Question: Need help completing a study guide question Required: 1. Prepare journal entries for the 18 transactions. 2. Prepare a trial balance showing what the ending

Need help completing a study guide question

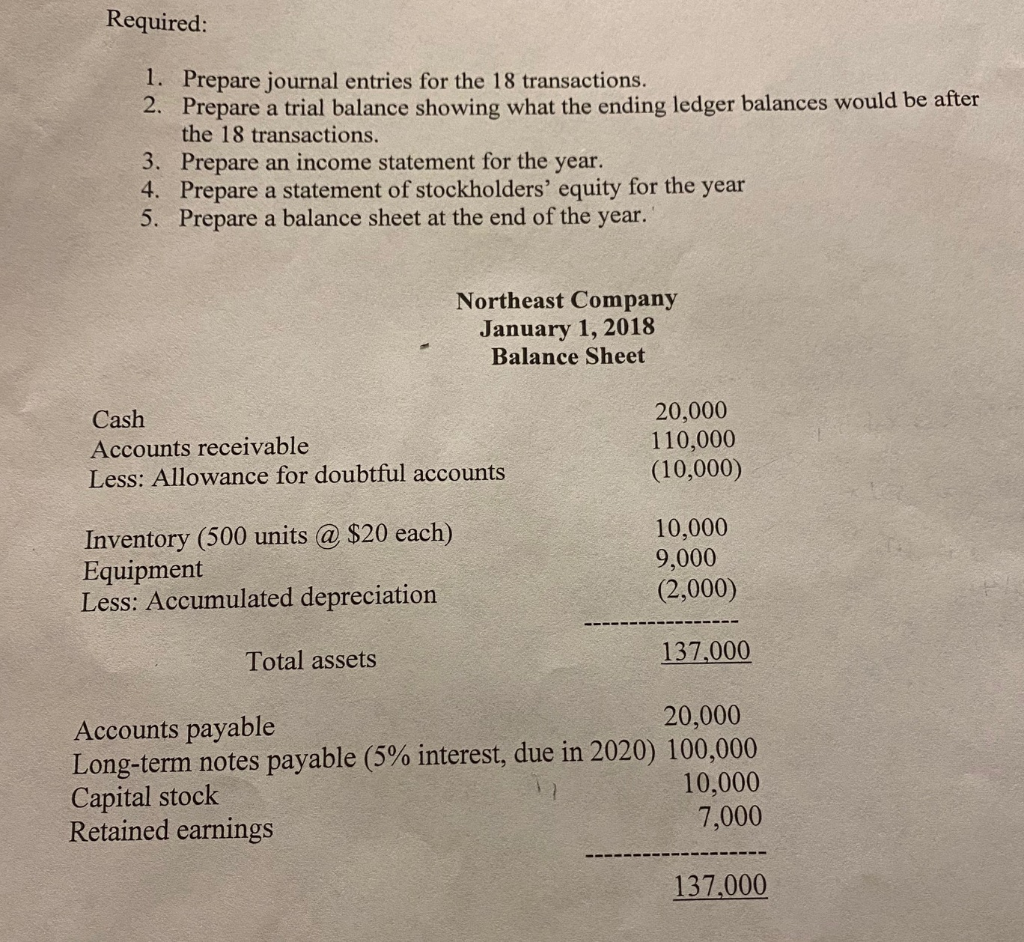

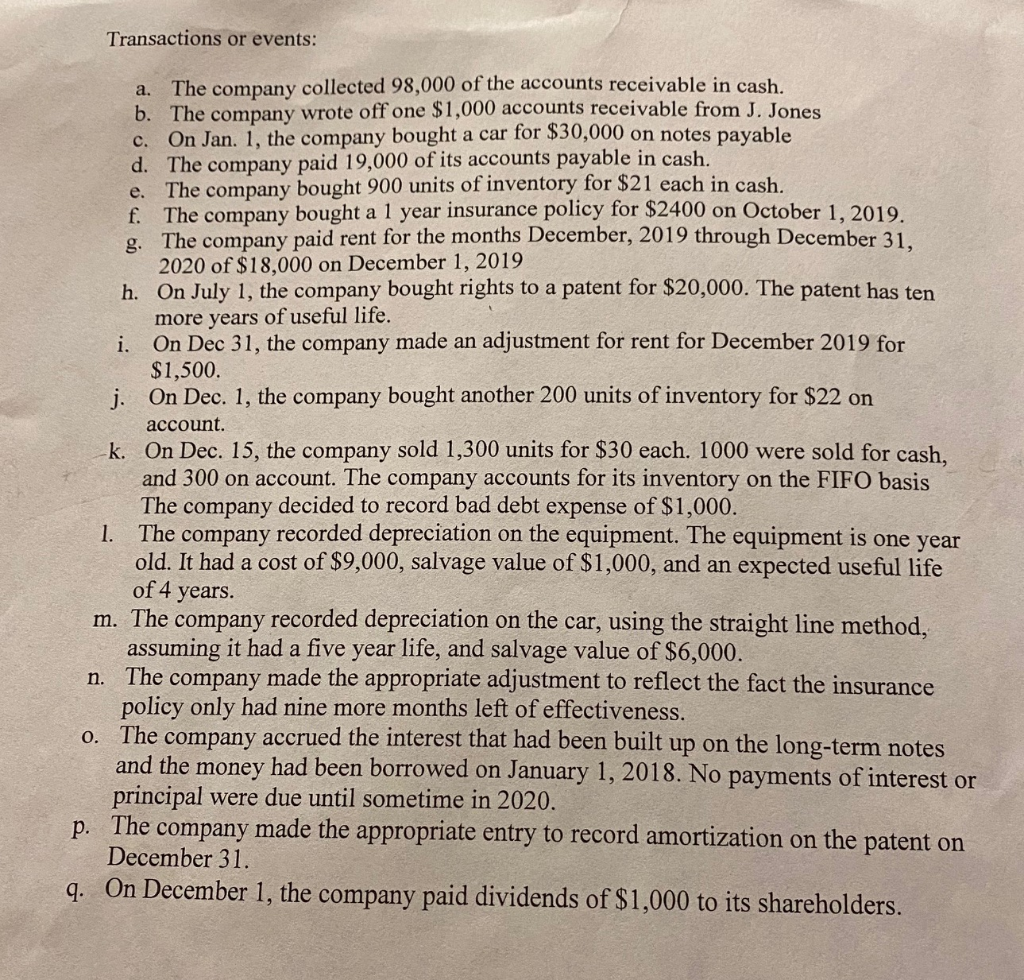

Required: 1. Prepare journal entries for the 18 transactions. 2. Prepare a trial balance showing what the ending ledger balances would be after the 18 transactions. 3. Prepare an income statement for the year. 4. Prepare a statement of stockholders' equity for the year 5. Prepare a balance sheet at the end of the year. Northeast Company January 1, 2018 Balance Sheet Cash Accounts receivable Less: Allowance for doubtful accounts 20,000 110,000 (10,000) Inventory (500 units @ $20 each) Equipment Less: Accumulated depreciation 10,000 9,000 (2,000) Total assets 137,000 Accounts payable 20,000 Long-term notes payable (5% interest, due in 2020) 100,000 Capital stock 10,000 Retained earnings 7,000 137,000 Transactions or events: a. The company collected 98,000 of the accounts receivable in cash. b. The company wrote off one $1,000 accounts receivable from J. Jones c. On Jan. 1, the company bought a car for $30,000 on notes payable The company paid 19,000 of its accounts payable in cash. e. The company bought 900 units of inventory for $21 each in cash. f. The company bought a 1 year insurance policy for $2400 on October 1, 2019 g. The company paid rent for the months December, 2019 through December 21 2020 of $18,000 on December 1, 2019 h. On July 1, the company bought rights to a patent for $20,000. The patent has ten more years of useful life. i. On Dec 31, the company made an adjustment for rent for December 2019 for $1,500. j. On Dec. 1, the company bought another 200 units of inventory for $22 on account. k. On Dec. 15, the company sold 1,300 units for $30 each. 1000 were sold for cash. and 300 on account. The company accounts for its inventory on the FIFO basis The company decided to record bad debt expense of $1,000. The company recorded depreciation on the equipment. The equipment is one year old. It had a cost of $9,000, salvage value of $1,000, and an expected useful life of 4 years. m. The company recorded depreciation on the car, using the straight line method, assuming it had a five year life, and salvage value of $6,000. n. The company made the appropriate adjustment to reflect the fact the insurance policy only had nine more months left of effectiveness. 0. The company accrued the interest that had been built up on the long-term notes and the money had been borrowed on January 1, 2018. No payments of interest or principal were due until sometime in 2020. p. The company made the appropriate entry to record amortization on the patent on December 31. 1. q. On December 1, the company paid dividends of $1,000 to its shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts