Question: Need HELP !!!! Don't know what to do for the wrong ones and the rest of the graph! With explanations please !! thank you!!! Return

Need HELP !!!! Don't know what to do for the wrong ones and the rest of the graph! With explanations please !! thank you!!!

Need HELP !!!! Don't know what to do for the wrong ones and the rest of the graph! With explanations please !! thank you!!!

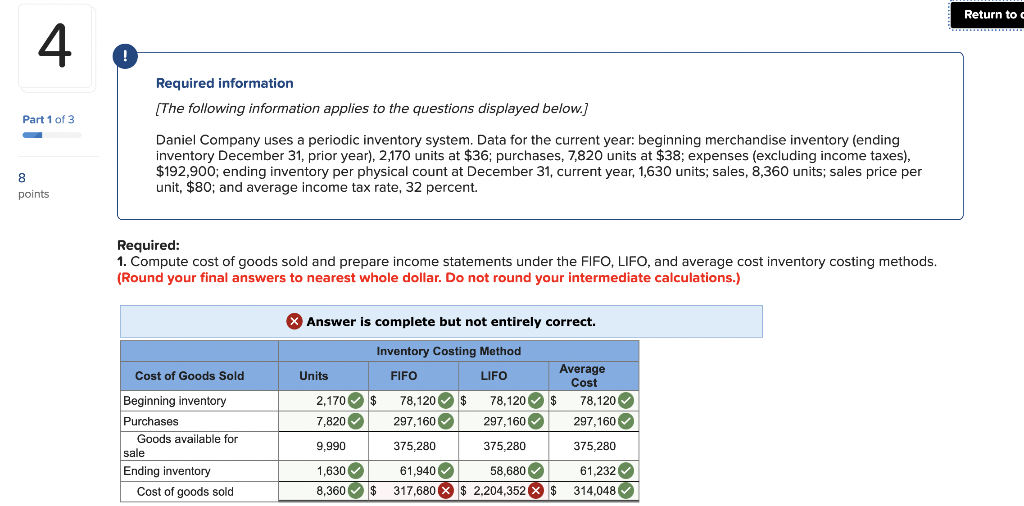

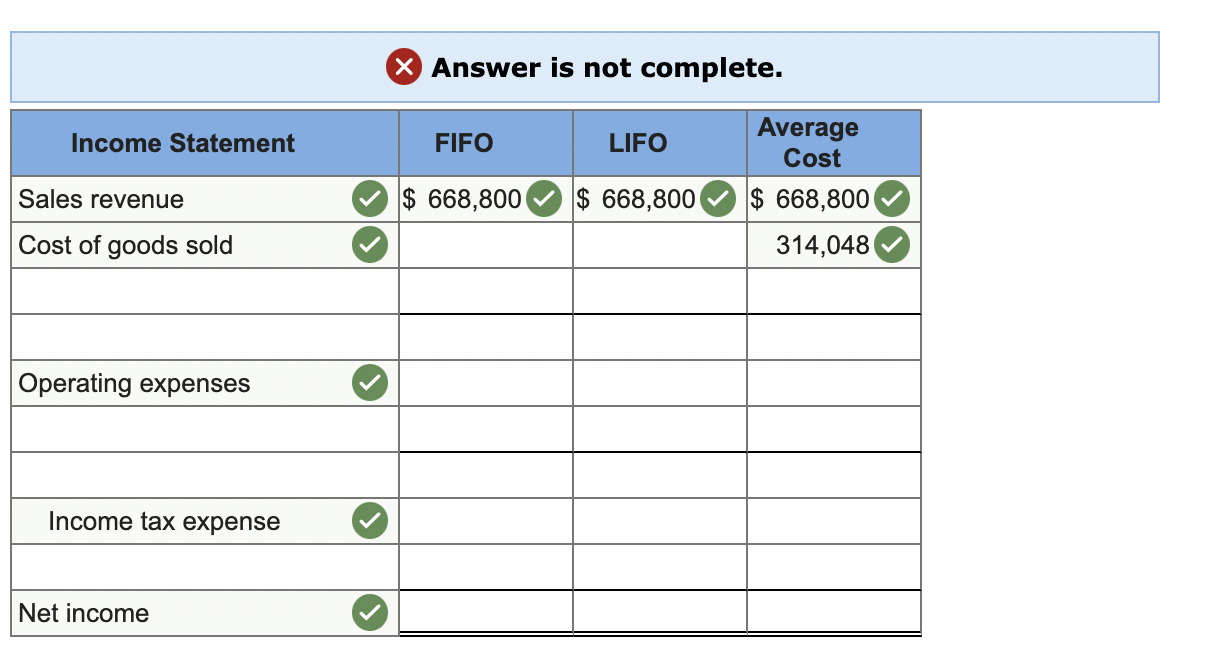

Return toc 4 Required information (The following information applies to the questions displayed below.] Part 1 of 3 Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,170 units at $36; purchases, 7,820 units at $38; expenses (excluding income taxes), $192,900; ending inventory per physical count at December 31, current year, 1,630 units, sales, 8,360 units; sales price per unit, $80; and average income tax rate, 32 percent. 8 points Required: 1. Compute cost of goods sold and prepare income statements under the FIFO, LIFO, and average cost inventory costing methods. (Round your final answers to nearest whole dollar. Do not round your intermediate calculations.) Answer is complete but not entirely correct. Cost of Goods Sold Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold Inventory Costing Method Units FIFO LIFO Average Cost 2,170$ 78,120$ 78,120$ 78,120 7,820 297,160 297,160 297,160 9.990 375,280 375,280 375,280 1,630 61,940 58,680 61,232 8,360$ 317,680 X $ 2,204,352 X $ 314,048 X Answer is not complete. Income Statement FIFO LIFO Sales revenue $ 668,800 $ 668,800 Average Cost $ 668,800 314,048 Cost of goods sold Operating expenses Income tax expense Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts