Question: Need help completing the forms (what was marked wrong). Required information Comprehensive Problem 20-80 (LO 20-1, LO 20-2, LO 20-3, LO 20-4, LO 20-5, LO

![displayed below.] Aaron, Deanne, and Keon formed the Blue Bell General Partnership](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e3d6bbbc29b_67566e3d6bb395cd.jpg)

Need help completing the forms (what was marked wrong).

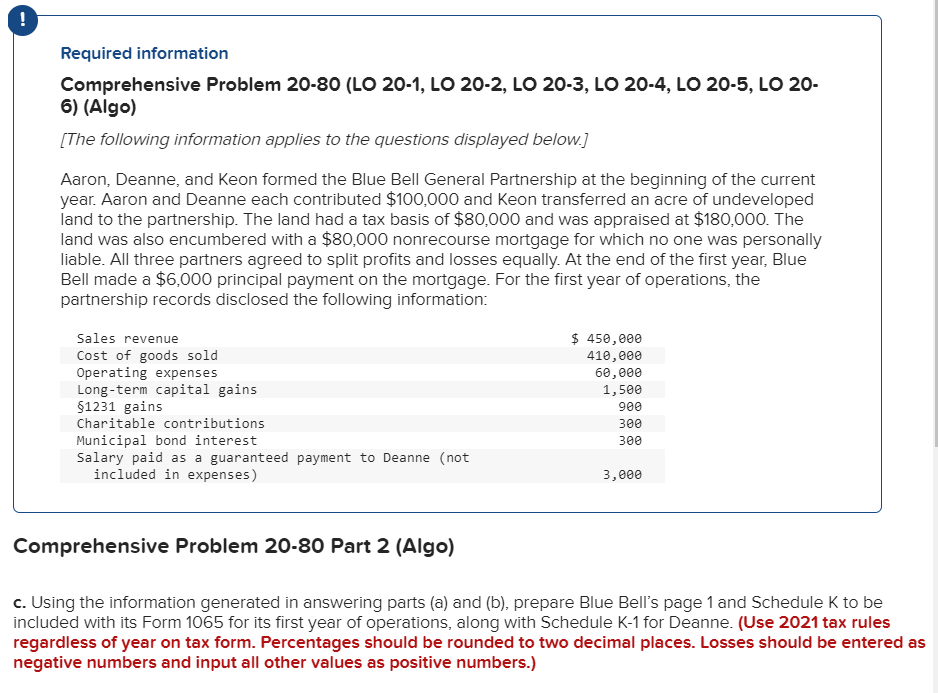

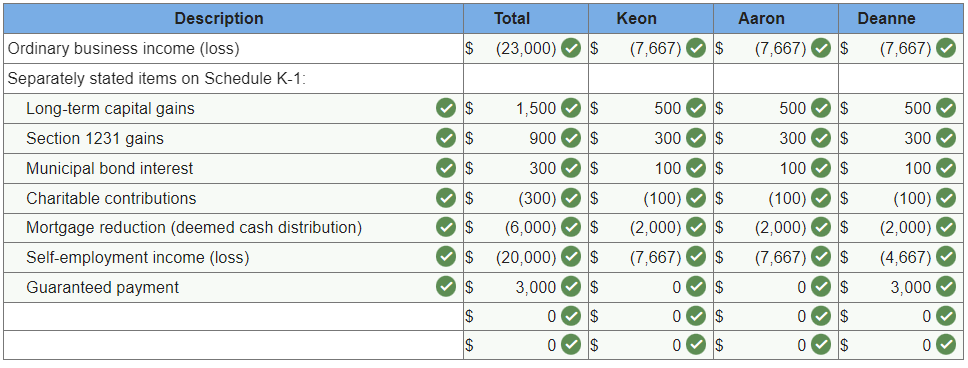

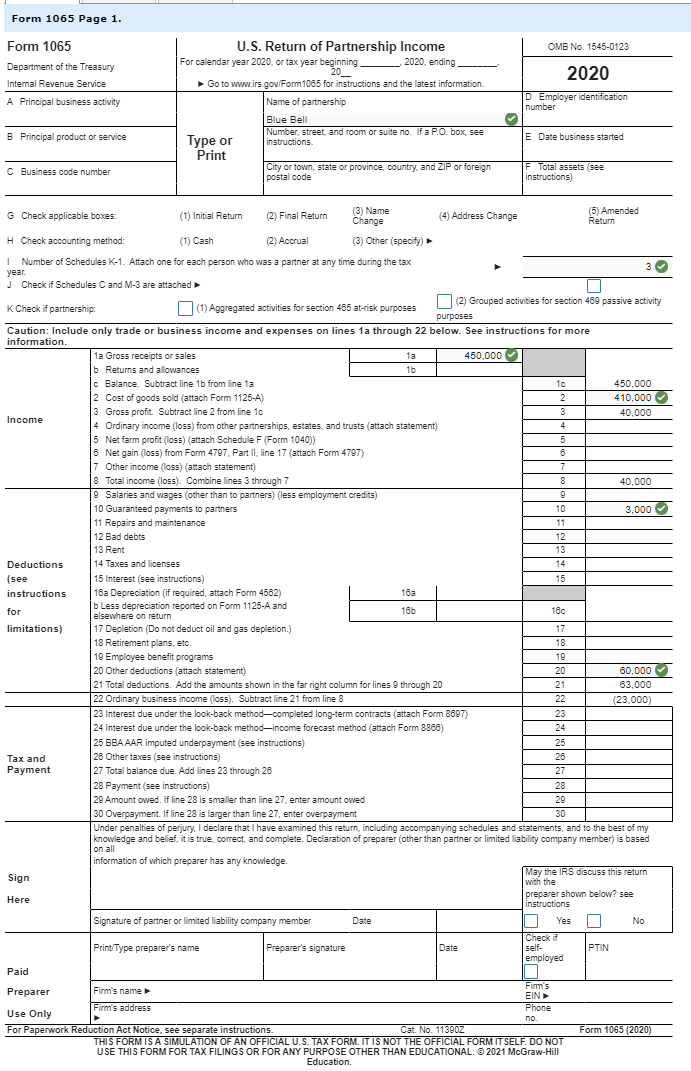

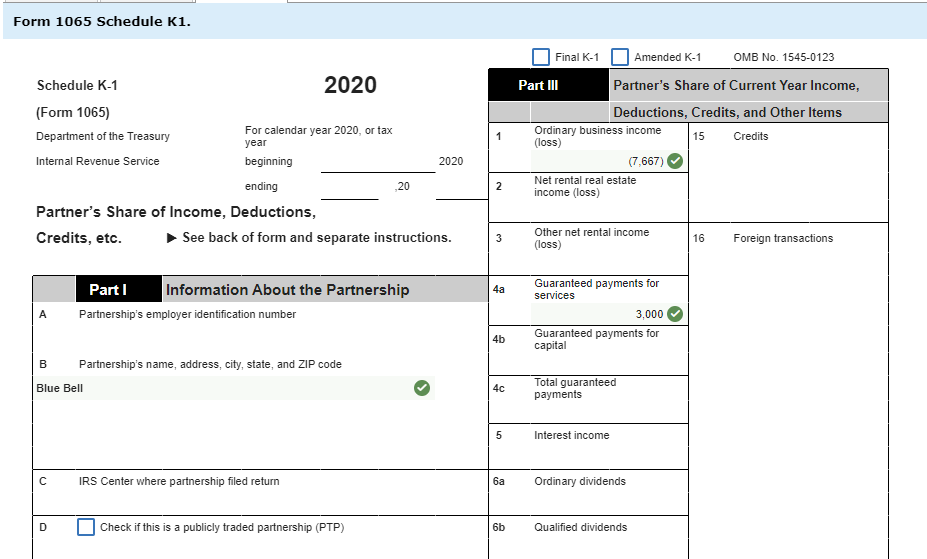

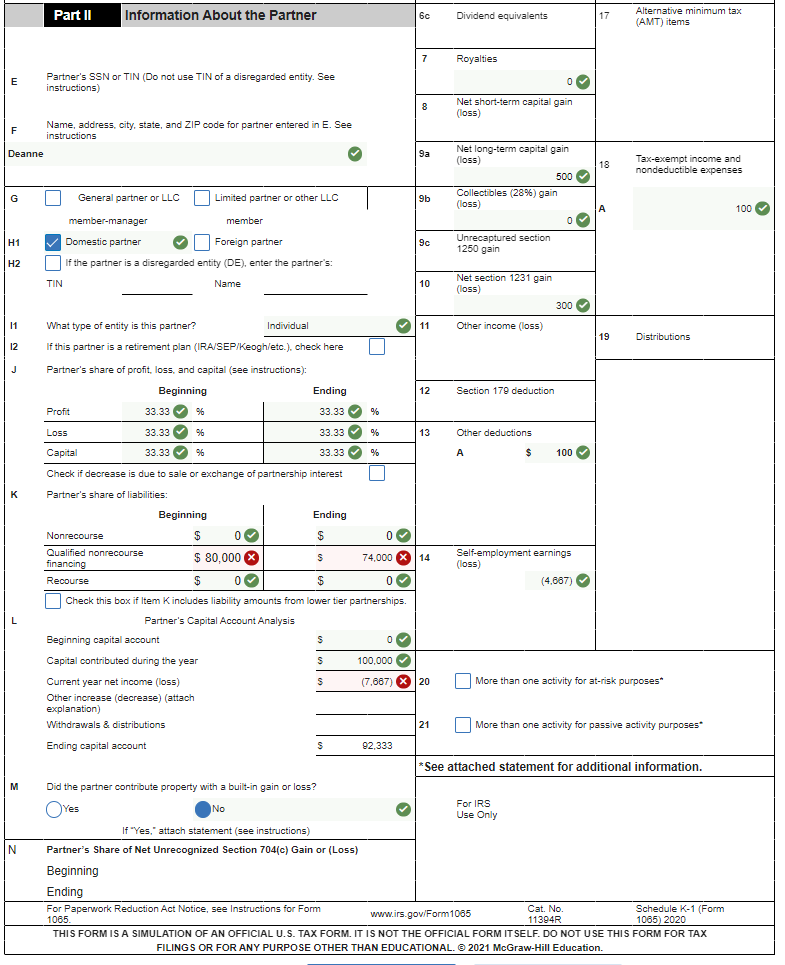

Required information Comprehensive Problem 20-80 (LO 20-1, LO 20-2, LO 20-3, LO 20-4, LO 20-5, LO 20- 6) (Algo) [The following information applies to the questions displayed below.] Aaron, Deanne, and Keon formed the Blue Bell General Partnership at the beginning of the current year. Aaron and Deanne each contributed $100,000 and Keon transferred an acre of undeveloped land to the partnership. The land had a tax basis of $80,000 and was appraised at $180,000. The land was also encumbered with a $80,000 nonrecourse mortgage for which no one was personally liable. All three partners agreed to split profits and losses equally. At the end of the first year, Blue Bell made a $6,000 principal payment on the mortgage. For the first year of operations, the partnership records disclosed the following information: Comprehensive Problem 20-80 Part 2 (Algo) c. Using the information generated in answering parts (a) and (b), prepare Blue Bell's page 1 and Schedule K to be included with its Form 1065 for its first year of operations, along with Schedule K-1 for Deanne. (Use 2021 tax rules regardless of year on tax form. Percentages should be rounded to two decimal places. Losses should be entered as negative numbers and input all other values as positive numbers.) Form 1065 Page 1. G Check applicable boxes: (1) Initial Return (2)FinalReturnChange(3)Name (4) Address Change (5) Amended H Check accounting method: (1) Cash (2) Accrual (3) Other (specify) I Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year. J Check if Schedules C and M-3 are attached K Check if partnership: Cation Aggregated activities for section 485 at-risk purposes (2) Grouped activities for section 489 passive activity Caution: Include only trade or business income and expenses on lines 1 a through 22 below. See instructions for more information. For Papenwork Reduction Act Notice, see separate instructions. THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM IT SELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. (9 2021 McGraw-Hill Education. Form 1065 Schedule K. Form 1065 Schedule K1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts