Question: need help figuring this question out please Return to question 2021 income statement of Adrian Express reports sales of $15,327.000, cost of goods sold of

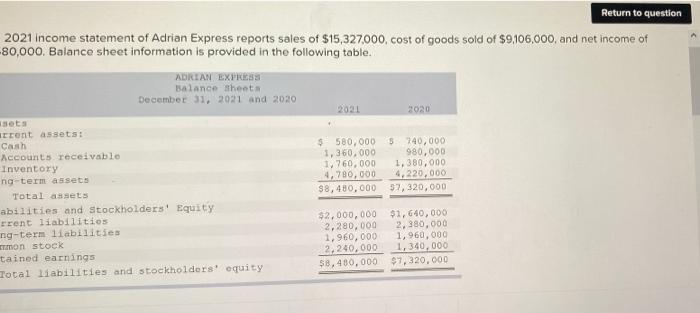

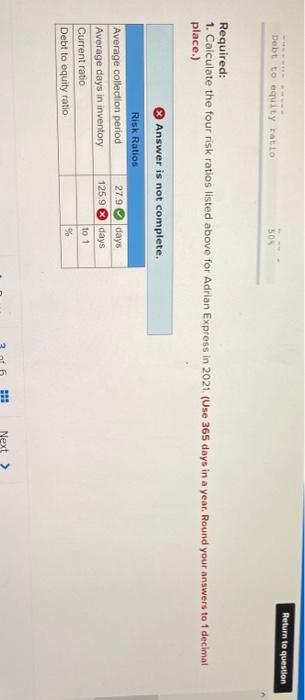

Return to question 2021 income statement of Adrian Express reports sales of $15,327.000, cost of goods sold of $9,106,000, and net income of 80,000. Balance sheet information is provided in the following table. ADRIAN EXPRESS Balance sheets December 31, 2021 and 2020 2031 2020 $ 580,000 $340,000 1,360,000 980,000 1.760,000 1,380,000 4,780,000 4,220,000 $8,480,000 37, 320,000 sets rent assets Cash Accounts receivable Inventory ng-term assets Total assets abilities and stockholders' Equity rrent liabilities ng-term liabilities mon stock tained earnings Total liabilities and stockholders' equity $2,000,000 $1,640,000 2,280,000 2,380,000 1,960,000 1,960,000 2.240,000 1,340,000 $8,480,000 $7,320,000 Return to question Debt to equity tatto 50 Required: 1. Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 decimal place.) Answer is not complete. Risk Ratios Average collection period 27.9 days Average days in inventory 125.9 days Current ratio to 1 Debt to equity ratio % 3 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts