Question: need help doing and understanding how to set up the example Part II Using an excel spreadsheet construct a cashflow for the investment property with

need help doing and understanding how to set up the example

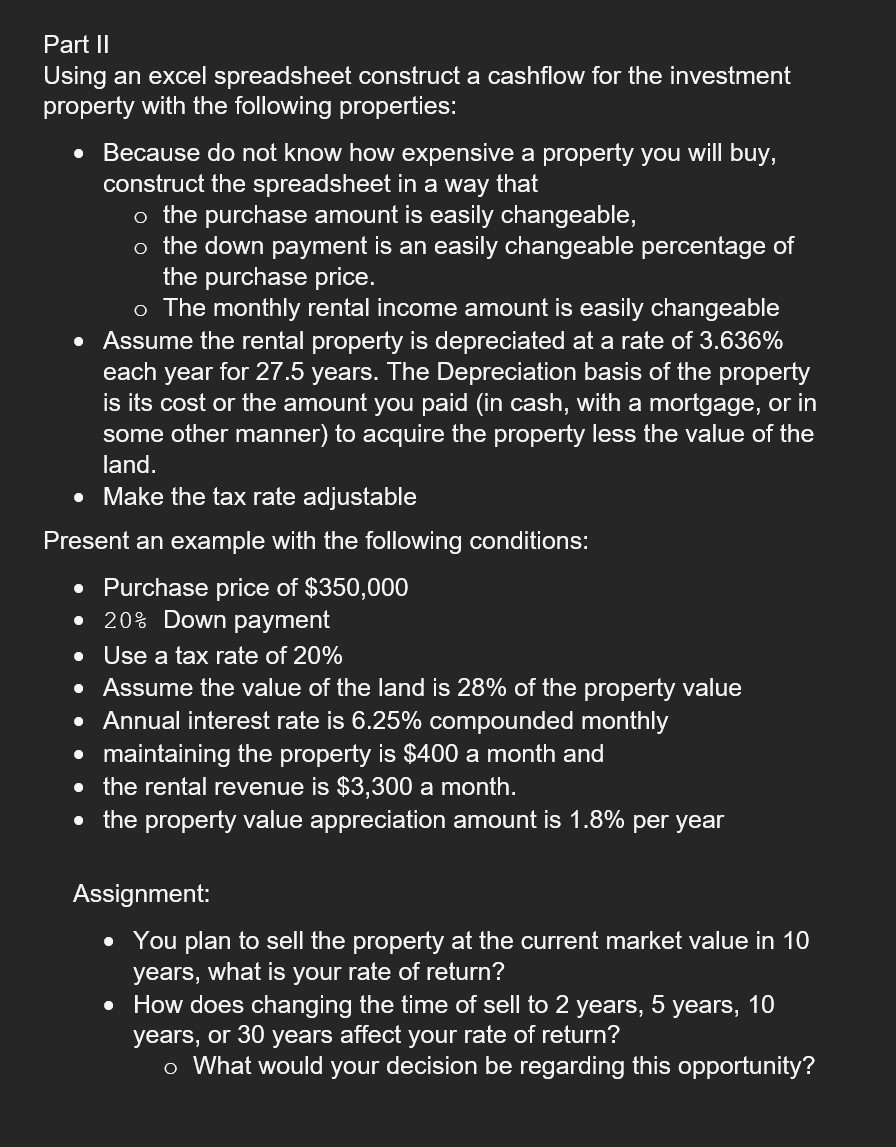

Part II Using an excel spreadsheet construct a cashflow for the investment property with the following properties: - Because do not know how expensive a property you will buy, construct the spreadsheet in a way that - the purchase amount is easily changeable, o the down payment is an easily changeable percentage of the purchase price. - The monthly rental income amount is easily changeable - Assume the rental property is depreciated at a rate of 3.636% each year for 27.5 years. The Depreciation basis of the property is its cost or the amount you paid (in cash, with a mortgage, or in some other manner) to acquire the property less the value of the land. - Make the tax rate adjustable Present an example with the following conditions: - Purchase price of $350,000 - 20\% Down payment - Use a tax rate of 20% - Assume the value of the land is 28% of the property value - Annual interest rate is 6.25% compounded monthly - maintaining the property is $400 a month and - the rental revenue is $3,300 a month. - the property value appreciation amount is 1.8% per year Assignment: - You plan to sell the property at the current market value in 10 years, what is your rate of return? - How does changing the time of sell to 2 years, 5 years, 10 years, or 30 years affect your rate of return? - What would your decision be regarding this opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts