Question: Need help double-checking, let me know if it's right. Thank you. Adam has just graduated, and has a good job at a decent starting salary.

Need help double-checking, let me know if it's right. Thank you.

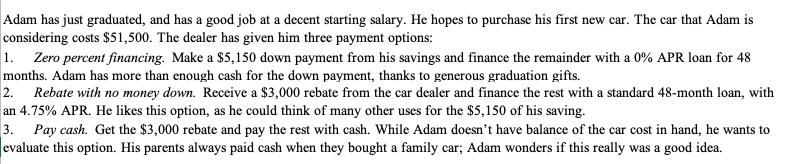

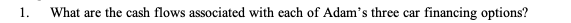

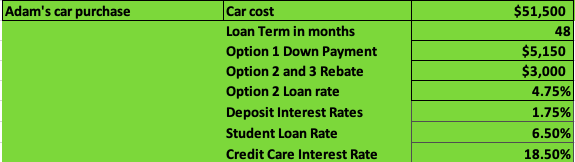

Adam has just graduated, and has a good job at a decent starting salary. He hopes to purchase his first new car. The car that Adam is considering costs $51,500. The dealer has given him three payment options: 1. Zero percent financing. Make a $5,150 down payment from his savings and finance the remainder with a 0% APR loan for 48 months. Adam has more than enough cash for the down payment, thanks to generous graduation gifts. 2. Rebate with no money down. Receive a $3,000 rebate from the car dealer and finance the rest with a standard 48 -month loan, with an 4.75% APR. He likes this option, as he could think of many other uses for the $5,150 of his saving. Pay cash. Get the $3,000 rebate and pay the rest with cash. While Adam doesn't have balance of the car cost in hand, he wants to evaluate this option. His parents always paid cash when they bought a family car; Adam wonders if this really was a good idea. 1. What are the cash flows associated with each of Adam's three car financing options? Question 1 (12 pts): MONTHLY CASH FLOWS: \begin{tabular}{|l|r|r|} \hline & Cash flow for Month 0 & Cash flow for Month 1 to 48 \\ \hline Option 1- Zero percent financing & & ($965.63) \\ \hline Option 2 - Rebate w/ \$0 down & & ($2,582.09) \\ \hline Option 3 - Pay cash & & $0.00 \\ \hline \end{tabular} Adam has just graduated, and has a good job at a decent starting salary. He hopes to purchase his first new car. The car that Adam is considering costs $51,500. The dealer has given him three payment options: 1. Zero percent financing. Make a $5,150 down payment from his savings and finance the remainder with a 0% APR loan for 48 months. Adam has more than enough cash for the down payment, thanks to generous graduation gifts. 2. Rebate with no money down. Receive a $3,000 rebate from the car dealer and finance the rest with a standard 48 -month loan, with an 4.75% APR. He likes this option, as he could think of many other uses for the $5,150 of his saving. Pay cash. Get the $3,000 rebate and pay the rest with cash. While Adam doesn't have balance of the car cost in hand, he wants to evaluate this option. His parents always paid cash when they bought a family car; Adam wonders if this really was a good idea. 1. What are the cash flows associated with each of Adam's three car financing options? Question 1 (12 pts): MONTHLY CASH FLOWS: \begin{tabular}{|l|r|r|} \hline & Cash flow for Month 0 & Cash flow for Month 1 to 48 \\ \hline Option 1- Zero percent financing & & ($965.63) \\ \hline Option 2 - Rebate w/ \$0 down & & ($2,582.09) \\ \hline Option 3 - Pay cash & & $0.00 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts