Question: Need help classifying what each type of transaction is. Either: 1) Sales & Cash Receipts 2) Purchases & Cash Disbursements 3) Payroll 4) Other Thank

Need help classifying what each type of transaction is. Either:

1) Sales & Cash Receipts

2) Purchases & Cash Disbursements

3) Payroll

4) Other

Thank you!

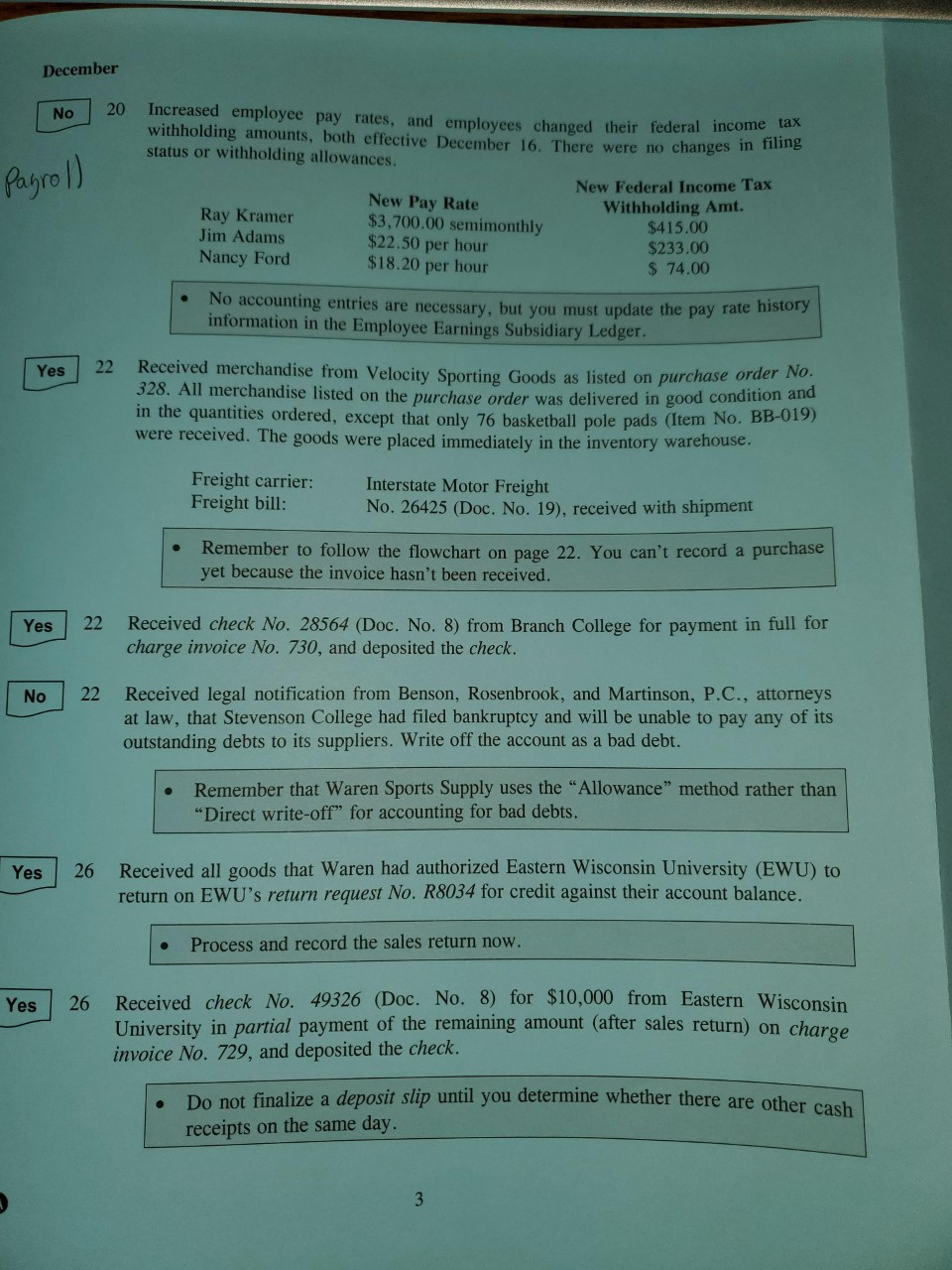

December No 20 Payroll Increased employee pay rates, and employees changed their federal income tax withholding amounts, both effective December 16. There were no changes in filing status or withholding allowances. New Federal Income Tax New Pay Rate Withholding Amt. Ray Kramer $3,700.00 semimonthly $415.00 Jim Adams $22.50 per hour $233.00 Nancy Ford $18.20 per hour $ 74.00 No accounting entries are necessary, but you must update the pay rate history information in the Employee Earnings Subsidiary Ledger. Received merchandise from Velocity Sporting Goods as listed on purchase order No. 328. All merchandise listed on the purchase order was delivered in good condition and in the quantities ordered, except that only 76 basketball pole pads (Item No. BB-019) were received. The goods were placed immediately in the inventory warehouse. Yes 22 Freight carrier: Freight bill: Interstate Motor Freight No. 26425 (Doc. No. 19), received with shipment Remember to follow the flowchart on page 22. You can't record a purchase yet because the invoice hasn't been received. Yes 22 Received check No. 28564 (Doc. No. 8) from Branch College for payment in full for charge invoice No. 730, and deposited the check. No 22 Received legal notification from Benson, Rosenbrook, and Martinson, P.C., attorneys at law, that Stevenson College had filed bankruptcy and will be unable to pay any of its outstanding debts to its suppliers. Write off the account as a bad debt. Remember that Waren Sports Supply uses the "Allowance" method rather than "Direct write-off" for accounting for bad debts. Yes 26 Received all goods that Waren had authorized Eastern Wisconsin University (EWU) to return on EWU's return request No. R8034 for credit against their account balance. Process and record the sales return now. Yes 26 Received check No. 49326 (Doc. No. 8) for $10,000 from Eastern Wisconsin University in partial payment of the remaining amount (after sales return) on charge invoice No. 729, and deposited the check. Do not finalize a deposit slip until you determine whether there are other cash receipts on the same day. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts