Question: NEED HELP IN EXERCISE 3. SHARING EXERCISE 1 FOR REFERENCE ONLY. Exercise 3 Consider the investment project in Exercise 1, but now introducing some new

NEED HELP IN EXERCISE 3. SHARING EXERCISE 1 FOR REFERENCE ONLY.

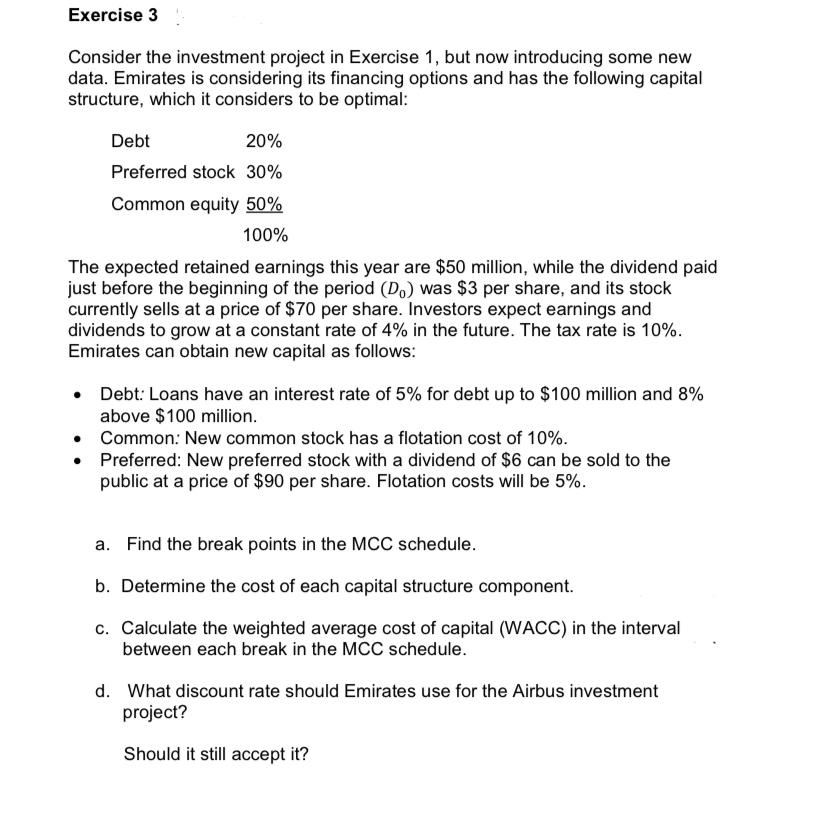

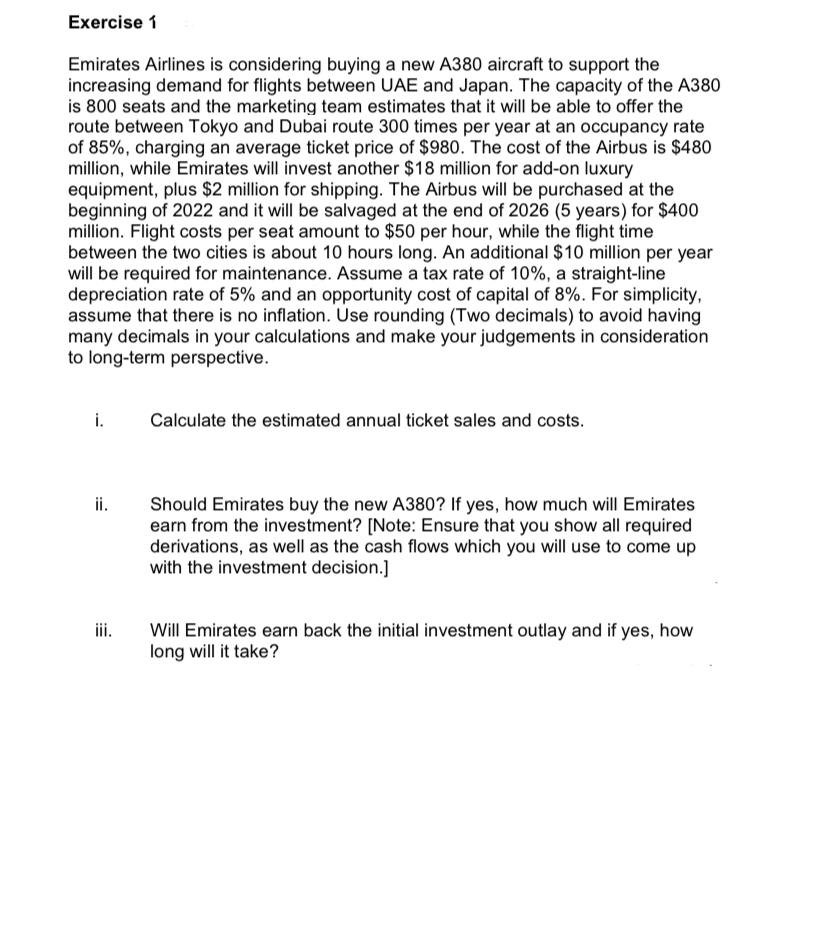

Exercise 3 Consider the investment project in Exercise 1, but now introducing some new data. Emirates is considering its financing options and has the following capital structure, which it considers to be optimal: Debt 20% Preferred stock 30% Common equity 50% 100% The expected retained earnings this year are $50 million, while the dividend paid just before the beginning of the period (D.) was $3 per share, and its stock currently sells at a price of $70 per share. Investors expect earnings and dividends to grow at a constant rate of 4% in the future. The tax rate is 10%. Emirates can obtain new capital as follows: Debt: Loans have an interest rate of 5% for debt up to $100 million and 8% above $100 million. Common: New common stock has a flotation cost of 10%. Preferred: New preferred stock with a dividend of $6 can be sold to the public at a price of $90 per share. Flotation costs will be 5%. a. Find the break points in the MCC schedule. b. Determine the cost of each capital structure component. c. Calculate the weighted average cost of capital (WACC) in the interval between each break in the MCC schedule. d. What discount rate should Emirates use for the Airbus investment project? Should it still accept it? Exercise 1 Emirates Airlines is considering buying a new A380 aircraft to support the increasing demand for flights between UAE and Japan. The capacity of the A380 is 800 seats and the marketing team estimates that it will be able to offer the route between Tokyo and Dubai route 300 times per year at an occupancy rate of 85%, charging an average ticket price of $980. The cost of the Airbus is $480 million, while Emirates will invest another $18 million for add-on luxury equipment, plus $2 million for shipping. The Airbus will be purchased at the beginning of 2022 and it will be salvaged at the end of 2026 (5 years) for $400 million. Flight costs per seat amount to $50 per hour, while the flight time between the two cities is about 10 hours long. An additional $10 million per year will be required for maintenance. Assume a tax rate of 10%, a straight-line depreciation rate of 5% and an opportunity cost of capital of 8%. For simplicity, assume that there is no inflation. Use rounding (Two decimals) to avoid having many decimals in your calculations and make your judgements in consideration to long-term perspective. i. Calculate the estimated annual ticket sales and costs. ii. Should Emirates buy the new A380? If yes, how much will Emirates earn from the investment? [Note: Ensure that you show all required derivations, as well as the cash flows which you will use to come up with the investment decision.] Will Emirates earn back the initial investment outlay and if yes, how long will it take

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts