Question: Need help doing balance sheet issues highlighted in red On December 31, 2021, the end of its first year of operations, Oriole Associates owned the

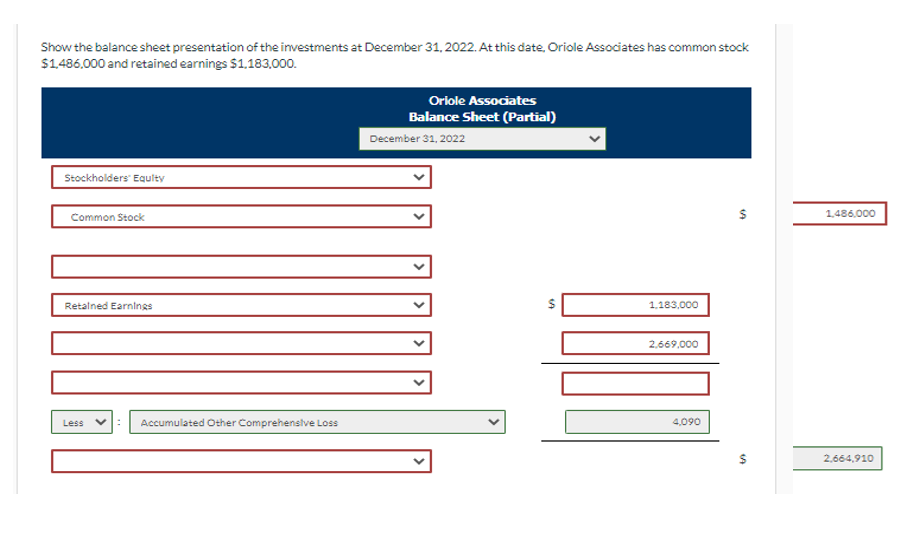

Need help doing balance sheet issues highlighted in red

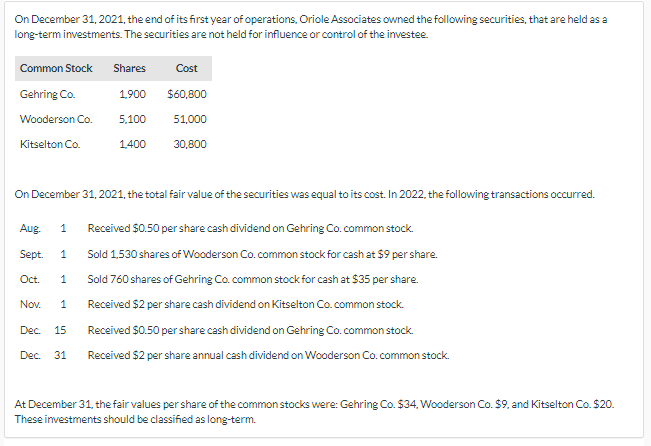

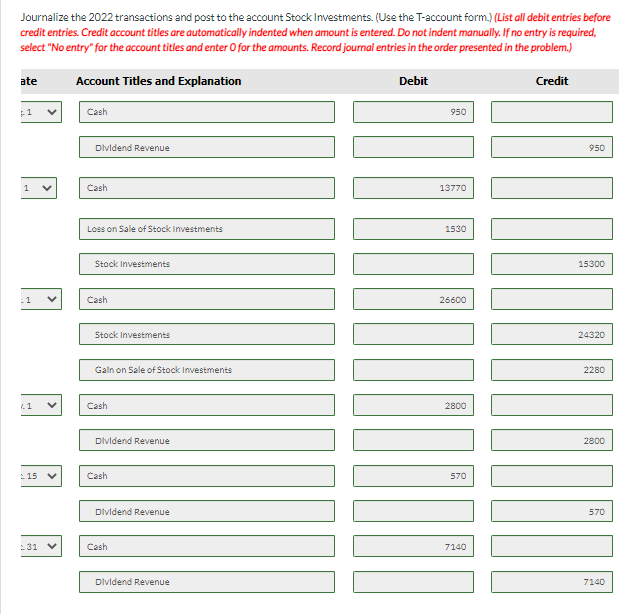

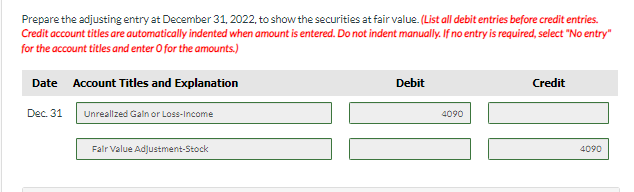

On December 31, 2021, the end of its first year of operations, Oriole Associates owned the following securities, that are held as a long-term investments. The securities are not held for influence or control of the investee. Common Stock Shares Cost Gehring Co. 1,900 $60,800 Wooderson Co. 5,100 51,000 Kitselton Co. 1,400 30,800 On December 31, 2021, the total fair value of the securities was equal to its cost. In 2022, the following transactions occurred. Aug. 1 Received $0.50 per share cash dividend on Gehring Co. common stock. Sept. 1 Sold 1,530 shares of Wooderson Co. common stock for cash at $9 per share. Oct. 1 Sold 760 shares of Gehring Co. common stock for cash at $35 per share. Nov. 1 Received $2 per share cash dividend on Kitselton Co. common stock. Dec. 15 Received $0.50 per share cash dividend on Gehring Co. common stock. Dec. 31 Received $2 per share annual cash dividend on Wooderson Co. common stock. At December 31, the fair values per share of the common stocks were: Gehring Co. $34, Wooderson Co. $9, and Kitselton Co. $20. These investments should be classified as long-term.Journalize the 2022 transactions and post to the account Stock Investments. (Use the T-account form.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) ate Account Titles and Explanation Debit Credit - 1 Cash 950 Dividend Revenue 950 1 v Cash 13770 Loss on Sale of Stock Investments 1530 Stock Investments 15300 1 v Cash 26600 Stock Investments 24320 Gain on Sale of Stock Investments 2280 . 1 Cash 2800 Dividend Revenue 2800 15 Cash 570 Dividend Revenue 570 31 Cash 7140 Dividend Revenue 7140\fPrepare the adjusting entry at December 31, 2022, to show the securities at fair value. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 Unrealized Gain or Loss-Income 4090 Fair Value Adjustment-Stock 4090Show the balance sheet presentation of the investments at December 31. 2022. At this date, Oriole Associates has common stock $1,486.000 and retained earnings $1,183,000. Oriole Associates Balance Sheet (Partial) December 31, 2022 Stockholders Equity Common Stock $ 1,486.000 Retained Earnings 1 183,000 2.669.000 v Less Accumulated Other Comprehensive Loss 4,090 v S 2.664.910

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts