Question: need help doing part b & c. thanks! as in part b and part c, part b( journal entry) and part c is the last

need help doing part b & c. thanks!

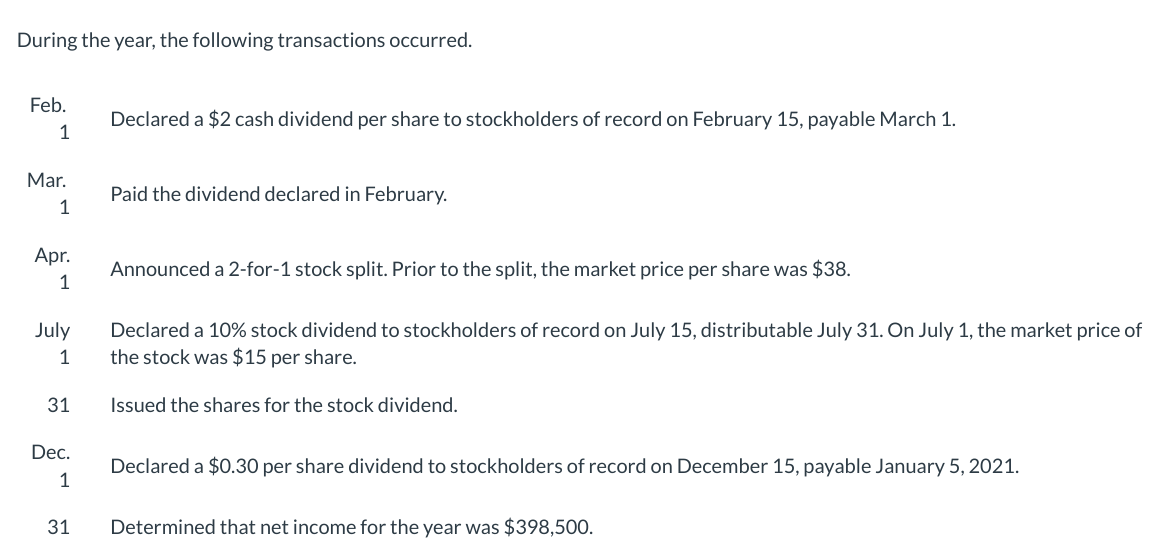

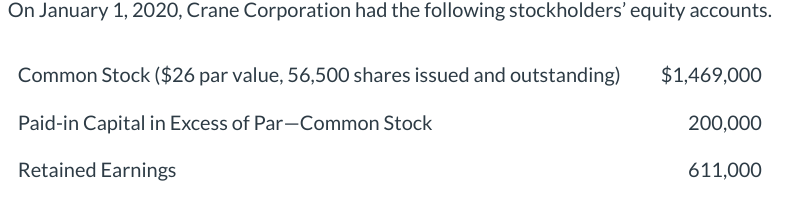

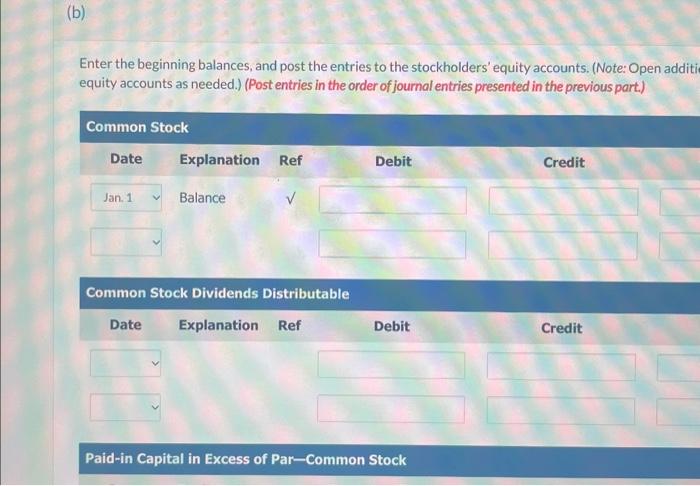

Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additi equity accounts as needed.) (Post entries in the order of journal entries presented in the previous part.) (c) The parts of this question must be completed in order. This part will be available when you complete the part above. On January 1, 2020, Crane Corporation had the following stockholders' equity accounts. Common Stock ( $26 par value, 56,500 shares issued and outstanding) $1,469,000 Paid-in Capital in Excess of Par-Common Stock 200,000 Retained Earnings 611,000 During the year, the following transactions occurred. Feb. Declared a \$2 cash dividend per share to stockholders of record on February 15, payable March 1. Mar. 1 Paid the dividend declared in February. Apr. 1 Announced a 2-for-1 stock split. Prior to the split, the market price per share was $38. July Declared a 10\% stock dividend to stockholders of record on July 15, distributable July 31 . On July 1, the market price of 1 the stock was $15 per share. 31 Issued the shares for the stock dividend. Dec. Declared a \$0.30 per share dividend to stockholders of record on December 15, payable January 5, 2021. 31 Determined that net income for the year was $398,500. Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additi equity accounts as needed.) (Post entries in the order of journal entries presented in the previous part.) (c) The parts of this question must be completed in order. This part will be available when you complete the part above. On January 1, 2020, Crane Corporation had the following stockholders' equity accounts. Common Stock ( $26 par value, 56,500 shares issued and outstanding) $1,469,000 Paid-in Capital in Excess of Par-Common Stock 200,000 Retained Earnings 611,000 During the year, the following transactions occurred. Feb. Declared a \$2 cash dividend per share to stockholders of record on February 15, payable March 1. Mar. 1 Paid the dividend declared in February. Apr. 1 Announced a 2-for-1 stock split. Prior to the split, the market price per share was $38. July Declared a 10\% stock dividend to stockholders of record on July 15, distributable July 31 . On July 1, the market price of 1 the stock was $15 per share. 31 Issued the shares for the stock dividend. Dec. Declared a \$0.30 per share dividend to stockholders of record on December 15, payable January 5, 2021. 31 Determined that net income for the year was $398,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts