Question: Need help determining if the answers are correct. Determine the Payback, Discounted Payback, Net Present Value, Internal rate of return, Modified internal rate of return,

Need help determining if the answers are correct.

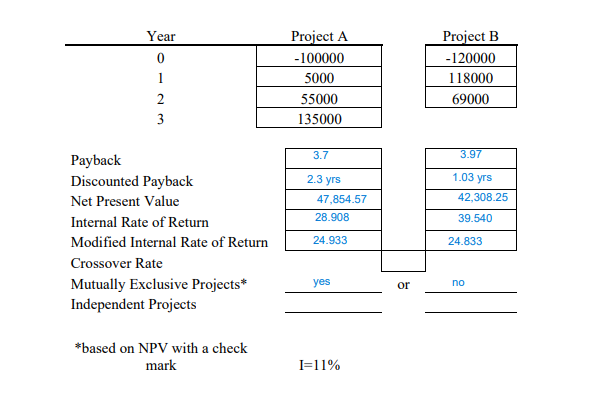

Determine the Payback, Discounted Payback, Net Present Value, Internal rate of return, Modified internal rate of return, Crossover rate, do the projects on their own, would you accept project, for projects A&B

In simple terms, the payback period is calculated by dividing the cost of the investment by the annual cash flow until the cumulative cash flow is positive, which is the payback year. Payback period is generally expressed in years.

Answers are based off of the cash flow of projects A&B. The cash flow starts in the negative and increases over the years. Each column is separate and calculations are done for each. the answers in blue are the numbers I came up with, when solving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts