Question: Need help getting the last three. Thank you. Problem 9-12 NPV and Modified ACRS (LO 2] Cochrane, Inc., is considering a new three-year expansion project

Need help getting the last three. Thank you.

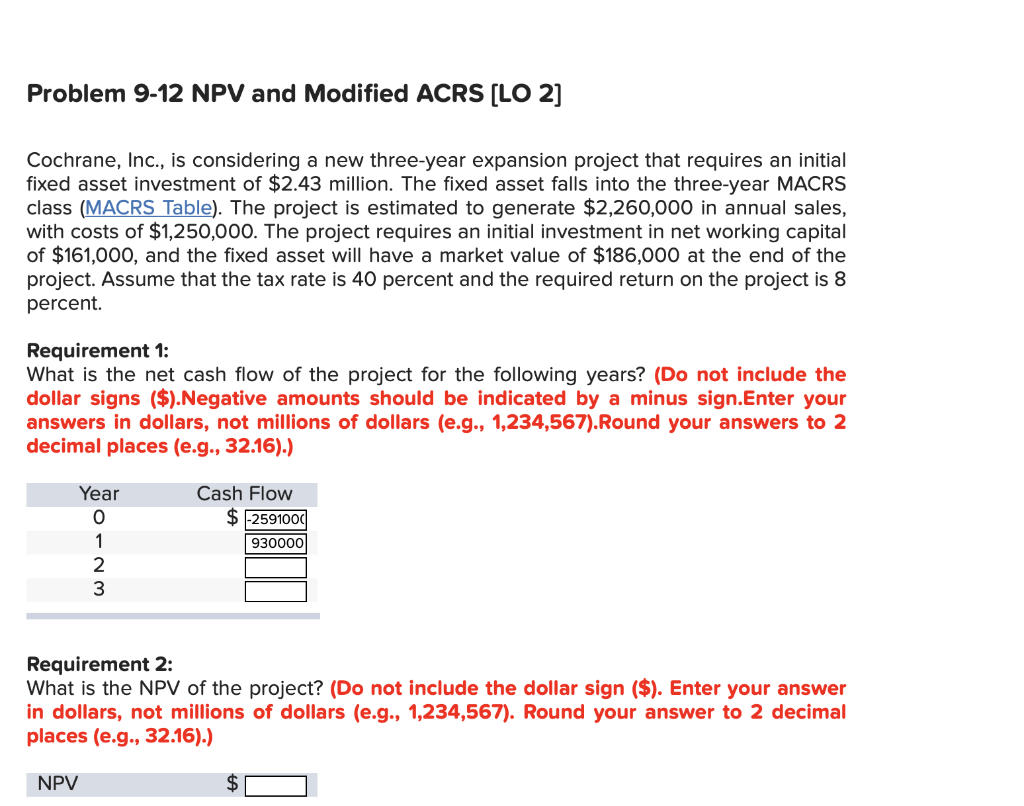

Problem 9-12 NPV and Modified ACRS (LO 2] Cochrane, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.43 million. The fixed asset falls into the three-year MACRS class (MACRS Table). The project is estimated to generate $2,260,000 in annual sales, with costs of $1,250,000. The project requires an initial investment in net working capital of $161,000, and the fixed asset will have a market value of $186,000 at the end of the project. Assume that the tax rate is 40 percent and the required return on the project is 8 percent. Requirement 1: What is the net cash flow of the project for the following years? (Do not include the dollar signs ($).Negative amounts should be indicated by a minus sign.Enter your answers in dollars, not millions of dollars (e.g., 1,234,567).Round your answers to 2 decimal places (e.g., 32.16).) Year Cash Flow $ -2591000 930000 WN-O Requirement 2: What is the NPV of the project? (Do not include the dollar sign ($). Enter your answer in dollars, not millions of dollars (e.g., 1,234,567). Round your answer to 2 decimal places (e.g., 32.16).) NPV $D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts