Question: Need help finding Line 18 Depreciation Expense or Depletion 8. Noah and Joan own a condo and use it as a rental property. The condo

Need help finding Line 18 Depreciation Expense or Depletion

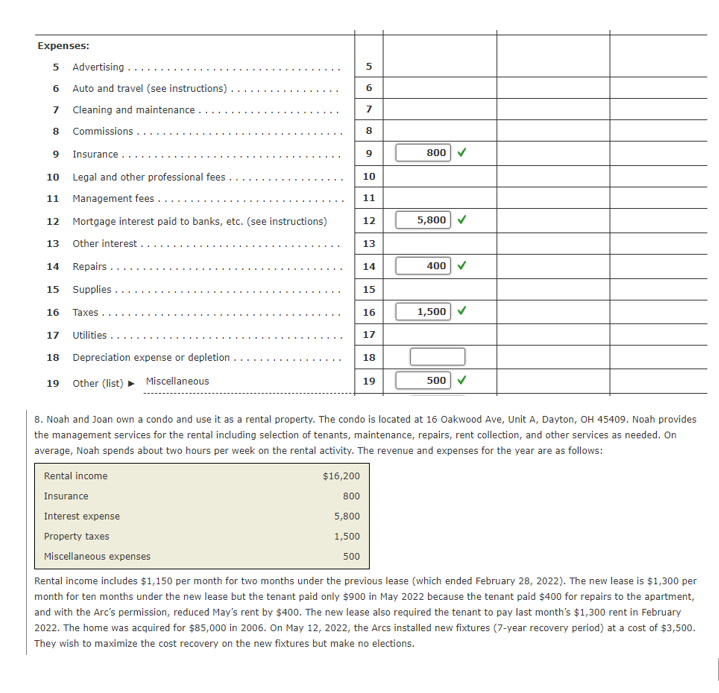

8. Noah and Joan own a condo and use it as a rental property. The condo is located at 16 Oakwood Ave, Unit A, Dayton, OH 45409 . Noah provides the management services for the rental including selection of tenants, maintenance, repairs, rent collection, and other services as needed. On average, Noah spends about two hours per week on the rental activity. The revenue and expenses for the year are as follows: Rental income includes $1,150 per month for two months under the previous lease (which ended February 28, 2022). The new lease is $1,300 per month for ten months under the new lease but the tenant paid only $900 in May 2022 because the tenant paid $400 for repairs to the apartment, and with the Arc's permission, reduced May's rent by $400. The new lease also required the tenant to pay last month's $1,300 rent in February 2022. The home was acquired for $85,000 in 2006. On May 12, 2022, the Arcs installed new fixtures (7-year recovery period) at a cost of $3,500. They wish to maximize the cost recovery on the new fixtures but make no elections. 8. Noah and Joan own a condo and use it as a rental property. The condo is located at 16 Oakwood Ave, Unit A, Dayton, OH 45409 . Noah provides the management services for the rental including selection of tenants, maintenance, repairs, rent collection, and other services as needed. On average, Noah spends about two hours per week on the rental activity. The revenue and expenses for the year are as follows: Rental income includes $1,150 per month for two months under the previous lease (which ended February 28, 2022). The new lease is $1,300 per month for ten months under the new lease but the tenant paid only $900 in May 2022 because the tenant paid $400 for repairs to the apartment, and with the Arc's permission, reduced May's rent by $400. The new lease also required the tenant to pay last month's $1,300 rent in February 2022. The home was acquired for $85,000 in 2006. On May 12, 2022, the Arcs installed new fixtures (7-year recovery period) at a cost of $3,500. They wish to maximize the cost recovery on the new fixtures but make no elections

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts