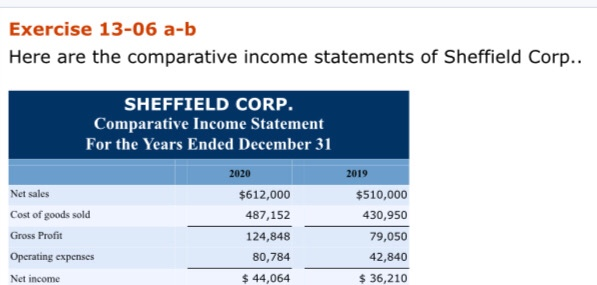

Question: Need help Exercise 13-06 a-b Here are the comparative income statements of Sheffield Corp.. SHEFFIELD CORP. Comparative Income Statement For the Years Ended December 31

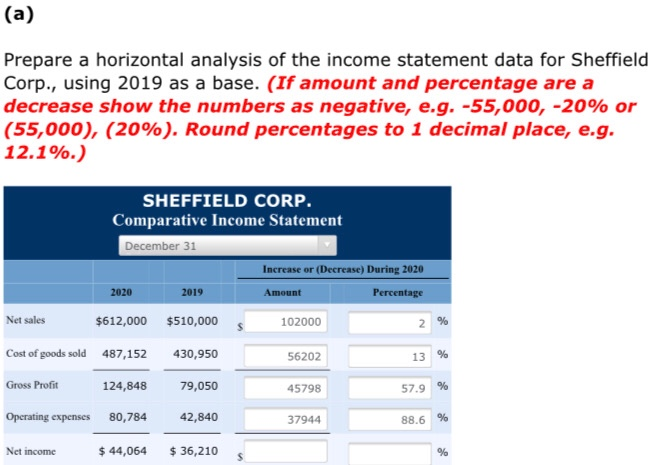

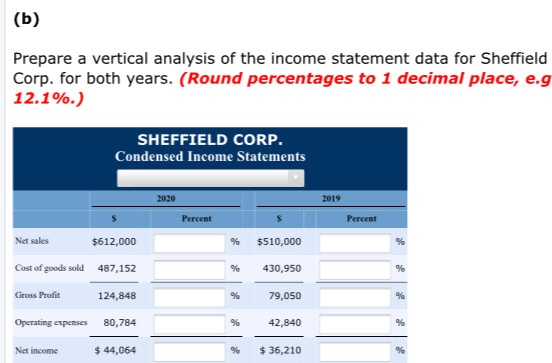

Exercise 13-06 a-b Here are the comparative income statements of Sheffield Corp.. SHEFFIELD CORP. Comparative Income Statement For the Years Ended December 31 2020 Net sales Cost of goods sold Gross Profit Operating expenses Net income $612,000 487,152 124,848 80,784 $ 44,064 2019 $510,000 430,950 79,050 42,840 $ 36,210 (a) Prepare a horizontal analysis of the income statement data for Sheffield Corp., using 2019 as a base. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) SHEFFIELD CORP. Comparative Income Statement December 31 Increase or (Decrease) During 2020 2019 Amount Percentage Net sales $612,000 $510,000 102000 2 Cost of goods sold 487,152 430,950 56202 13 % 2020 % s Gross Profit 124,848 79,050 45798 57.9 % Operating expenses 80,784 42,840 37944 88.6 % Net income $ 44,064 $ 36,210 % (b) Prepare a vertical analysis of the income statement data for Sheffield Corp. for both years. (Round percentages to 1 decimal place, e.g 12.1%.) SHEFFIELD CORP. Condensed Income Statements 2020 2019 Percent Percent Net sales $612,000 % $510,000 % Cost of goods sold 487,152 430,950 % Gross Profit 124,848 % 79,050 % Operating expenses 80,784 % 42,840 % Net income $ 44,064 $36,210 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts