Question: Need help for this question Saved Help Save & Exit S Crestfield leases office space. On January 3, the company incurs $10,000 to improve the

Need help for this question

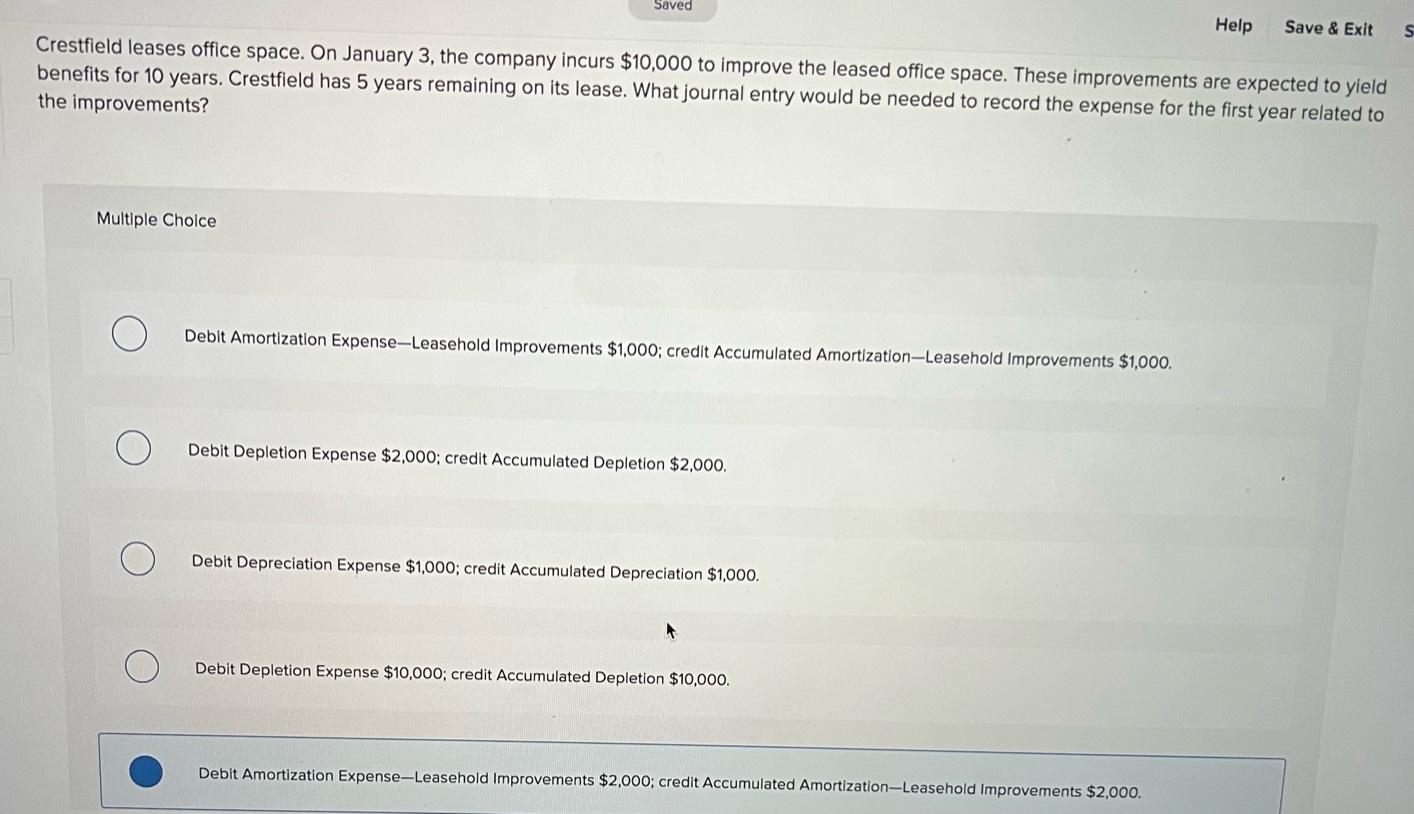

Saved Help Save & Exit S Crestfield leases office space. On January 3, the company incurs $10,000 to improve the leased office space. These improvements are expected to yield benefits for 10 years. Crestfield has 5 years remaining on its lease. What journal entry would be needed to record the expense for the first year related to the improvements? Multiple Choice Debit Amortization Expense-Leasehold Improvements $1,000; credit Accumulated Amortization-Leasehold Improvements $1,000. Debit Depletion Expense $2,000; credit Accumulated Depletion $2,000. Debit Depreciation Expense $1,000; credit Accumulated Depreciation $1,000. Debit Depletion Expense $10,000; credit Accumulated Depletion $10,000. Debit Amortization Expense--Leasehold Improvements $2,000; credit Accumulated Amortization-Leasehold Improvements $2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts