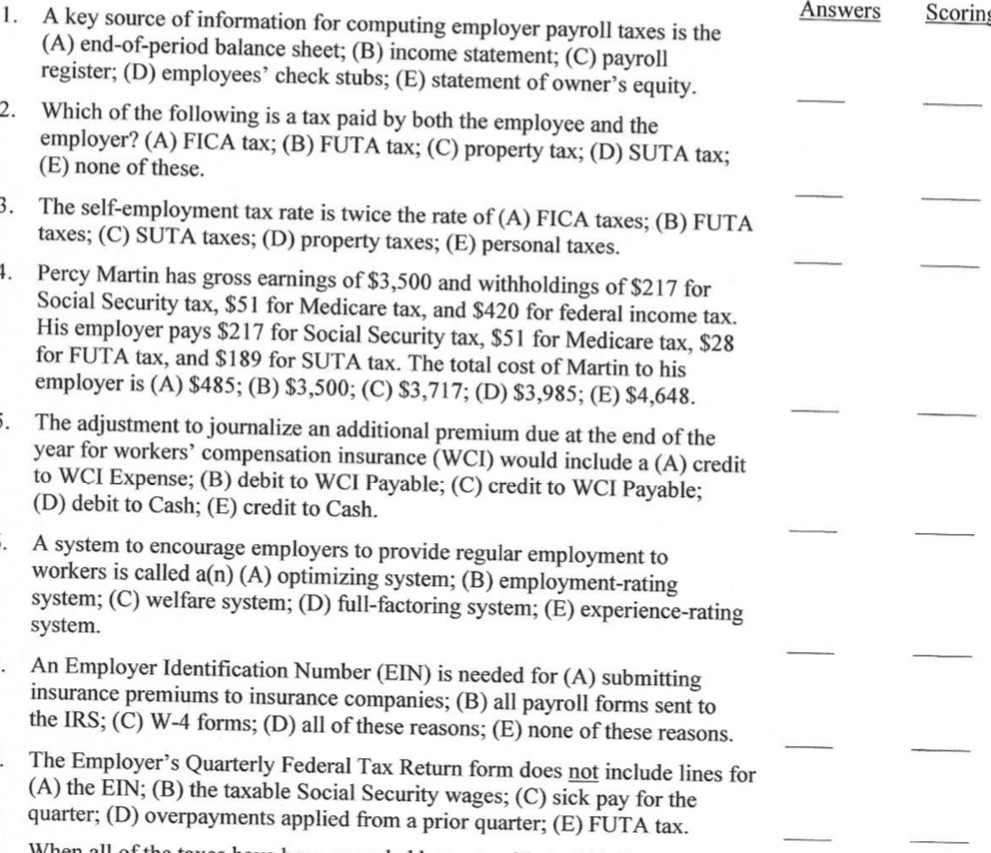

Answers Scoring 1. A key source of information for computing employer payroll taxes is the (A) end-of-period balance sheet; (B) income statement; (C) payroll register; (D) employees' check stubs; (E) statement of owner's equity. Which of the following is a tax paid by both the employee and the employer? (A) FICA tax; (B) FUTA tax; (C) property tax; (D) SUTA tax; (E) none of these. The self-employment tax rate is twice the rate of (A) FICA taxes; (B) FUTA taxes; (C) SUTA taxes; (D) property taxes; (E) personal taxes. Percy Martin has gross earnings of $3,500 and withholdings of $217 for Social Security tax, $51 for Medicare tax, and $420 for federal income tax. His employer pays $217 for Social Security tax, $51 for Medicare tax, $28 for FUTA tax, and $189 for SUTA tax. The total cost of Martin to his employer is (A) $485; (B) $3,500; (C) $3,717; (D) $3,985; (E) $4,648. The adjustment to journalize an additional premium due at the end of the year for workers' compensation insurance (WCI) would include a (A) credit to WCI Expense; (B) debit to WCI Payable; (C) credit to WCI Payable; (D) debit to Cash; (E) credit to Cash. A system to encourage employers to provide regular employment to workers is called a(n) (A) optimizing system; (B) employment-rating system; (C) welfare system; (D) full-factoring system; (E) experience-rating system. An Employer Identification Number (EIN) is needed for (A) submitting insurance premiums to insurance companies; (B) all payroll forms sent to the IRS; (C) W-4 forms; (D) all of these reasons; (E) none of these reasons. The Employer's Quarterly Federal Tax Return form does not include lines for (A) the EIN; (B) the taxable Social Security wages; (C) sick pay for the quarter; (D) overpayments applied from a prior quarter; (E) FUTA tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts