Question: Need help completing questions 3 and 4 using excel You've uncovered the following per-share information about a certain mutual fund: . On the basis of

Need help completing questions 3 and 4 using excel

Need help completing questions 3 and 4 using excel

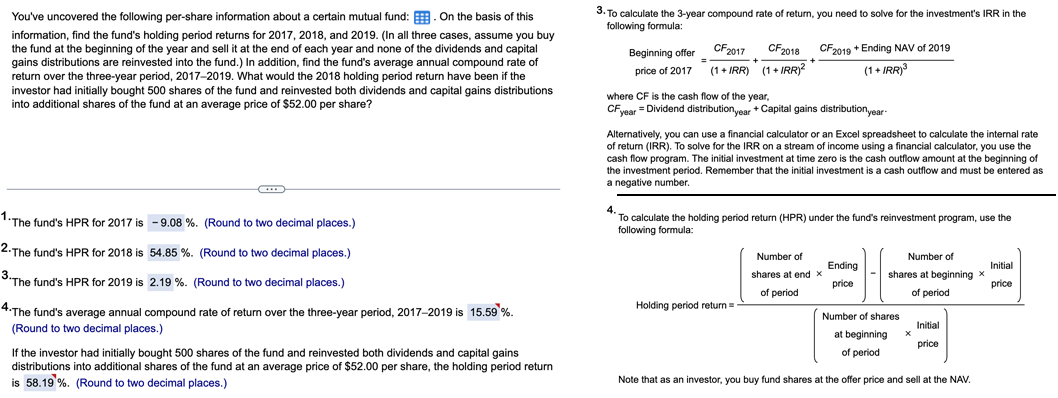

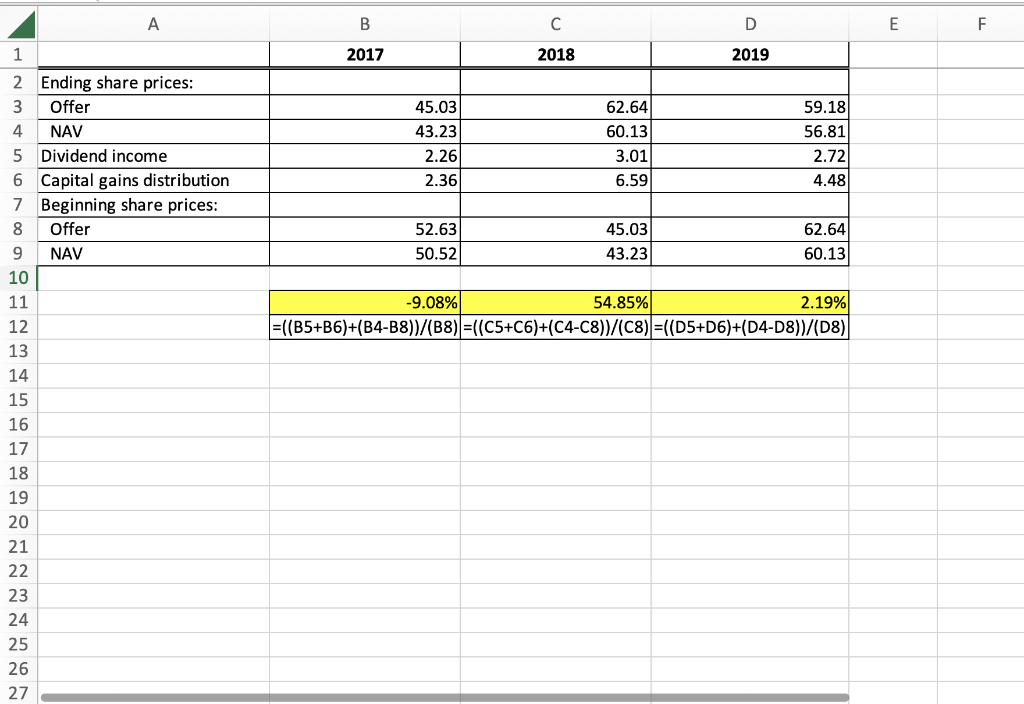

You've uncovered the following per-share information about a certain mutual fund: . On the basis of this 3. To calculate the 3-year compound rate of return, you need to solve for the investment's IRR in the information, find the fund's holding period returns for 2017, 2018, and 2019. (In all three cases, assume you buy the fund at the beginning of the year and sell it at the end of each year and none of the dividends and capital gains distributions are reinvested into the fund.) In addition, find the fund's average annual compound rate of return over the three-year period, 2017-2019. What would the 2018 holding period return have been if the following formula: investor had initially bought 500 shares of the fund and reinvested both dividends and capital gains distributions Beginning offer =(1+IRR)CF2017+(1+RR)2CF2018+(1+IRR)3CF2019+EndingNAVof2019 into additional shares of the fund at an average price of $52.00 per share? where CF is the cash flow of the year, CFyear= Dividend distribution year + Capital gains distribution year . Alternatively, you can use a financial calculator or an Excel spreadsheet to calculate the internal rate of return (IRR). To solve for the IRR on a stream of income using a financial calculator, you use the cash flow program. The initial investment at time zero is the cash outflow amount at the beginning of the investment period. Remember that the initial investment is a cash outflow and must be entered as a negative number. 1. The fund's HPR for 2017 is \%. (Round to two decimal places.) 4. 2. The fund's HPR for 2018 is 6. (Round to two decimal places.) 3. The fund's HPR for 2019 is 2.19%. (Round to two decimal places.) 4. The fund's average annual compound rate of return over the three-year period, 2017-2019 is 15.59 '\%. (Round to two decimal places.) If the investor had initially bought 500 shares of the fund and reinvested both dividends and capital gains distributions into additional shares of the fund at an average price of $52.00 per share, the holding period return To calculate the holding period return (HPR) under the fund's reinvestment program, use the following formula: is 58.19%. (Round to two decimal places.) Note that as an investor, you buy fund shares at the offer price and sell at the NAV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts