Question: Need help, homework do before 11 pm Topic: Days Inventory Outstanding LIFO versus FIFO 6. The January 28, 2017 (fiscal year 2016) financial statements of

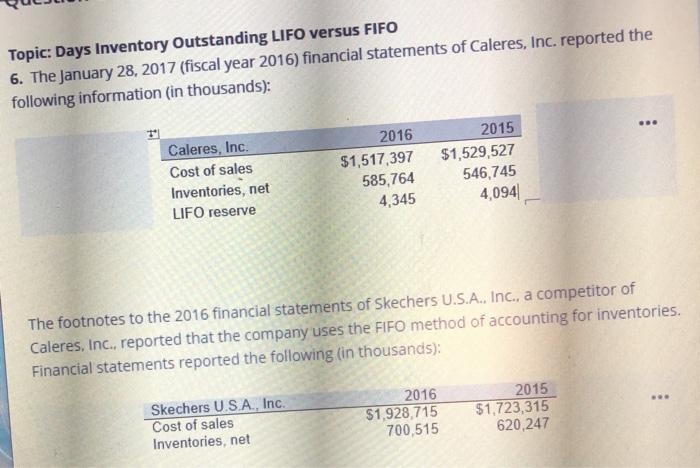

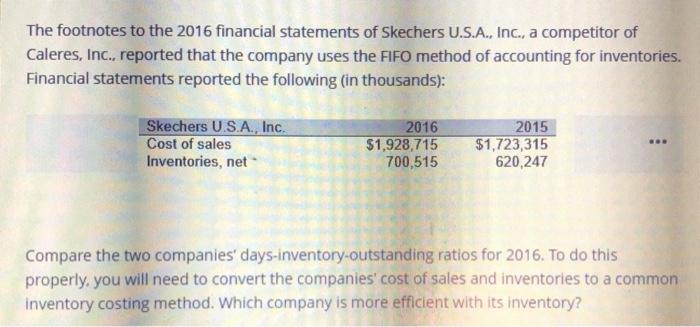

Topic: Days Inventory Outstanding LIFO versus FIFO 6. The January 28, 2017 (fiscal year 2016) financial statements of Caleres, Inc. reported the following information (in thousands): Caleres, Inc. Cost of sales Inventories, net LIFO reserve 2016 $1,517,397 585,764 4,345 2015 $1,529,527 546,745 4,094 The footnotes to the 2016 financial statements of Skechers U.S.A., Inc., a competitor of Caleres, Inc., reported that the company uses the FIFO method of accounting for inventories. Financial statements reported the following (in thousands): Skechers U.S.A., Inc. Cost of sales Inventories, net 2016 $1,928,715 700,515 2015 $1,723,315 620,247 The footnotes to the 2016 financial statements of Skechers U.S.A., Inc., a competitor of Caleres, Inc., reported that the company uses the FIFO method of accounting for inventories. Financial statements reported the following (in thousands): Skechers U.S.A., Inc. Cost of sales Inventories, net 2016 $1,928,715 700,515 2015 $1,723,315 620,247 Compare the two companies' days-inventory-outstanding ratios for 2016. To do this properly, you will need to convert the companies' cost of sales and inventories to a common inventory costing method. Which company is more efficient with its inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts