Question: Need help for these questions Problem 9-16 Project Evaluation (LO2) Blooper Industries must replace its magnooslum purification system. Quick & Dirty Systems sells a relatively

Need help for these questions

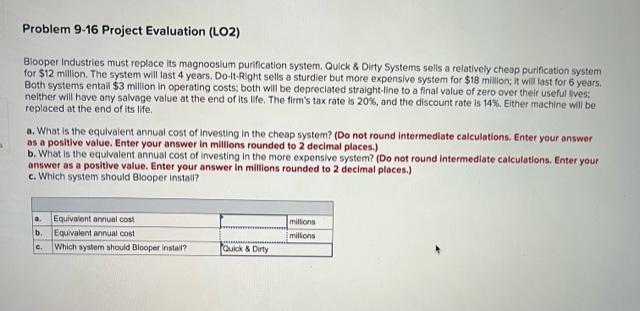

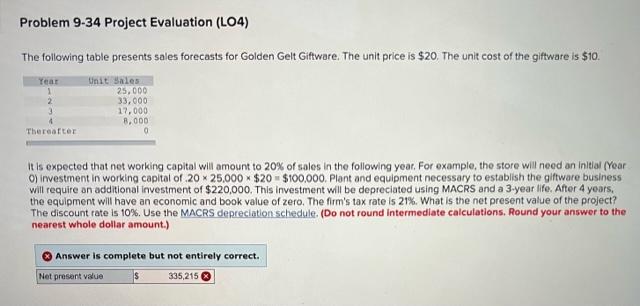

Problem 9-16 Project Evaluation (LO2) Blooper Industries must replace its magnooslum purification system. Quick & Dirty Systems sells a relatively cheap purification system for $12 million. The system will last 4 years. Do-It-Right sells a sturdier but more expensive system for $18 million it will last for 6 years. Both systems entall $3 million in operating costs, both will be depreciated straight line to a final value of zero over their useful lives. neither will have any salvage value at the end of its life. The firm's tax rate is 20%, and the discount rate is 14%. Either machine will be replaced at the end of its life. a. What is the equivalent annual cost of Investing in the cheap system? (Do not round Intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.) b. What is the equivalent annual cost of investing in the more expensive system? (Do not round Intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places.) c. Which system should Blooper install? a b. Equivalent annual cost Equivalent annual cost Which system should Blooper install? millions millions e. Quick & Dirty Problem 9-34 Project Evaluation (L04) The following table presents sales forecasts for Golden Gelt Giftware. The unit price is $20. The unit cost of the giftware is $10. Year 1 2 3 Unit Sales 25,000 33,000 17.000 8.000 0 Thereafter it is expected that not working capital will amount to 20% of sales in the following year For example, the store will need an initial Year C) investment in working capital of 20 * 25.000 $20 - $100.000 plant and equipment necessary to establish the giftware business will require an additional investment of $220,000. This investment will be depreciated using MACRS and a 3-year life. After 4 years, the equipment will have an economic and book value of zero. The firm's tax rate is 21%. What is the net present value of the project? The discount rate is 10%. Use the MACRS depreciation schedule. (Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount.) Answer is complete but not entirely correct. Net present value S 335,215

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts