Question: Need help completing these tables based on the given information. Both part A and B please. PA10. LO 6.4 Carlton's Kitchen's three cost pools and

Need help completing these tables based on the given information.

Both part A and B please.

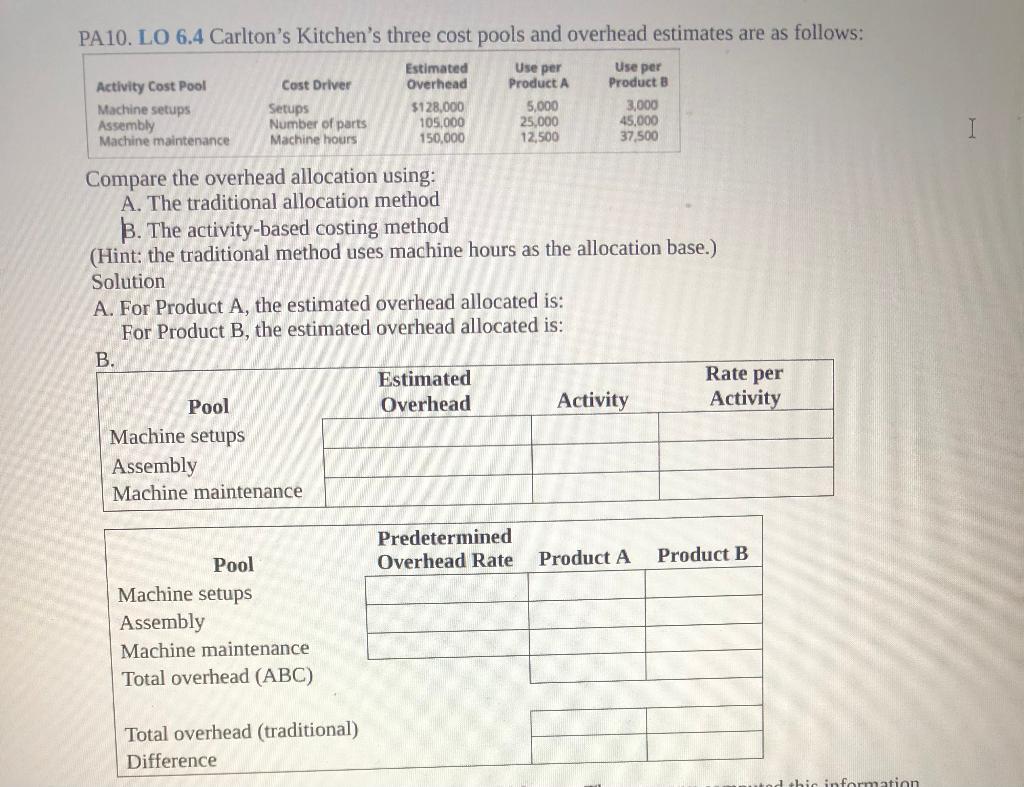

PA10. LO 6.4 Carlton's Kitchen's three cost pools and overhead estimates are as follows: Activity Cost Pool Machine setups Assembly Machine maintenance Cost Driver Setups Number of parts Machine hours Estimated Overhead $128.000 105,000 150,000 Use per Product A 5,000 25,000 12,500 Use per Product B 3,000 45.000 37,500 I Compare the overhead allocation using: A. The traditional allocation method B. The activity-based costing method (Hint: the traditional method uses machine hours as the allocation base.) Solution A. For Product A, the estimated overhead allocated is: For Product B, the estimated overhead allocated is: B. Estimated Pool Overhead Activity Activity Machine setups Assembly Machine maintenance Rate per Predetermined Overhead Rate Product A Product B Pool Machine setups Assembly Machine maintenance Total overhead (ABC) Total overhead (traditional) Difference bi information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts