Question: Need help finding the C-1 portion of the problem. You are looking to finance your home. The bank is offering a three-year ARM (adjustable-rate mortgage)

Need help finding the C-1 portion of the problem.

Need help finding the C-1 portion of the problem.

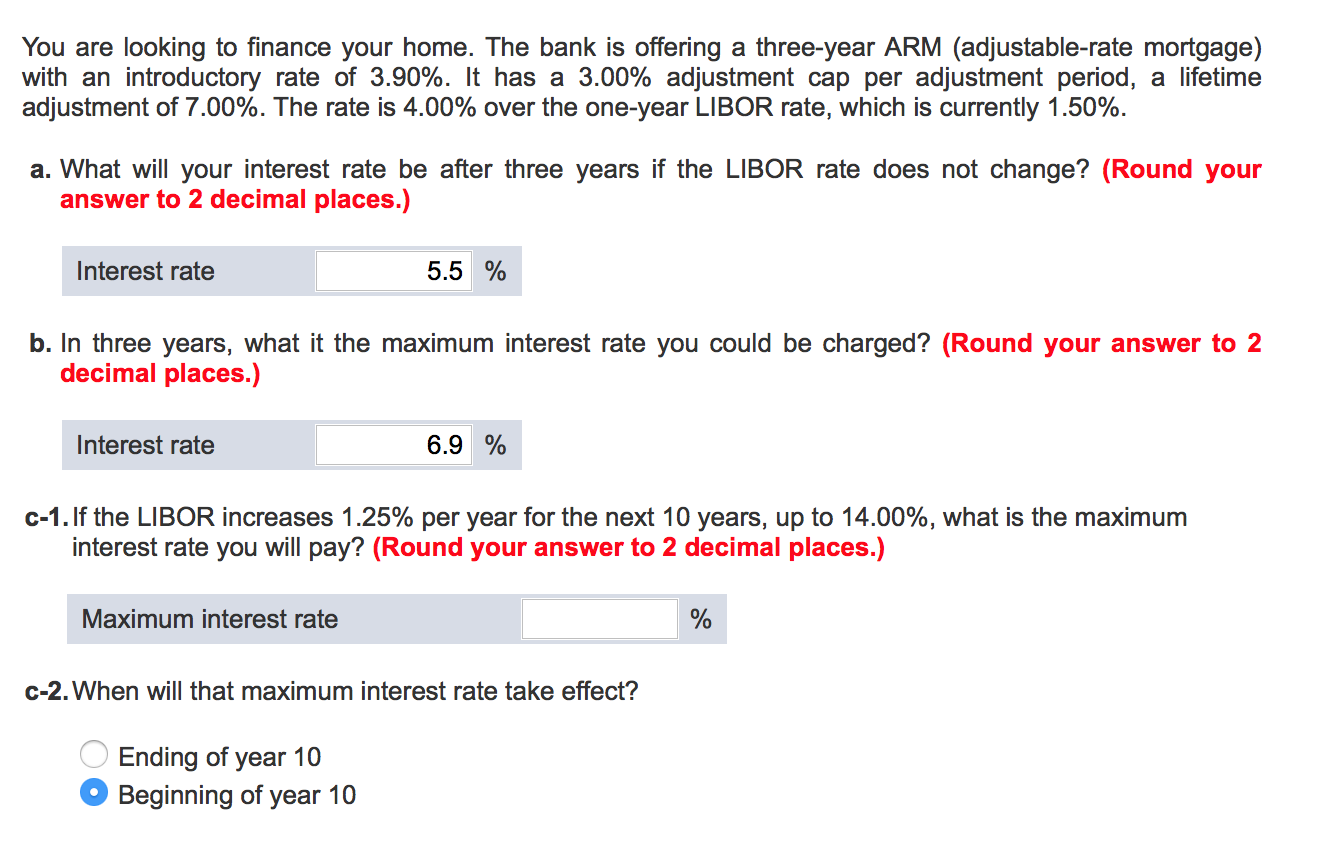

You are looking to finance your home. The bank is offering a three-year ARM (adjustable-rate mortgage) with an introductory rate of 3.90%. It has a 3.00% adjustment cap per adjustment period, a lifetime adjustment of 7.00%. The rate is 4.00% over the one-year LIbeR rate, which is currently 1.50%. a. What will your interest rate be after three years if the LIbeR rate does not change? b. In three years, what it the maximum interest rate you could be charged? c-1. If the LIbeR increases 1.25% per year for the next 10 years, up to 14.00%, what is the maximum interest rate you will pay? c-2. When will that maximum interest rate take effect? Ending of year 10 Beginning of year 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts