Question: Need help finding present value Sheridan Pharma is a fast-growing drug company. Management forecasts that in the next three years, the company's dividend growth rates

Need help finding present value

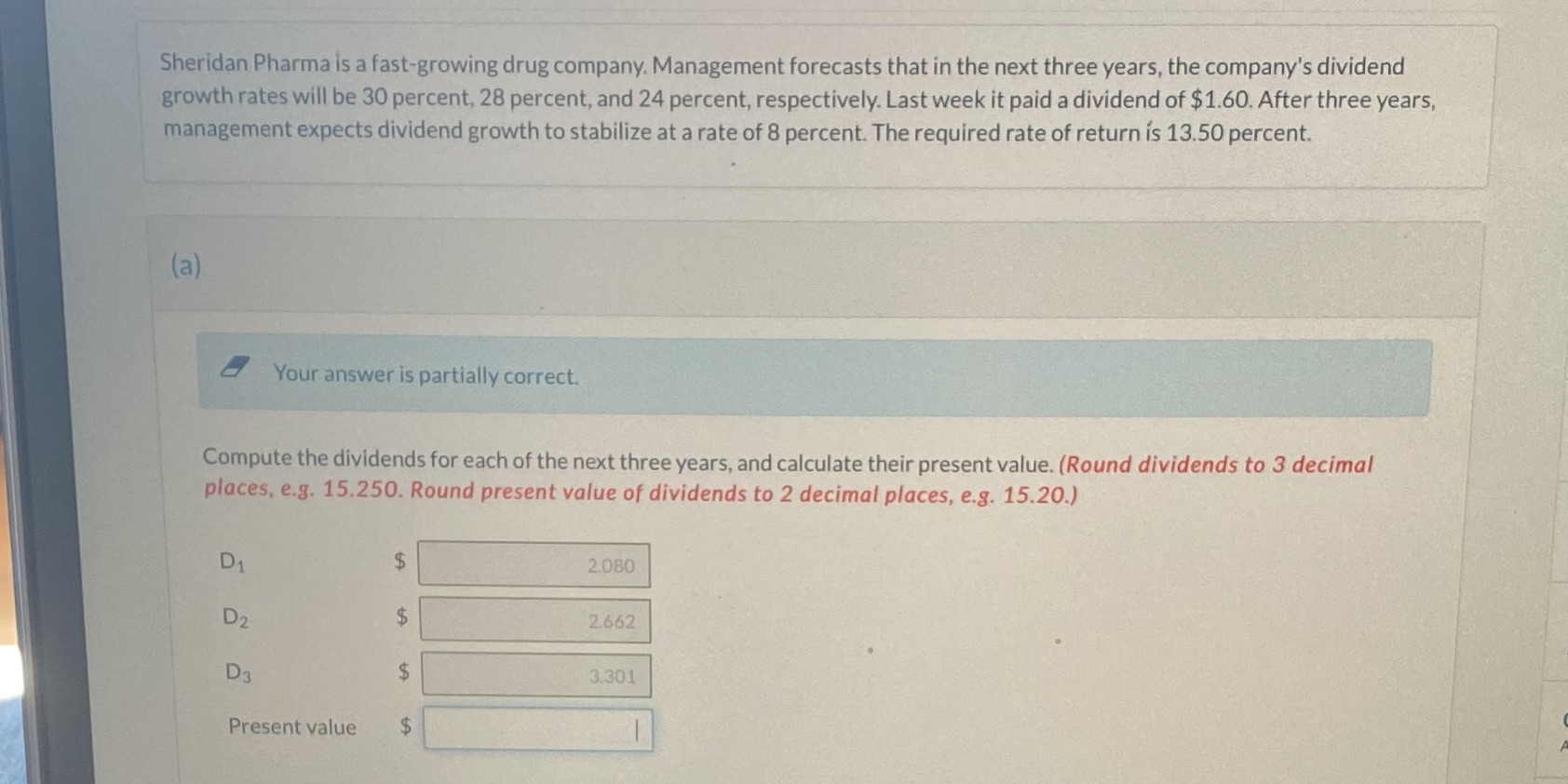

Sheridan Pharma is a fast-growing drug company. Management forecasts that in the next three years, the company's dividend growth rates will be 30 percent, 28 percent, and 24 percent, respectively. Last week it paid a dividend of $1.60. After three years, management expects dividend growth to stabilize at a rate of 8 percent. The required rate of return is 13.50 percent. (a) Your answer is partially correct. Compute the dividends for each of the next three years, and calculate their present value. (Round dividends to 3 decimal places, e.g. 15.250. Round present value of dividends to 2 decimal places, e.g. 15.20.) D1 2.080 D 2 2.662 D 3 3.301 Present value $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts