Question: Need help commenting on the issues discussed during the meeting with the clients audit committee and assessing the impact on the client firm. I have

Need help commenting on the issues discussed during the meeting with the clients audit committee and assessing the impact on the client firm. I have also provided you with the statement of financial position and statement of operation excel sheet if you need to use that as well. Thank you

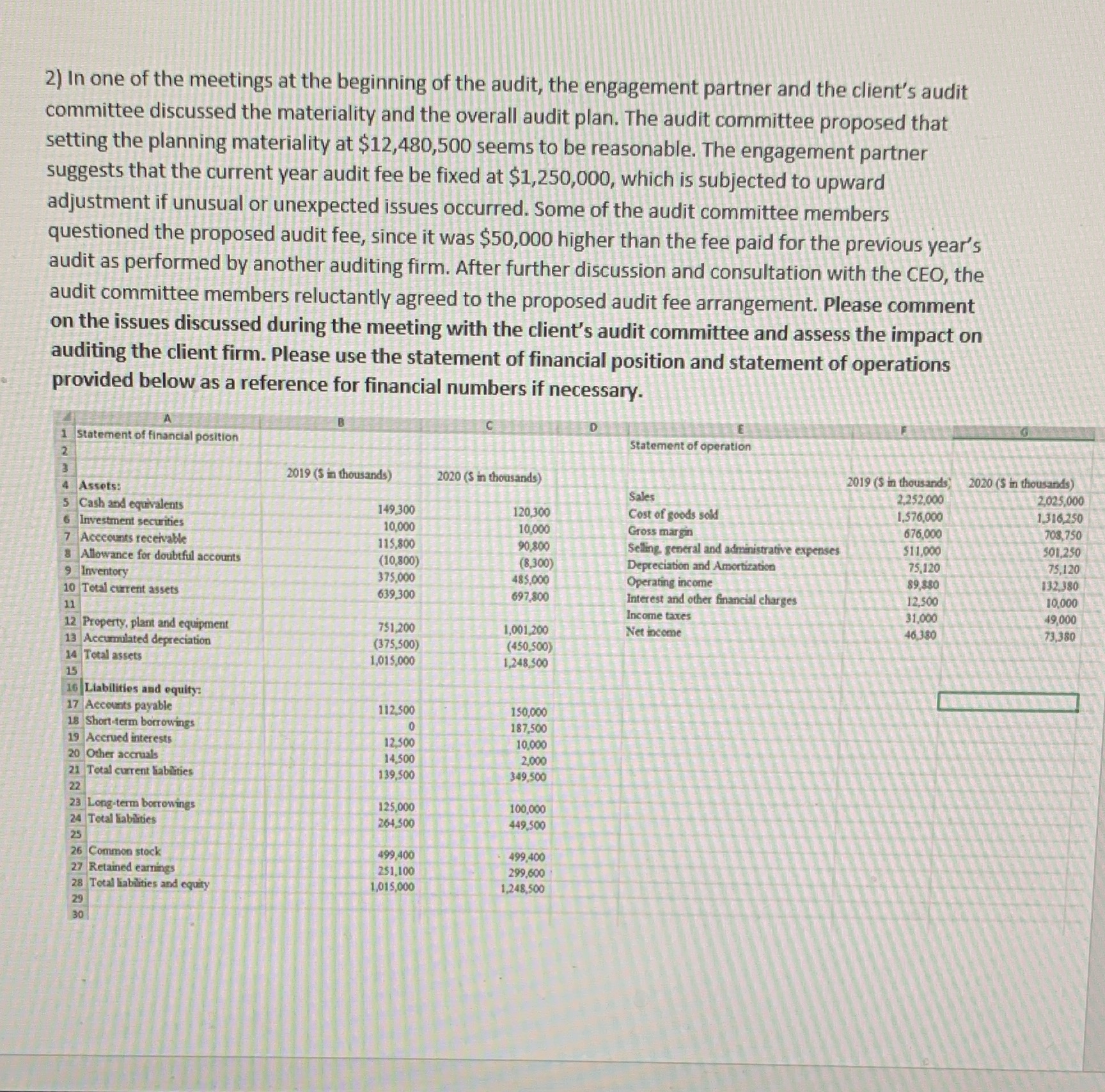

2) In one of the meetings at the beginning of the audit, the engagement partner and the client's audit committee discussed the materiality and the overall audit plan. The audit committee proposed that setting the planning materiality at $12,480,500 seems to be reasonable. The engagement partner suggests that the current year audit fee be fixed at $1,250,000, which is subjected to upward adjustment if unusual or unexpected issues occurred. Some of the audit committee members questioned the proposed audit fee, since it was $50,000 higher than the fee paid for the previous year's audit as performed by another auditing firm. After further discussion and consultation with the CEO, the audit committee members reluctantly agreed to the proposed audit fee arrangement. Please comment on the issues discussed during the meeting with the client's audit committee and assess the impact on auditing the client firm. Please use the statement of financial position and statement of operations provided below as a reference for financial numbers if necessary. 1 Statement of financial position Statement of operation 2 2019 ($ in thousands) 2020 (S in thousands) 2019 ($ in thousands) 2020 ($ in thousands) 4 Assets: Sales 2,252,000 2,025,000 5 Cash and equivalents 149,300 120,300 Cost of goods sold 1,576,000 1.316,250 6 Investment securities 10,000 10,000 Gross margin 676,000 708, 750 7 Acccounts receivable 115,800 90 800 Selling general and administrative expenses $11,000 501,230 8 Allowance for doubtful accounts (10,800 (8,300) Depreciation and Amortization 75,120 75,120 9 Inventory 375,000 485,000 Operating income 89,$80 132.380 10 Total current assets 639,300 697.800 Interest and other financial charges 12,500 10,000 11 Income taxes 31,000 49,000 12 Property, plant and equipment 751.200 1,001,200 Net income 46.380 73,380 13 Accumulated depreciation (375,500) (450,500) 14 Total assets 1,015,000 ,248,500 15 16 Liabilities and equity: 17 Accounts payable 112.500 150,090 18 Short term borrowings 187 500 19 Accrued interests 12 500 10.900 20 Other accruals 14.500 2.000 21 Total current liabilities 139,500 349,500 22 23 Long-term borrowings 125,000 100,000 24 Total Nabilities 264.500 449 500 25 26 Common stock 499.400 499,400 27 Retained earnings 251,100 299,600 28 Total liabilities and equity 1,015,000 1,248,500 29 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts