Question: Need help explaining this problem. Asking how we get answer B. LO 3-7 13. SK Corporation acquired Neptune, Inc., on January 1, 2020, by issuing

Need help explaining this problem. Asking how we get answer B.

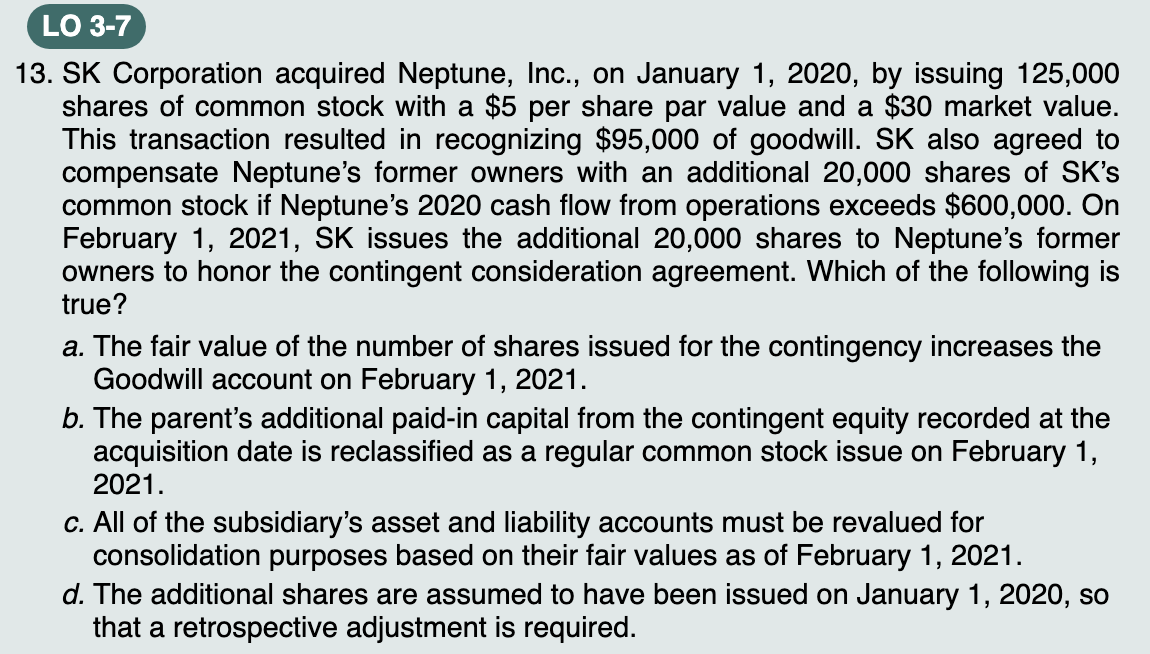

LO 3-7 13. SK Corporation acquired Neptune, Inc., on January 1, 2020, by issuing 125,000 shares of common stock with a $5 per share par value and a $30 market value. This transaction resulted in recognizing $95,000 of goodwill. SK also agreed to compensate Neptune's former owners with an additional 20,000 shares of SK's common stock if Neptune's 2020 cash flow from operations exceeds $600,000. On February 1, 2021, SK issues the additional 20,000 shares to Neptune's former owners to honor the contingent consideration agreement. Which of the following is true? a. The fair value of the number of shares issued for the contingency increases the Goodwill account on February 1, 2021. b. The parent's additional paid-in capital from the contingent equity recorded at the acquisition date is reclassified as a regular common stock issue on February 1, 2021. c. All of the subsidiary's asset and liability accounts must be revalued for consolidation purposes based on their fair values as of February 1, 2021. d. The additional shares are assumed to have been issued on January 1, 2020, so that a retrospective adjustment is required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts