Question: need help have no idea how to start this assignment, please use excel Finance 332: Computer Option Project (Spring 2018): Due Thursday March Ist at

need help have no idea how to start this assignment, please use excel

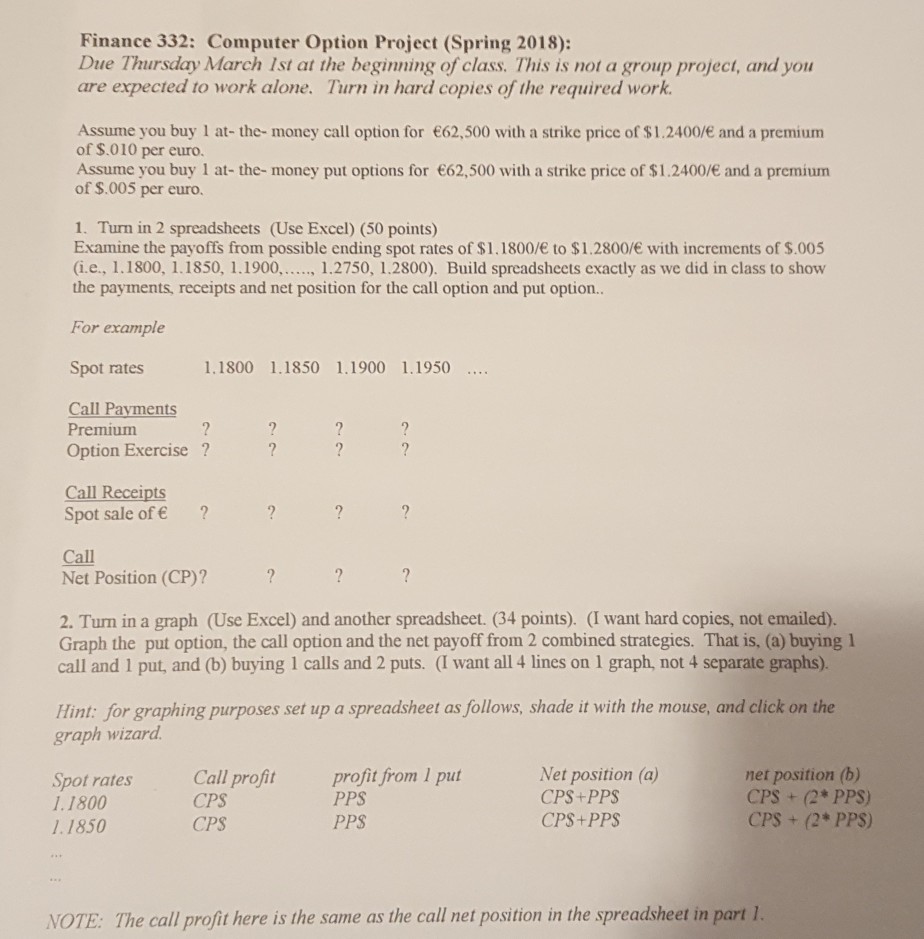

Finance 332: Computer Option Project (Spring 2018): Due Thursday March Ist at the beginning of class. This is not a group project, and you are expected to work alone. Turn in hard copies of the required work Assume you buy 1 at- the- money call option for 62,500 with a strike price of $1.2400/ and a premium of $.010 per euro. Assume you buy 1 at- the- money put options for 62,500 with a strike price of $1.2400/ and a premium of $.005 per euro. 1. Turn in 2 spreadsheets (Use Excel) (50 points) Examine the payoffs from possible ending spot rates of $1.1800/ to $1.2800/ with increments of $.005 (i.e., 1.1800, 1.1850, 1.1900,. 1.2750, 1.2800). Build spreadsheets exactly as we did in class to show the payments, receipts and net position for the call option and put option.. For example Spot rates 1.1800 1.1850 1.1900 1.1950 Call Payments Premiumm Option Exercise?? Call Receipts Spot sale of E Call Net Position (CP)? ?? 2. Turn in a graph (Use Excel) and another spreadsheet. (34 points). (I want hard copies, not emailed). Graph the put option, the call option and the net payoff from 2 combined strategies. That is, (a) buying 1 call and 1 put, and (b) buying 1 calls and 2 puts. (I want all 4 lines on 1 graph, not 4 separate graphs). Hint: for graphing purposes set up a spreadsheet as follows, shade it with the mouse, and click on the graph wizard Spot rates Call profit profit from 1 put 1.1800 1.1850 CPS CPS PPS PPS Net position (a) CPS+PPS CPS+PPS net position (b) CPS + (2* PPS) CPS (2* PPS) NOTE: The call profit here is the same as the call net position in the spreadsheet in part

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts