Question: need help in part c and d Phillip and Case are in the process of forming a partnership to Import Belgian chocolates, to which Phillip

need help in part c and d

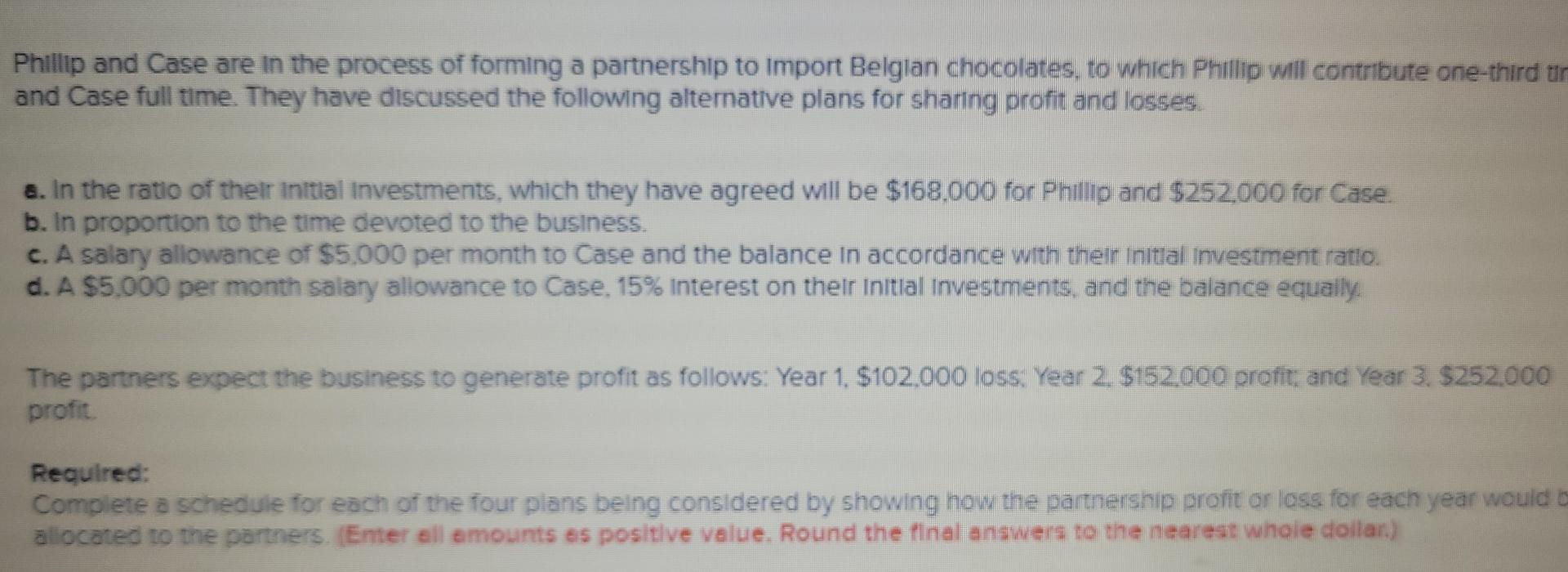

Phillip and Case are in the process of forming a partnership to Import Belgian chocolates, to which Phillip will contribute one-third ur and Case full time. They have discussed the following alternative plans for sharing profit and losses. a. In the ratio of their initial Investments, which they have agreed will be $168.000 for Phillip and $252,000 for Case b. In proportion to the time devoted to the business. c. A salary allowance of $5.000 per month to Case and the balance in accordance with their initial Investment ratio. d. A $5,000 per month salary allowance to Case. 15% Interest on their initial Investments, and the balance equally. The partners expect the business to generate profit as follows: Year 1, $102.000 loss Year 2. $152,000 profit and Year 3. $252.000 profit. Required: Complete a schedule for each of the four plans being considered by showing how the partnership profit or loss for each year would allocated to the partners. (Enter all amounts as positive value. Round the final answers to the nearest whole dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts