Question: Need help completing the table with calculations as well as answering the few questions below the table. ACCOUNTS PAYABLE You import textile products from Turkey

Need help completing the table with calculations as well as answering the few questions below the table.

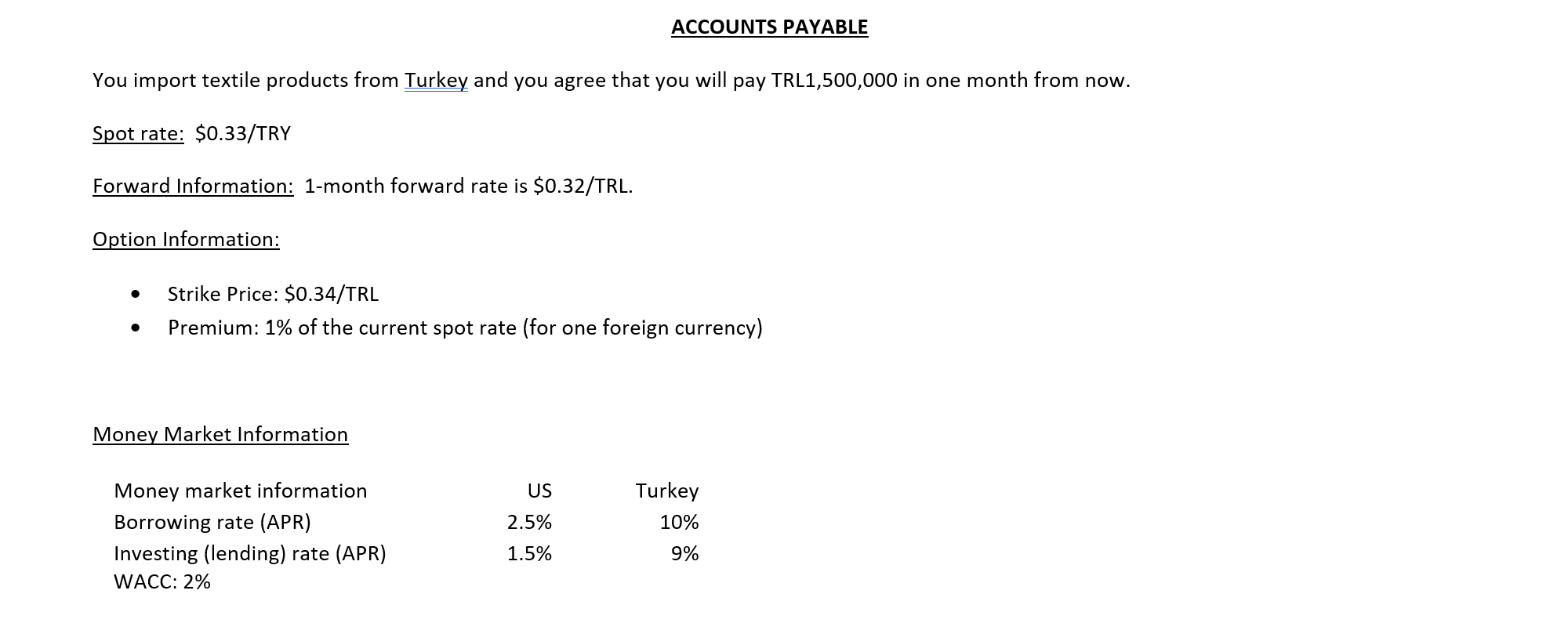

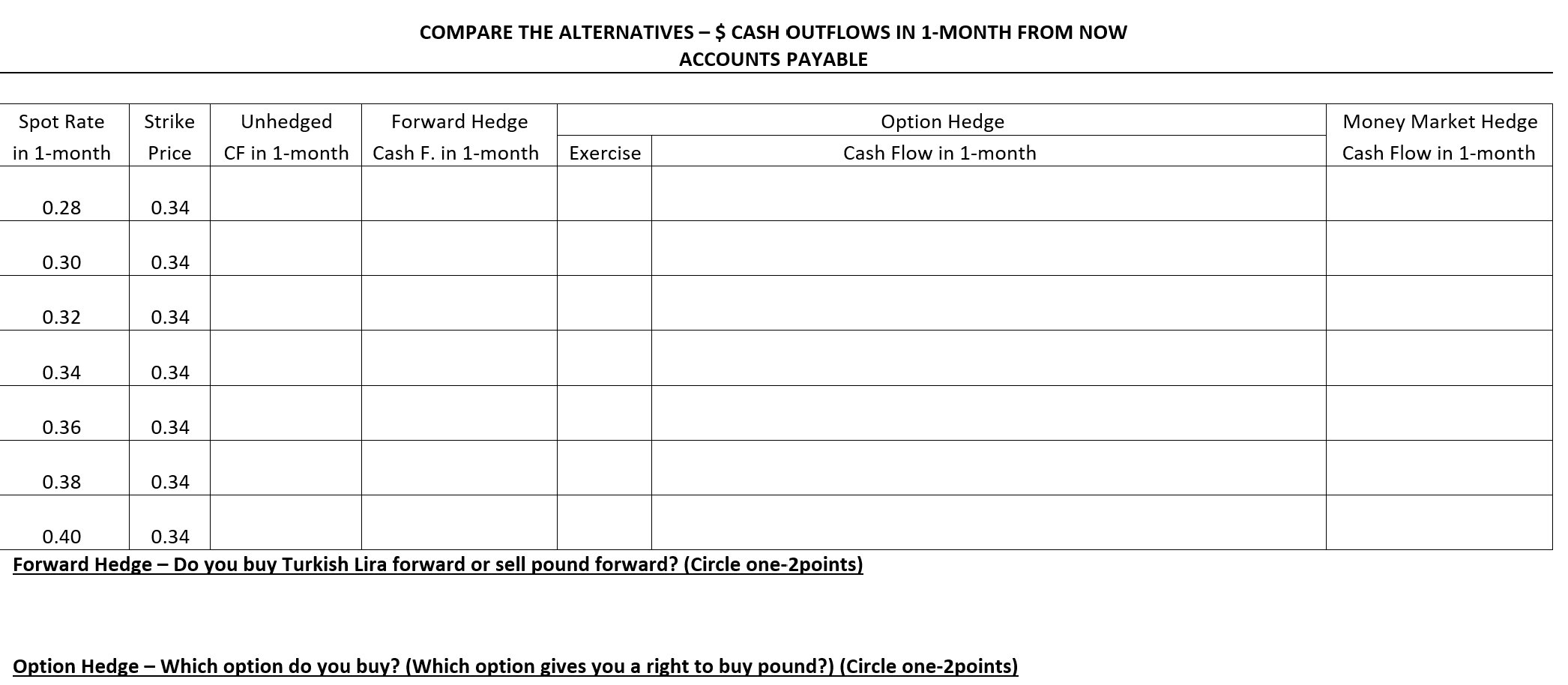

ACCOUNTS PAYABLE You import textile products from Turkey and you agree that you will pay TRL1,500,000 in one month from now. Spot rate: $0.33/TRY Forward Information: 1-month forward rate is $0.32/TRL. Option Information: . Strike Price: $0.34/TRL Premium: 1% of the current spot rate (for one foreign currency) . Money Market Information US Turkey 10% 2.5% Money market information Borrowing rate (APR) Investing (lending) rate (APR) WACC: 2% 1.5% 9% - COMPARE THE ALTERNATIVES - $ CASH OUTFLOWS IN 1-MONTH FROM NOW ACCOUNTS PAYABLE Strike Spot Rate in 1-month Unhedged CF in 1-month Forward Hedge Cash F. in 1-month Option Hedge Cash Flow in 1-month Money Market Hedge Cash Flow in 1-month Price Exercise 0.28 0.34 0.30 0.34 0.32 0.34 0.34 0.34 0.36 0.34 0.38 0.34 0.40 0.34 Forward Hedge - Do you buy Turkish Lira forward or sell pound forward? (Circle one-2points) Option Hedge - Which option do you buy? (Which option gives you a right to buy pound?) (Circle one-2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts