Question: need help computing the JBL ratios, attepted a few bur not sure if they are right. B G Open recovered workbooks? Your recent changes were

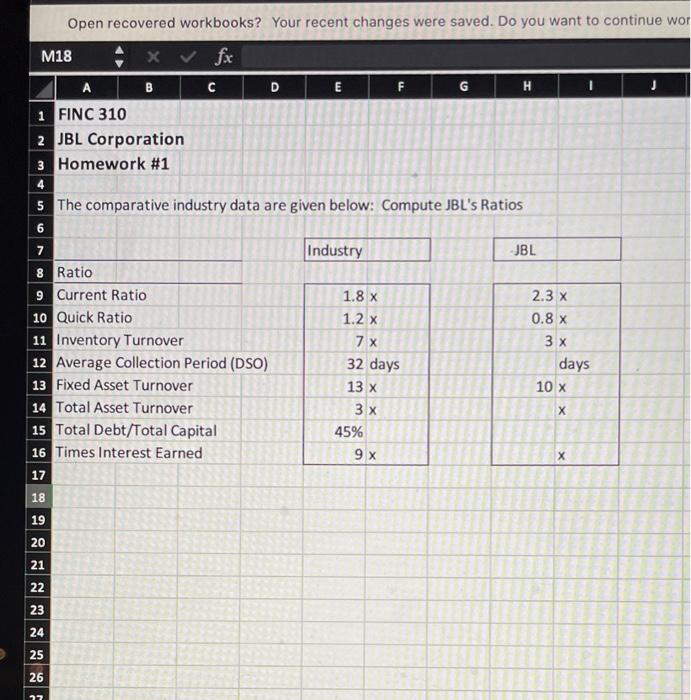

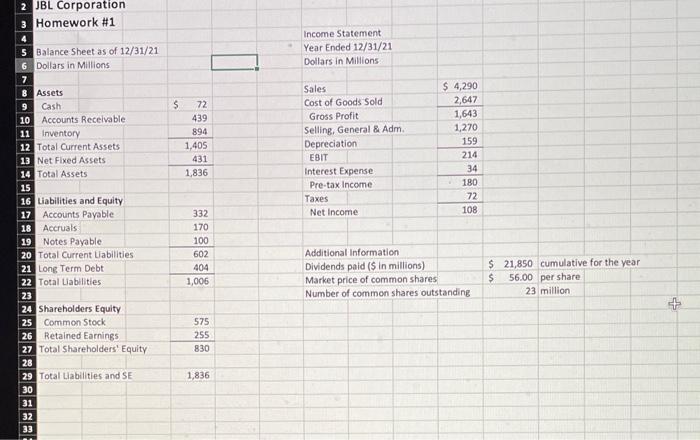

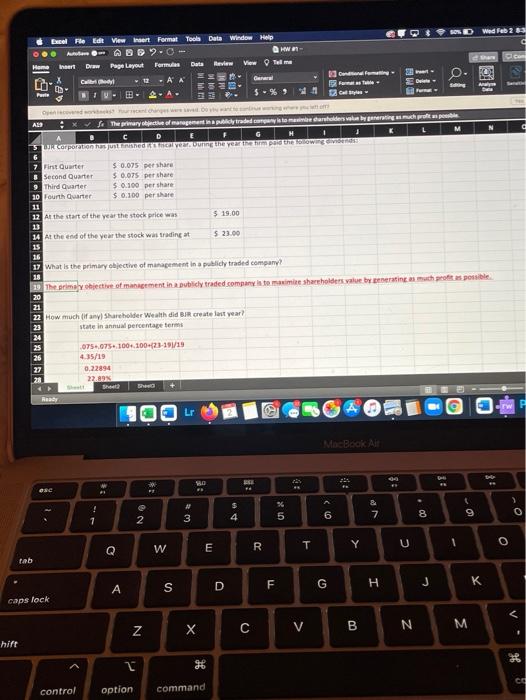

B G Open recovered workbooks? Your recent changes were saved. Do you want to continue wor M18 x fx A D E F H 1 FINC 310 2 JBL Corporation 3 Homework #1 4 5 The comparative industry data are given below: Compute JBL's Ratios 6 7 Industry JBL 8 Ratio 9 Current Ratio 1.8 x 2.3 x 10 Quick Ratio 1.2 x 0.8 x 11 Inventory Turnover 7 x 3 x 12 Average Collection Period (DSO) 32 days days 13 Fixed Asset Turnover 14 Total Asset Turnover 15 Total Debt/Total Capital 45% 16 Times Interest Earned 9x 17 10 x 13 x 3 x 18 19 20 21 22 23 24 25 26 27 2 JBL Corporation 3 Homework #1 Income Statement Year Ended 12/31/21 Dollars in Millions $ 72 439 894 1,405 431 1,836 Sales Cost of Goods Sold Gross Profit Selling, General & Adm. Depreciation EBIT Interest Expense Pre-tax Income Taxes Net Income $ 4,290 2,647 1,643 1,270 159 214 34 180 72 108 5 Balance Sheet as of 12/31/21 6 Dollars in Millions 7 8 Assets 9 Cash 10 Accounts Receivable 11 Inventory 12 Total Current Assets 13 Net Fixed Assets 14 Total Assets 15 16 Liabilities and Equity 17 Accounts Payable 18 Accruals 19 Notes Payable 20 Total Current Liabilities 21 Long Term Debt 22 Total Liabilities 23 24 Shareholders Equity 25 Common Stock 26 Retained Earnings 27 Total Shareholders' Equity 28 29 Total Liabilities and SE 30 31 32 33 332 170 100 602 404 1,006 Additional Information Dividends paid (s in millions) Market price of common shares Number of common shares outstanding $ 21,850 cumulative for the year $ 56.00 per share 23 million + 575 255 830 1,836 HD Wed Feb 28 El File Viewer Formal Tools Data window Help Wen- Home Art Draw Page Layout Formulas joll: Data Review View Tell me . O. Cab 13 A A De *6 Come was able 2 Gallo S EM Anu 1 1 N ABS Si The primary to managementy traded to marefulders burting muchos A H 1 5WR Corporation has just the views 7 First Quarter $ 0.075 per share Second Quarter $ 0.075 per share Third Quarter $ 0.100 per share 20 Fourth Quarter $ 0.100 per share 11 12 At the start of the year the stock price was 13 14 At the end of the year the stock wis trading at $ 19.00 $ 23.00 16 17 What is the primary objective of management in a publicly traded company! 29 The may hjective of management in publicly traded company is to maxime shareholders value beating a muchos possible 20 22 How much (if any) Shareholder Wealth did I create last year! state in annual percentage terms RENAXARAAM 075.075 1004.100-23-191/19 4.35/19 0.22894 22.89% Sh Ready Lr MoeBook SO 11 * 13 ac F o > ! 7 $ 4 2 0 01X % 5 8 7 6 8 9 O 3 2 E T R E Y O T W U 1 Q Cab A K S D F G TI HJ caps lock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts