Question: Need help for PART E ... Thanks PART E Consider an insurance company that needs to pay out 10 million in each of the years

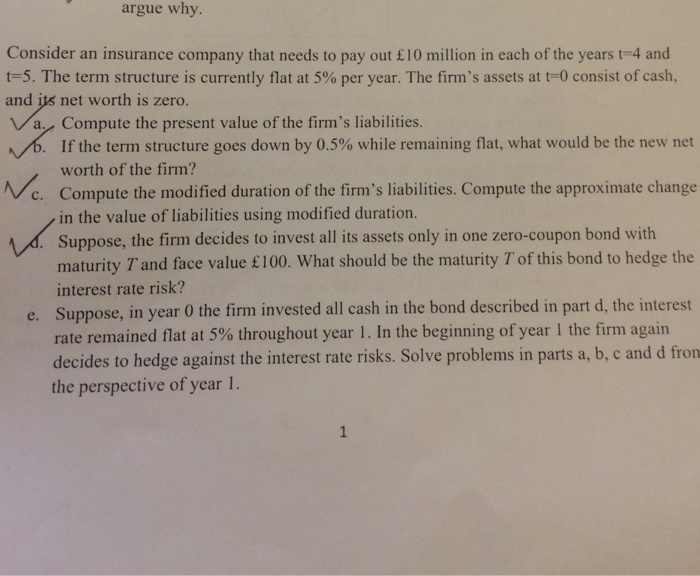

Consider an insurance company that needs to pay out 10 million in each of the years t = 4 and t = 5. The term structure is currently flat at 5% per year. The firm's assets at t = 0 consist of cash, and net worth is zero. a. Compute the present value of the firm's liabilities. b. If the term structure goes down by 0.5% while remaining flat, what would be the new net worth of the firm? c. Compute the modified duration of the firm's liabilities. Compute the approximate change y in the value of liabilities using modified duration. Suppose, the firm decides to invest all its assets only in one zero-coupon bond with maturity T and face value pound 100. What should be the maturity T of this bond to hedge the interest rate risk? e. Suppose, in year 0 the firm invested all cash in the bond described in part d, the interest rate remained flat at 5% throughout year 1. In the beginning of year 1 the firm again decides to hedge against the interest rate risks. Solve problems in parts a, b, c and d from the perspective of year 1. Consider an insurance company that needs to pay out 10 million in each of the years t = 4 and t = 5. The term structure is currently flat at 5% per year. The firm's assets at t = 0 consist of cash, and net worth is zero. a. Compute the present value of the firm's liabilities. b. If the term structure goes down by 0.5% while remaining flat, what would be the new net worth of the firm? c. Compute the modified duration of the firm's liabilities. Compute the approximate change y in the value of liabilities using modified duration. Suppose, the firm decides to invest all its assets only in one zero-coupon bond with maturity T and face value pound 100. What should be the maturity T of this bond to hedge the interest rate risk? e. Suppose, in year 0 the firm invested all cash in the bond described in part d, the interest rate remained flat at 5% throughout year 1. In the beginning of year 1 the firm again decides to hedge against the interest rate risks. Solve problems in parts a, b, c and d from the perspective of year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts