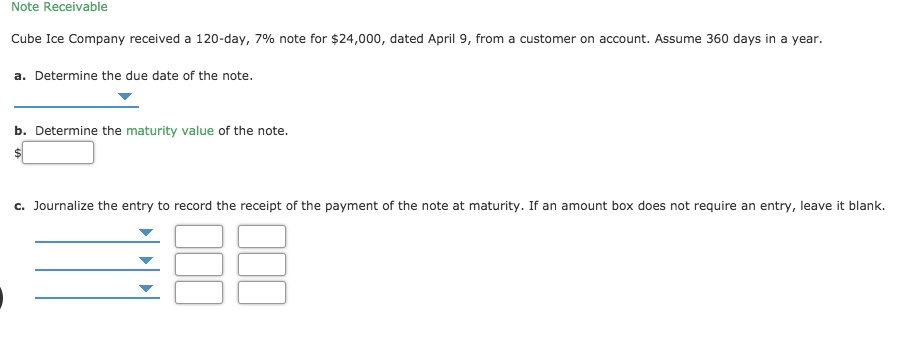

Question: Need help. For a. Due date options: May 1, July 12, August 1, August 7, November 10, November 15. For c. Accounts Receivable, Cash, Interest

Need help. For a. Due date options: May 1, July 12, August 1, August 7, November 10, November 15.

For c. Accounts Receivable, Cash, Interest Receivable, IR, NR, Unearned interest

Note Receivable Cube Ice Company received a 120-day, 7% note for $24,000, dated April 9, from a customer on account. Assume 360 days in a year. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. BB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts