Question: Need help for part C only! Thanks OL: (17 points) Magnum Inc. is considering a new project, requiring an initial investment of SI million today.

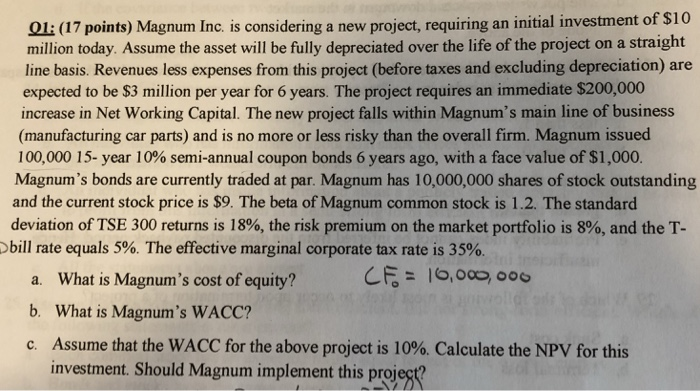

OL: (17 points) Magnum Inc. is considering a new project, requiring an initial investment of SI million today. Assume the asset will be fully depreciated over the life of the project on a straight line basis. Revenues less expenses from this project (before taxes and excluding depreciation) are expected to be $3 million per year for 6 years. The project requires an immediate $200,000 increase in Net Working Capital. The new project falls within Magnum's main line of business (manufacturing car parts) and is no more or less risky than the overall firm. Magnum issued 100,000 15-year 10% semi-annual coupon bonds 6 years ago, with a face value of $1,000. Magnum's bonds are currently traded at par. Magnum has 10,000,000 shares of stock outstanding and the current stock price is $9. The beta of Magnum common stock is 1.2. The standard deviation of TSE 300 returns is 18%, the risk premium on the market portfolio is 8%, and the T- bill rate equals 5%. The effective marginal corporate tax rate is 35%. a. What is Magnum's cost of equity? b. What is Magnum's WACC? c Assume that the WACC for the above project is 10%. Calculate the NPV for this investment. Should Magnum implement this projegt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts