Question: Need help explaining please - If your last name begins with M-Z: Describe how inventory assumptions (e.g., weighted average, FIFO, etc.) impact the Balance Sheet

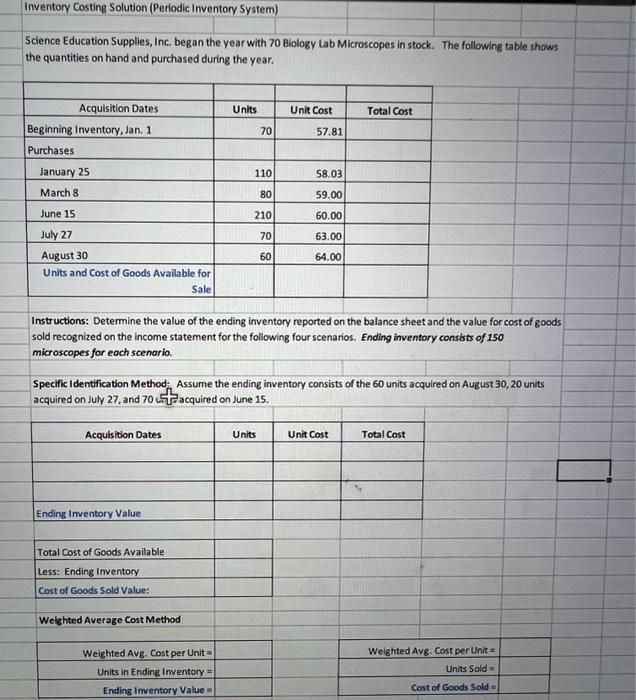

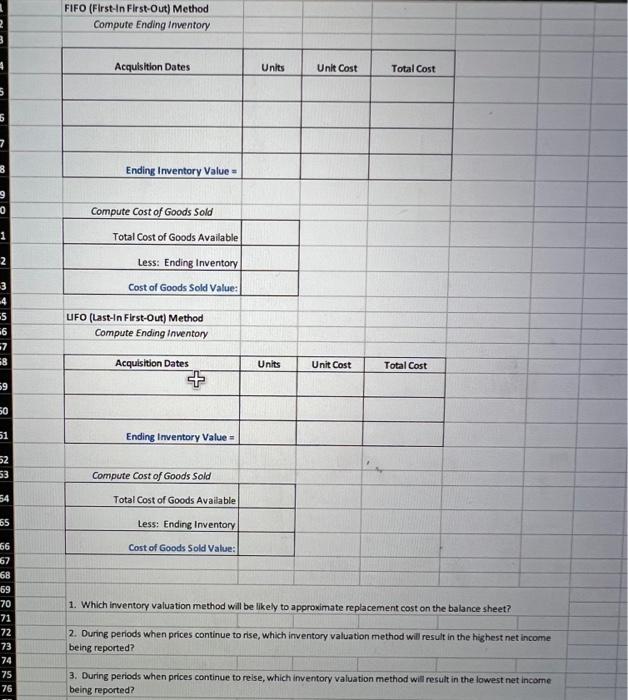

- If your last name begins with M-Z: Describe how inventory assumptions (e.g., weighted average, FIFO, etc.) impact the Balance Sheet and the Income Statement. Provide an example. Discussion Response Due by Saturday: Respond to a student from a different group. Science Education Supplies, Inc. began the year with 70 Biology Lab Microscopes in stock. The following table shows the quantities on hand and purchased during the year. Instructions: Determine the value of the ending inventory reported on the balance sheet and the value for cost of goods sold recognized on the income statement for the following four scenarios. Ending inventory consibts of 150 microscopes for each scenario. Specific Identification Method; Assume the ending inventory consists of the 60 units acquired on August 30,20 units acquired on July 27, and 70 L. 2 a acquired on June 15. FIFO (First-In First-Out) Method Compute Ending imentory \begin{tabular}{|l|l|l|l|} \hline Acquisition Dates & Units & Unit Cost & Total Cost \\ \hline & & & \\ \hline & & & \\ \hline Ending Inventory Value = & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|} \hline \multicolumn{2}{|c|}{ Compute Cost of Goods Sold } \\ \hline Total Cost of Goods Available & \\ \hline Less: Ending Inventory & \\ \hline Cost of Goods Sold Value: & \\ \hline \end{tabular} UFO (Last-in First-Out) Method Compute Ending inventory \begin{tabular}{|c|l|l|l|} \hline Acquisition Dates & Units & Unit Cost & Total Cost \\ \hline & & & \\ \hline Ending inventory value = & & & \\ \hline & & & \\ \hline \end{tabular} 1. Which inventory valuation method will be likely to approvimate replacement cost on the balance sheet? 2. During periods when prices continue to rise, which inventory valuation method will result in the highest net income being reported? 3. During periods when prices continue to reise, which inventory valuation method will result in the lowest net income being reported? - If your last name begins with M-Z: Describe how inventory assumptions (e.g., weighted average, FIFO, etc.) impact the Balance Sheet and the Income Statement. Provide an example. Discussion Response Due by Saturday: Respond to a student from a different group. Science Education Supplies, Inc. began the year with 70 Biology Lab Microscopes in stock. The following table shows the quantities on hand and purchased during the year. Instructions: Determine the value of the ending inventory reported on the balance sheet and the value for cost of goods sold recognized on the income statement for the following four scenarios. Ending inventory consibts of 150 microscopes for each scenario. Specific Identification Method; Assume the ending inventory consists of the 60 units acquired on August 30,20 units acquired on July 27, and 70 L. 2 a acquired on June 15. FIFO (First-In First-Out) Method Compute Ending imentory \begin{tabular}{|l|l|l|l|} \hline Acquisition Dates & Units & Unit Cost & Total Cost \\ \hline & & & \\ \hline & & & \\ \hline Ending Inventory Value = & & & \\ \hline \end{tabular} \begin{tabular}{|r|l|} \hline \multicolumn{2}{|c|}{ Compute Cost of Goods Sold } \\ \hline Total Cost of Goods Available & \\ \hline Less: Ending Inventory & \\ \hline Cost of Goods Sold Value: & \\ \hline \end{tabular} UFO (Last-in First-Out) Method Compute Ending inventory \begin{tabular}{|c|l|l|l|} \hline Acquisition Dates & Units & Unit Cost & Total Cost \\ \hline & & & \\ \hline Ending inventory value = & & & \\ \hline & & & \\ \hline \end{tabular} 1. Which inventory valuation method will be likely to approvimate replacement cost on the balance sheet? 2. During periods when prices continue to rise, which inventory valuation method will result in the highest net income being reported? 3. During periods when prices continue to reise, which inventory valuation method will result in the lowest net income being reported

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts