Question: Need help. I know the answer, but I need an explanation of how it was done. We have given information of the Adjusted Trial Balance

Need help. I know the answer, but I need an explanation of how it was done.

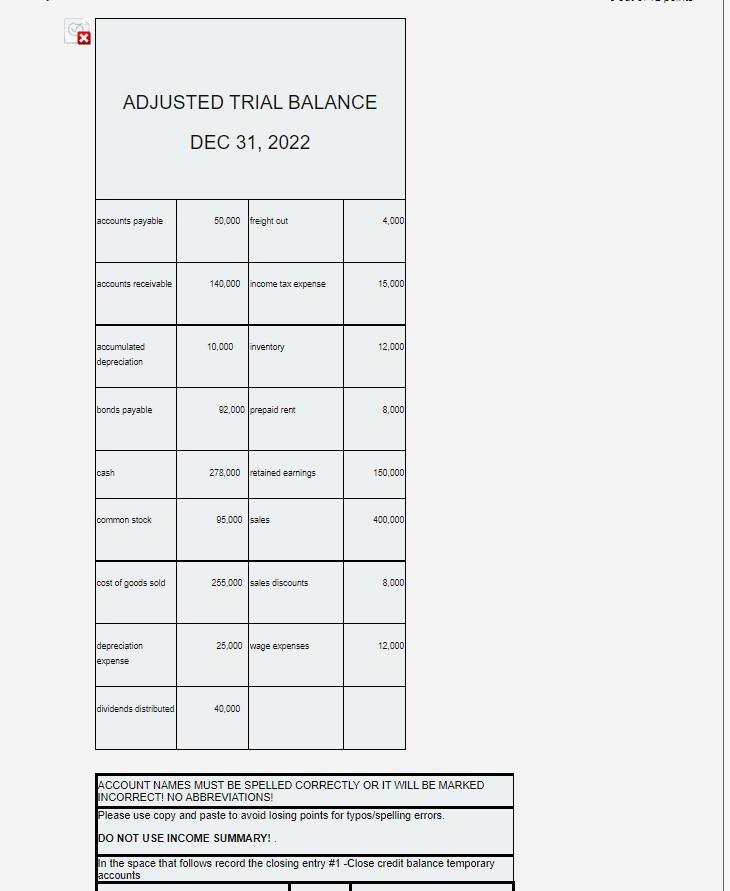

We have given information of the Adjusted Trial Balance

Also need to solve 3 given questions + The ENDING BALANCE FOR RETAINED EARNINGS

I know all the answers, but I do not understand how was found The ENDING BALANCE FOR RETAINED EARNINGS

#1 closed credit balance temporary accounts

| Description | debit | credit |

| Sales | 400,000 | |

| Retained Earnings | 400,000 |

#2 Close debit balance temporary accounts: Income Summary

| Description | debit | credit |

| Retained Earnings | 319,000 | |

| Cost of goods sold | 255,000 | |

| Depression Expenses | 25,000 | |

| Freight out | 4,000 | |

| Income Tax Expenses | 15,000 | |

| Sales discount | 8,000 | |

| wage Expenses | 12,000 |

#3 Close dividends

| Description | Debit | Credit |

| Retained Earnings | 40,000 | |

| Dividends Discount | 40,000 |

#4 The The ENDING BALANCE FOR RETAINED EARNINGS AFTER CLOSING - $191,000 ?

How we get $191,000?

Thank you in advance.

X ADJUSTED TRIAL BALANCE DEC 31, 2022 accounts payable 50,000 Freight out 4000) accounts receivable 140,000 income tax expense 15,000 10,000 Inventory 12.0001 Jaccumulated depreciation bonds payable 92,000 prepaid rent 8,000 cash 278,000 retained earnings 150,000 common stock 95.000 sales 400,000 cost of goods sold 255,000 sales discounts 8,000 25,000 wage expenses 12,000 depreciation expense dividends distributed 40.000 ACCOUNT NAMES MUST BE SPELLED CORRECTLY OR IT WILL BE MARKED INCORRECT! NO ABBREVIATIONS! Please use copy and paste to avoid losing points for typos/spelling errors. DO NOT USE INCOME SUMMARY: In the space that follows record the closing entry #1 -Close credit balance temporary accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts