Question: need help completing this question Required information [The following information applies to the questions displayed below) On January 1, 2018, Red Flash Photography had the

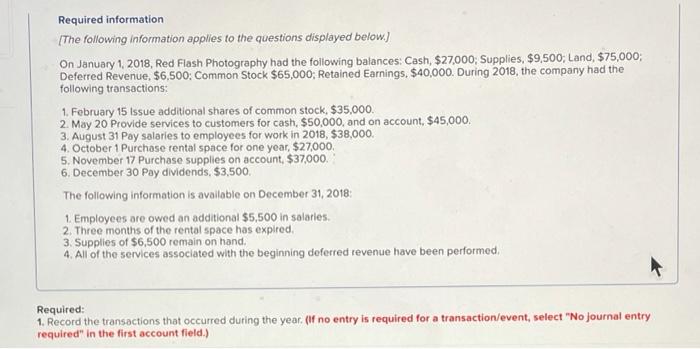

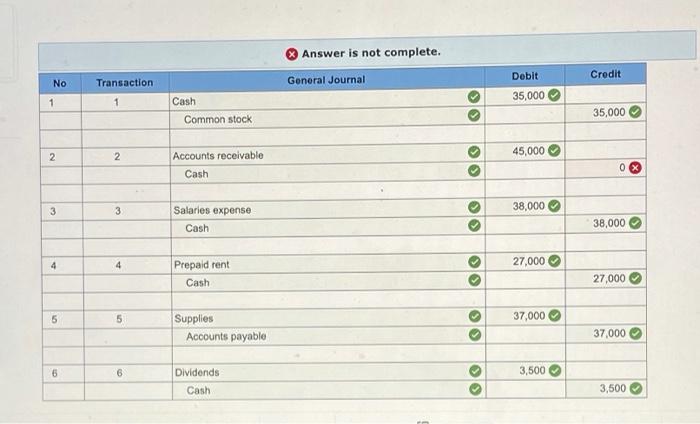

Required information [The following information applies to the questions displayed below) On January 1, 2018, Red Flash Photography had the following balances: Cash, $27.000; Supplies, $9,500, Land, $75,000; Deferred Revenue, $6,500: Common Stock $65,000; Retained Earnings. $40,000. During 2018, the company had the following transactions 1. February 15 Issue additional shares of common stock. $35,000. 2. May 20 Provide services to customers for cash. $50,000, and on account, $45,000. 3. August 31 Pay salaries to employees for work in 2018, $38,000. 4. October 1 Purchase rental space for one year, $27,000 5. November 17 Purchase supplies on account, $37,000. 6. December 30 Pay dividends, $3,500 The following information is available on December 31, 2018 1. Employees are owed an additional $5,500 in salaries. 2. Three months of the rental space has expired. 3. Supplies of $6,500 remain on hand, 4. All of the services associated with the beginning deferred revenue have been performed Required: 1. Record the transactions that occurred during the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. Debit Credit No Transaction General Journal 35,000 1 1 Cash Common stock > 35,000 2 2 45,000 Accounts receivable Cash 0 X 3 3 38,000 Salaries expense Cash >> 38,000 4 4 27,000 Prepaid rent Cash >S 27,000 5 5 37,000 Supplies Accounts payable 37,000 6 6 3,500 Dividends Cash 3,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts