Question: need help for question 2. Go to pg AD 14-1 Analyze and Compare Amazon.com, Best Buy, and Wal-Mart Obj. 2 The condensed income statements through

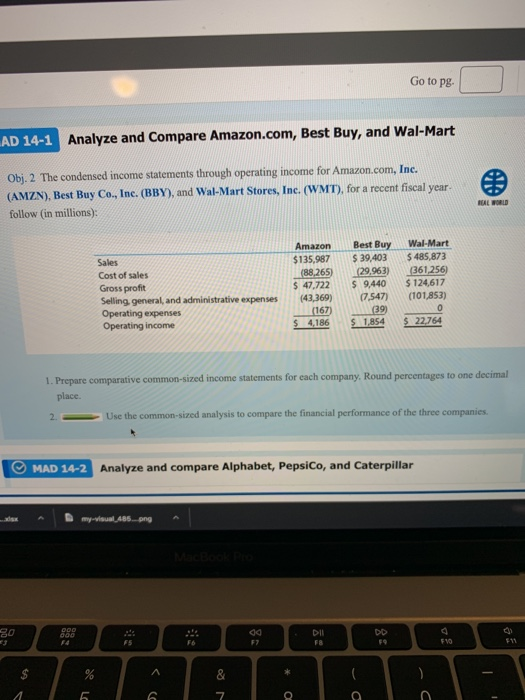

Go to pg AD 14-1 Analyze and Compare Amazon.com, Best Buy, and Wal-Mart Obj. 2 The condensed income statements through operating income for Amazon.com, Inc. (AMZN), Best Buy Co., Inc. (BBY), and Wal-Mart Stores, Inc. (WMT), for a recent fiscal year- follow (in millions): RAL WORLD Sales Cost of sales Gross profit Selling general, and administrative expenses Operating expenses Operating income Amazon $135.987 (88,265) $ 47,722 (43,369) (167) $ 4,186 Best Buy $ 39,403 (29.963) $ 9,440 (7.547) (39) $ 1,854 Wal-Mart $ 485,873 (361,256) $ 124,617 (101,853) 0 $ 22,764 1. Prepare comparative common-sized income statements for each company, Round percentages to one decimal place. 2. Use the common-sized analysis to compare the financial performance of the three companies. MAD 14-2 Analyze and compare Alphabet, PepsiCo, and Caterpillar my-visual485.png 000 20 DII 14 F5 F6 F7 F9 FVO * - & % 4 5 6 7 a C C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts